03 Mar 2023 - {{hitsCtrl.values.hits}}

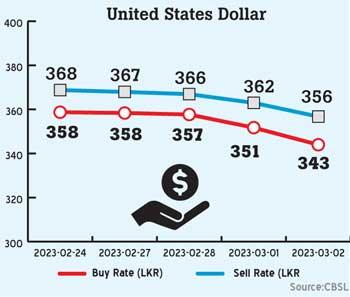

The Sri Lankan rupee continued to gain yesterday against the US dollar, a trend that started a few days ago amid the lower demand in the domestic forex market though banks remain flushed with dollars. According to the Central Banka data, the buying rate of US dollar yesterday was Rs.343.97, down from Rs.351.72 on Wednesday while the selling rate was Rs.356.73, down from Rs.362.95.

The Sri Lankan rupee continued to gain yesterday against the US dollar, a trend that started a few days ago amid the lower demand in the domestic forex market though banks remain flushed with dollars. According to the Central Banka data, the buying rate of US dollar yesterday was Rs.343.97, down from Rs.351.72 on Wednesday while the selling rate was Rs.356.73, down from Rs.362.95.

The middle spot rate was Rs.354.65 against the US dollar, down from Rs.358.46 on Wednesday.

Two specific actions by the Central Bank have also contributed positively for the rupee’s appreciation. They are, the relaxing of surrender rules on export proceeds to 15 percent from 25 percent and the increasing of the daily forex trading band.

Yesterday, the Central Bank increased the trading band to Rs.7.50 from Wednesday’s middle spot rate of Rs.353.65. This initially was Rs.2.60, and on February 27 the Central bank raised the trading band to Rs.5.00.

In addition to these, expectation of an earlier deal with the International Monetary Fund (IMF), higher inflows by way of workers’ remittances, tourism and increased foreign investor interest in government securities and stocks trading on the Colombo Stock Exchange have positively contributed to the recent upward movement of the rupee.

But most of all, the demand in the domestic forex market has plunged owning to the contracting economy. After defaulting, the authorities and the Central Bank destroyed the aggregate demand in the economy by raising policy rates and tightening the monetary policy to rein in on inflation, which was getting out of hand.

A dovish tilt in the monetary policy is expected to support the economic revival and for the demand to return. Sri Lanka unlocking the IMF bailout package as early as possible remains key for this.

19 Dec 2024 1 hours ago

19 Dec 2024 2 hours ago

19 Dec 2024 3 hours ago

19 Dec 2024 4 hours ago

19 Dec 2024 4 hours ago