20 Oct 2022 - {{hitsCtrl.values.hits}}

President Ranil Wickremesinghe yesterday said that the International Monetary Fund was of the view that the amount of revenue obtained from direct taxes should exceed the present 20% and therefore lowering of the taxable income threshold to Rs.100,000 was inevitable.

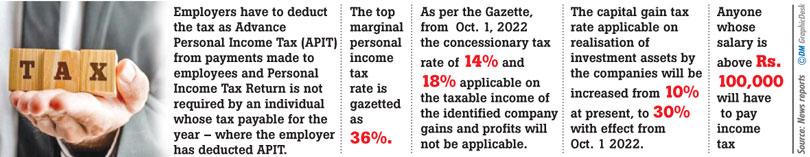

President Ranil Wickremesinghe yesterday said that the International Monetary Fund was of the view that the amount of revenue obtained from direct taxes should exceed the present 20% and therefore lowering of the taxable income threshold to Rs.100,000 was inevitable.

“According to this mechanism, and to achieve the goals of 2026, the treasury and the International Monetary Fund discussed the possibility of limiting the taxation from those who have an income of 02 lakhs, but that was not possible. Eventually, income tax has to be levied on people earning over 100,000. Today, this has become a huge problem in the country,” he said.

“We have obtained the majority of taxes through indirect taxing. Even the majority of the country’s people below the poverty line had no choice but to pay taxes indirectly. Our direct tax revenue is 20% and 80% was derived from indirect taxes.”

“The International Monetary Fund had specific questions about it and they were of the view that the amount of tax obtained from direct taxes should exceed 20%. Otherwise, they noted that this would not be successful, as ordinary citizens would be forced to pay taxes.”

“I would like to point out that in this backdrop, we may not be able to achieve the desired goals without this tax system. The desired goal is to achieve a revenue target of 14.5% - 15% of the GDP by 2026,” he said.

He further said: The International Monetary Fund notified us that we need to show a surplus in our primary budget. We agreed to it because we needed their support.

The other factor is that it was decided to increase the country’s income from 8.5% to 14.5% of the GDP. It’s impossible to do it all at once. We have planned to increase the country’s income to 14.5% of the GDP by 2026.

Initially, we had to think about how we were going to increase our income. We have printed money because our income decreased. During the past two years, Rs. 2300 billion has been printed. As a result, inflation has risen to 70% - 75%. Food inflation has increased even more.

These need to be controlled, but we also need to secure our revenue. Therefore, a new tax system was proposed during these discussions. The International Monetary Fund had notified that even the export industries are required to pay taxes.

It was indicated especially in countries with an export economy, taxes are being paid. The IMF also pointed out that our primary export economy was the plantation industry. During British rule, taxes were charged from every plantation sector, including tea, coconut and rubber. Therefore, we decided that if we are to move towards that goal, we will have to pay taxes. The export sector has now questioned this move and if these facts are to be submitted to the International Monetary Fund, we have discussed about carrying out an analysis.

The second matter is individual taxes.

If we withdraw from this programme, we will not receive assistance from the IMF. If we don’t get IMF certification, we will not get the support of those international institutions such as the World Bank, and Asian Development Bank, and the countries that provide support. If that happens, we will have to go back to the era of queues.

We may have to face even tougher times ahead. We have to obtain these loans and go for the debt-restructuring programme. We are not doing these willfully. We have to take certain decisions even reluctantly. However, we will reconsider these decisions periodically.

06 Oct 2024 49 minute ago

05 Oct 2024 05 Oct 2024

05 Oct 2024 05 Oct 2024

05 Oct 2024 05 Oct 2024