14 Nov 2023 - {{hitsCtrl.values.hits}}

By Indika Sakalasooriya

By Indika Sakalasooriya

President Ranil Wickremesinghe yesterday unveiled a budget that could be deemed pragmatic, acknowledging the limited fiscal and political room for additional taxes, while simultaneously showcasing ambition through its revenue proposals and deficit targets to satisfy the International Monetary Fund (IMF).

Contrary to expectations, the 2024 budget did not introduce new taxes or increase existing tax rates. Instead, the primary revenue proposal appears to have centred around a 3 per cent increase in the Value-Added Tax (VAT), sanctioned by the Cabinet of Ministers prior to the budget announcement.

It’s evident that President Wickremesinghe’s administration lacks the political leeway to impose additional taxes on a population already burdened by high taxation, especially in the context of the upcoming Presidential and General Elections, next year.

Besides, further taxation wouldn’t help a growth-hungry economy, as higher taxes could further weaken consumption. Sri Lanka’s economy contracted 7.8 per cent in 2022 and recorded contraction of 3.1 per cent in the second quarter of this year.

The move to increase the cost-of-living allowance (CoL) of the public sector by Rs.10,000 and the CoL of pensioners by Rs.2,500 will not only augur well politically for Wickremesinghe but also will give some impetus to consumption, thereby fostering economic growth. For this, 2024 budget has set aside Rs.133 billion.

“Some people denote this budget as an election budget. The reason is the Presidential Election and the General Election is scheduled in the next year. Such a budget is designed to provide various concessions and salary increments, aiming at an election victory. This is what happened during the past 75 years since the independence,” President Wickremesinghe said.

“However, this election budget is different. This is a budget that constructs the future of the country. This is a budget that was prepared for the victory of the county,” he stressed.

Despite the seeming lack of revenue proposals, the 2024 budget has some ambitious government revenue and deficit projections.

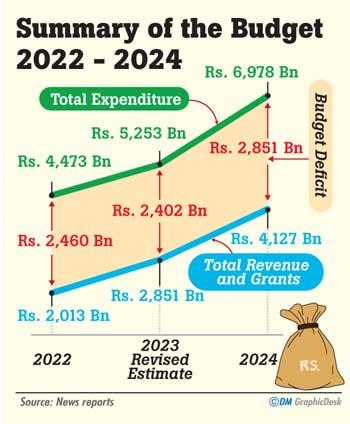

The government expects to raise Rs.4,127 billion as revenue in 2024, which is a sharp increase from the revised Rs.2,851 billion revenue target in 2023. The estimated budget deficit for the year is 9.1 per cent of the GDP (including the bank recapitalization), a little higher than the estimated 8.5 per cent deficit for 2023.

From taxes, the government expects to raise Rs.3,820 billion, compared to Rs.2, 596 billion in 2023.

In the 2024 budget, the government has indicated its clear intentions to tighten the country’s tax net and to improve the tax base.

In the 2024 budget, the government has indicated its clear intentions to tighten the country’s tax net and to improve the tax base.

While introducing penal provisions to prosecute people who have not submitted tax returns and information required by the tax officials, the 2024 budget proposes the submission of a Tax Identification Number (TIN) mandatory for basic activities like opening a bank account, registering or licensing a vehicle, obtaining approval for a building plan and registering a land or title to a land.

In the meantime, projected expenditure for 2024 is at Rs.6.98 billion, marking a surge of 33 per cent from the previous year. This includes a more than twofold increase in capital expenditure, and an allocation of Rs.450 billion specifically earmarked for bank recapitalization.

The IMF, which is yet to approve the second tranche of the US $ 3 billion loan facility for Sri Lanka, had called for a “strong budget.” The extent to which the 2024 budget meets this criterion is a matter of debate.

But the public and the country’s businesses can tentatively breathe a sigh of relief, as no additional taxes have been imposed on them, thereby avoiding further hardships on their livelihoods.

18 Dec 2024 8 hours ago

18 Dec 2024 9 hours ago

18 Dec 2024 18 Dec 2024

18 Dec 2024 18 Dec 2024

18 Dec 2024 18 Dec 2024