25 Feb 2022 - {{hitsCtrl.values.hits}}

Govt. under pressure to urgently ease the escalating crises

Govt. under pressure to urgently ease the escalating crises  Senior CEB sources say power crisis result of all governments failing

Senior CEB sources say power crisis result of all governments failing

By JAMILA HUSAIN

Public anger has grown in Sri Lanka as the government is struggling to sort the foreign exchange crisis, thereby leading to the massive power and fuel crisis, a halt in imports as well as a soaring cost of living with some terming the daily struggles as ‘unimaginable’. In fact public confidence in this government has dipped with the escalating turmoils and people are urging for some relief from the President and Prime Minister to carry on with their daily lives.

The opposition too have failed to play any vital role with statements being limited only to social media and protests being limited to Parliament. In fact, as much as the popularity of the government has dipped, popularity of the main opposition - the SJB has also dipped with public confidence on almost all parliamentarians now lifted.

Presently Sri Lanka is seeing long queues for fuel, essential food items and even medicines with officials warning this will only deepen further in the coming months if the dollars fail to come in.

For that, the government is stubborn it does not want to go in for an agreement with the IMF, which many economists see as the most ideal solution for immediate relief, and instead hope countries will grant big loans which will help them out of the crisis with the dollars coming in.

Finance Minister Basil Rajapaksa is off to India yet again today, his second visit to New Delhi in two months, to discuss a one billion dollar loan agreement that will facilitate the imports of essential commodities and pharmaceuticals. The agreement is to be signed with an Indian Bank with the intervention of the Indian government.

The Daily Mirror learns that discussions to obtain loans are also ongoing with Saudi Arabia and China in order to increase Sri Lanka’s foreign reserves, while presently Sri Lanka’s foreign reserves stands at US2.3 billion dollars only as of end January.

This however, is not enough. In fact, in order to save dollars, Sri Lanka halted almost all its imports to prevent the dollars from going out. This has led to the country plunging into chaos and the lengthy queues for almost every essential needs.

Food crisis in Sri Lanka what lies ahead?

While food such as rice, milk powder, dhal and sugar are now limited, the prices of these items are also soaring. Chairman of the National Movement for the Protection of Consumer Rights, Ranjith Vithanage told Daily Mirror that in several areas these items were now not available and there was a limit that each individual could purchase. He said that items such as rice, sugar, flour and milk powder were being sold at different rates and there was no price controls as the government had cancelled the necessary gazette which made it mandatory for prices to be controlled on essential items. He said initially this was not so. Prices of these items would only increase in a year or two and that too because of some reason. But now prices were fluctuating daily with no stable prices maintained. He said retailers sold it at much above the market rates and if today the price of a kilo of sugar was Rs.120 then tomorrow it could rise to Rs.240. “There is nobody monitoring this and these items are being sold at exorbitant rates. Even the locally manufactured items including basic vegetables are being sold at skyrocketing prices,” Vithanage said. He further alleged that despite people standing in queues for hours to purchase these essential food items, they had received complaints that those who paid much higher prices behind closed doors were handed over the items first and there was no limits for them. This has severely angered the public but authorities have gone blind to it. Vithanage also said that with the country having no dollars, essential food items imported into the country remained stuck at the Colombo Port and till such time Sri Lanka’s foreign exchange crisis did not ease, the shortage in all food items would continue and prices would continue to soar.

While food such as rice, milk powder, dhal and sugar are now limited, the prices of these items are also soaring. Chairman of the National Movement for the Protection of Consumer Rights, Ranjith Vithanage told Daily Mirror that in several areas these items were now not available and there was a limit that each individual could purchase. He said that items such as rice, sugar, flour and milk powder were being sold at different rates and there was no price controls as the government had cancelled the necessary gazette which made it mandatory for prices to be controlled on essential items. He said initially this was not so. Prices of these items would only increase in a year or two and that too because of some reason. But now prices were fluctuating daily with no stable prices maintained. He said retailers sold it at much above the market rates and if today the price of a kilo of sugar was Rs.120 then tomorrow it could rise to Rs.240. “There is nobody monitoring this and these items are being sold at exorbitant rates. Even the locally manufactured items including basic vegetables are being sold at skyrocketing prices,” Vithanage said. He further alleged that despite people standing in queues for hours to purchase these essential food items, they had received complaints that those who paid much higher prices behind closed doors were handed over the items first and there was no limits for them. This has severely angered the public but authorities have gone blind to it. Vithanage also said that with the country having no dollars, essential food items imported into the country remained stuck at the Colombo Port and till such time Sri Lanka’s foreign exchange crisis did not ease, the shortage in all food items would continue and prices would continue to soar.

In fact this shortage has prompted the Consumer Affairs Authority to act.

A senior official of the Consumer Affairs Authority (CAA) told Daily Mirror that they are going to identify the existing essential goods stocks that are already with the importers as importers usually keep a backup stock that was sufficient for two months. Once they identify this, all these items will be immediately released into the market.

The officials said the government also intends to import critical item stocks from India, and preparations are being made. The CAA will next week meet the importers to get a count of their stocks.

Finance Minister Basil Rajapaksa however said yesterday that based on data available with the Sri Lanka Customs, essential goods that are required for three months have entered the country.

Medicine shortage - Panadol, Panadein, Paracetamol, Insulin, Saline and other essential drugs to stop in three months

The public have complained that essential drugs such as Panadol and even insulin are very limited in the market and whatever socks are available are being purchased by desperate customers. The All-Island Private Pharmacy Owners’ Association (AIPPOA) said that this was because the ingredients required to manufacture these medicines had been halted due to the ban on imports. In fact the situation will worsen so much that in three months most of these essential drugs will not be available in the market with the government presently not having any backup solution.

“With the current dollar crisis in the country, the manufacturers and importers cannot manufacture or import the required medicine stocks as they are higher in price. If some of the drugs they import are subjected to a price control imposed on several drugs, they cannot sell them in the local market. Most of the drugs are sold at controlled prices,” officials said.

Power Crisis in Sri Lanka only to deepen - 10-hour power cuts to be imposed daily from March

The Public Utilities Commission of Sri Lanka increased the power cut timings to over five hours today. In a special cabinet meeting held with President Gotabaya Rajapaksa on Tuesday, sources said the President was desperate that monies be released to clear the fuel stocks lying at the Colombo Port to ensure power cuts are limited as much as possible. Sources within the CEB said the situation however was ‘at its worst’ and will only escalate further. With the lack of dollars to purchase fuel, these past few months, officials were compelled to switch to hydropower and have now used up the water from its reservoirs. “Now only the rains can save us and a miracle. If not we will be compelled to go in for 10-hour power cuts from March due to the lack of fuel supplies and lack of water,” a senior CEB source said.

The Daily Mirror in its articles on the power crisis published last month had in fact predicted this. In previous articles, the Daily Mirror had said the power crisis would lead to long power cuts imposed daily and by March, a power supplying time would be released, similar to some African countries. The CEB is now preparing for the worse and have urged the public to use electricity sparingly. The Kelanitissa Power Plant has come to a complete halt due to the lack of fuel while other plants are running on a bare minimum. CEB officials said this however was not the fault of this government alone and even the past government was to blame for failing to take the country towards a self-sustained economy. “Only a miracle can now save us from the power cuts,” CEB sources said.

Economic crisis - Where do we stand at the moment

According to Deshal de Mel, Research Director at, Verité Research, Sri Lanka has had challenging macroeconomic and debt dynamics even prior to the COVID-19 pandemic. However, the country maintained access to global financial markets until early 2020 and was able to manage its external debt as a result. However, with the tax policy changes at end 2019 Sri Lanka lost access to global financial markets (Fitch revised Sri Lanka’s credit rating to negative on 18th December 2019 citing reversals in tax policy). Subsequently, Sri Lanka has had to settle maturing debt out of its foreign exchange reserves, resulting in reserves declining rapidly in the last two years from US$7.6bn at end 2019, de Mel said.

He further explained that Sri Lanka’s foreign exchange reserves had declined to US$ 2.3 bn by end January 2022, of which US$1.57 bn was a yuan-denominated swap. “There is no clarity as to whether the yuan swap can be used to settle US dollar-denominated liabilities, therefore excluding the yuan swap, usable foreign reserves were at US$ 790 mn as at end January - this is just around half a month of import coverage. Sri Lanka’s monthly average imports in 2021 was US$ 1.7 bn - that was when oil was a lot cheaper than it is today,” de Mel said.

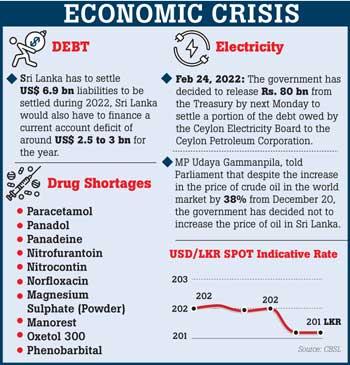

Sri Lanka has to settle US$ 1.84 billion foreign currency debt liabilities in the months of February and March 2022. This is excluding current account payments (that is payments for imports of goods and services). In addition to US$ 6.9 bn liabilities to be settled during 2022, Sri Lanka would also have to finance a current account deficit of around US$ 2.5 to 3 bn for the year.

“Given the country’s low reserve position and large near term debt liabilities, Sri Lanka has had to ration the usage of foreign exchange to pay for imports of goods and services, resulting in limited availability of foreign currency to pay for critical imports including fuel. Sri Lanka’s authorities expect to bridge the gap between maturing debt liabilities and limited reserves through bilateral loans and swaps, asset divestments, and tourism inflows. However the gap between near term debt liabilities and reserves is large and time is limited,” de Mel said.

De Mel further said that to emerge from this crisis Sri Lanka’s most pragmatic option would be to enter into negotiations with its foreign creditors with a view to restructuring its external debt. That could entail delaying capital payments to create some space for Sri Lanka to put in place the necessary fiscal reforms and build up reserves to improve its credit ratings and regain access to global capital markets in order to continue servicing its external liabilities.

“An agreement with the IMF would play an important role in providing a credible debt sustainability analysis that will be accepted by all stakeholders, and an IMF programme can unlock additional sources of financing for Sri Lanka whilst it navigates what could be a challenging restructuring process,” de Mel said.

Dollars sold at Rs.260 in the black market as official rate stands at Rs.203

Amidst all these crises, those who are travelling overseas are in for another shock. With banks giving limited dollars, that too after following some procedures, people were presently dependent only on the black market to purchase their dollars. Presently one US dollar is available at Rs.260 in the black market when compared to the official rate of Rs.203 sold by the banks.

20 Dec 2024 26 minute ago

20 Dec 2024 2 hours ago

20 Dec 2024 2 hours ago

20 Dec 2024 4 hours ago

20 Dec 2024 4 hours ago