29 Jun 2023 - {{hitsCtrl.values.hits}}

Sri Lanka is on the cusp of unveiling a groundbreaking decision that will have a profound impact on its economy, marking a significant turning point in recent history. One could say it is akin to the decision that was taken to open up Sri Lanka’s economy in late 1970s, which has massive economic implications.

During a special Cabinet meeting held yesterday, the approval of the Cabinet of Ministers for the highly-anticipated domestic debt restructuring (DDR) plan prepared by the Finance Ministry and the Central Bank was obtained. Following Cabinet Ministers’ approval, it will follow the proper approval process by going through the Committee on Public Finance (CoPF) and Parliament via a debate during the weekend.

Both the President and the Central Bank Governor have already assured that the proposed DDR will have no impact on the membership balance of superannuation funds such as the Employees’ Provident Fund and customers deposits in banks. They also said it will not pose any adverse threat to the stability of the country’s banking sector.

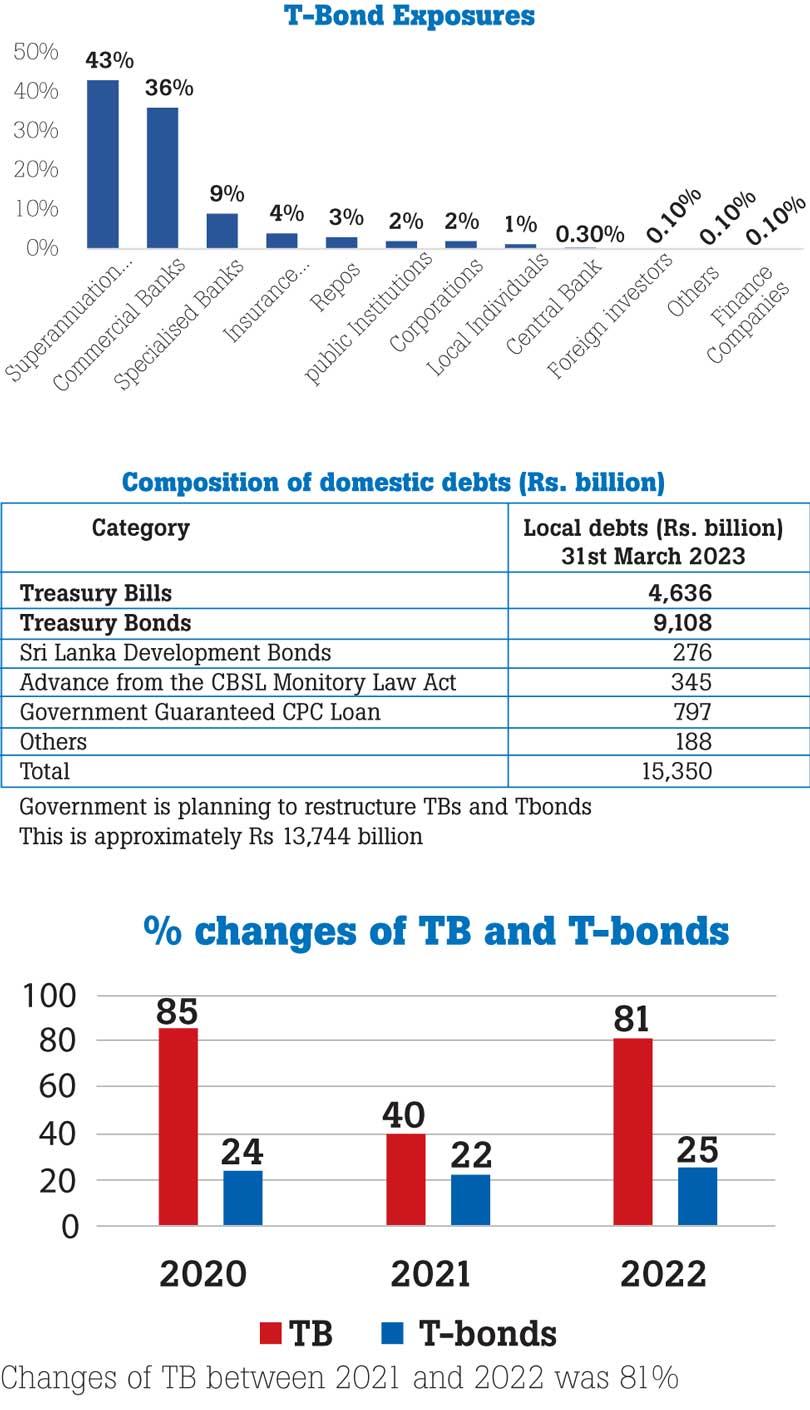

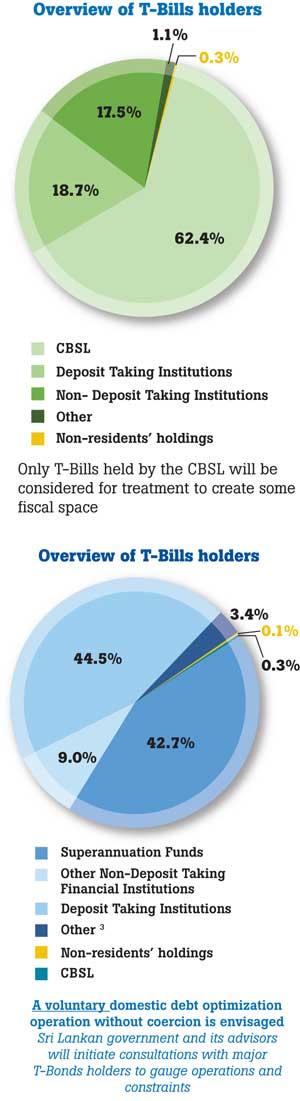

The shape and form of the proposed DDR plan is yet to be known. But according to the initial plan of the DDR presented in March, only Treasury bills held by the Central Bank will be part of the restructuring process. The Central Bank holds over 60 percent of T-bills.

At the same time the authorities announced a domestic debt optimization (DDO) for Treasury bond holders on a voluntary basis. The superannuation funds and the country’s banks are the biggest holders of Treasury bonds. The key word here is ‘voluntary basis.’ If the voluntary take-up is not to the expected levels, authorities will be pushed to take measures to persuade bondholders to take up the DDO.

However, it is not clear yet whether the DDR/DDO that will be unveiled this week is completely in line with what was initially announced in March. Nevertheless, it is clear that the country’s banking sector is not ready to take any hit given the precarious financial situation they are already in.

Graphics courtesy: Wasantha Athukorala, PhD Professor of Economics, University of Peradeniya.

What is debt restructuring?

According to the definition provided by the Central Bank, debt restructuring refers to the actions taken to restore the ability to manage debt effectively. The decision to initiate a debt restructuring process is made when there are no viable alternatives deemed politically or socially acceptable to regain debt sustainability.

Types of debt restructuring

There are four ways debt restructuring can be carried out.

1. Face value reduction: Lowering of the principal amount the issuer owes to the bondholders or creditors

2. Maturity extension: Lengthening of the maturity period of a financial instrument, such as a bond or a loan to modify the repayment scheduled

3. Coupon adjustment: Altering of interest rate attached to a financial instrument

4. A combination of all three.

What is domestic debt restructuring?

Sri Lanka has two types of debt—the debt the country owes to foreign creditors (external debt) and to domestic creditors. Domestic debt restructuring refers to the process of reorganizing and modifying the outstanding debt obligations of a country that are owed to domestic creditors.

Why EDR/DDR/DDO required?

As per the Debt Sustainability Analysis (DSA) carried out by the International Monetary Fund (IMF), Sri Lanka’s debt is not sustainable. Sri Lanka’s total public debt, comprising both domestic and foreign debt, amounted to US $ 83.7 billion by the end of 2022, representing 128.3 percent of the Gross Domestic Product (GDP). According to experts, for a middle-income market access country like ours, we should target below 60 percent. IMF estimates that Sri Lanka needs a debt reduction to the tune of US $ 17 billion to make our debt sustainable.

Why debt sustainability is important?

Debt sustainability is key to promoting economic growth, ensuring financial sector stability, generating investor confidence and maintaining fiscal space for the authorities to carry out develop infrastructure, provide social welfare etc.

Isn’t EDR (external debt restructuring) enough?

Expert opinion is divided on this. Some argue that given Sri Lanka’s high debt to GDP and gross financing needs make DDR inevitable. Others contend that a potential DDR will weaken the country’s economy and the banking sector, further deteriorating the country’s repayment capacity.

The Sri Lankan authorities previously maintained that there wouldn’t be a DDR. But later they changed their stance, probably believing that DDR would create momentum around EDR, for which Sri Lanka is yet to clinch a deal with its foreign creditors. Also, the authorities may be of the view that a DDR is required for the country to reduce its overall debt to 95 percent of GDP by 2032 as per the ongoing IMF programme targets.

What will DDR include?

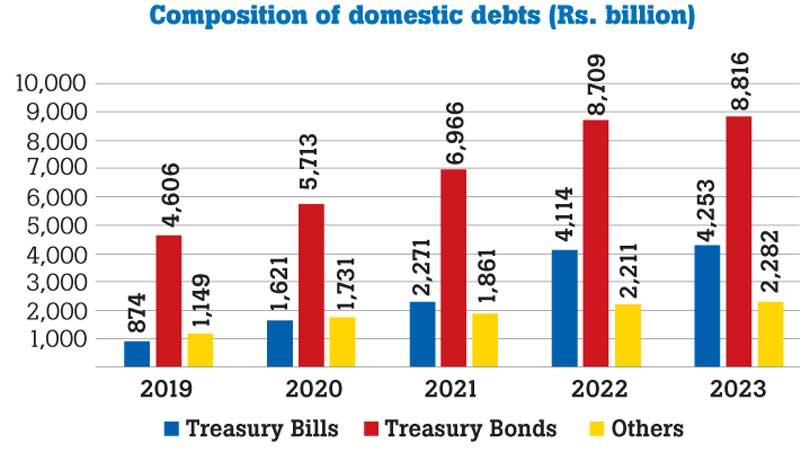

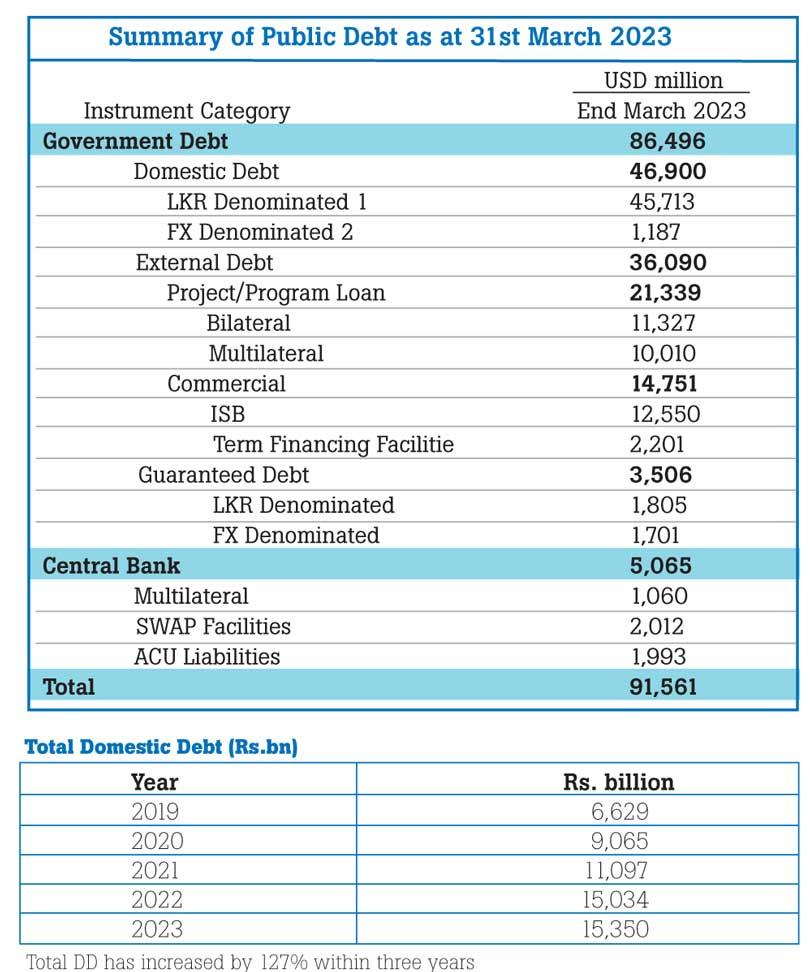

The DDR plan will cover US $ 46.9 billion worth of domestic debt (as at March 31, 2023), which includes both rupee and foreign currency denominated debt. It is speculated that the DDR, which is to be announced this week, will include maturity extensions and coupon rate cuts.

Potential impact

As aforementioned, the government and the Central Bank maintain that the DDR will have no adverse impact on the banking sector stability, superannuation funds and customer deposits at banks.

But the President Ranil Wickremesinghe on Tuesday said Sri Lanka is expecting US $ 17 billion debt relief from foreign creditors and called upon the domestic creditors to do their bit. Given the fair and equitable treatment that is expected to be practiced in debt restructuring, it is not clear whether the President Wickremesinghe wants the domestic creditors to make similar contribution.

Extended bank holiday

The government declared June 30 a special bank holiday targeting the DDR announcement. The move is considered prudent as the DDR announcement could influence markets—debt, equity and forex—heavily. Also, during the approval process, there could be a lot of unverified claims, statements etc. pertaining to DDR, which are not essentially in line with the final outcome. Extreme volatility is not good for any market. Once the final decision on DDR is reached hopefully by Monday, on Tuesday the markets can digest the news and react to it as they fit.

28 Dec 2024 49 minute ago

28 Dec 2024 2 hours ago

27 Dec 2024 27 Dec 2024

27 Dec 2024 27 Dec 2024

27 Dec 2024 27 Dec 2024