25 Apr 2016 - {{hitsCtrl.values.hits}}

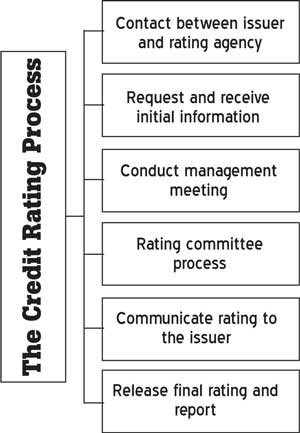

The previous articles provided an understanding on what credit ratings are and discussed the content of a rating report in detail. Today’s article will give an understanding of the process and methodologies followed in a credit rating.

How is a credit rating initiated?

A credit rating is initiated when an entity wishes to assess its credit worthiness. The entity is typically referred to as the obligor or issuer and will seek a rating for the entity or issuance of debt. The decision to initiate or maintain an existing rating depends on the availability of information. The rating agency has to determine whether the information provided is sufficient to reach a view of the creditworthiness of the obligor or issuer. If the rating agency deems the information insufficient to form an opinion on creditworthiness, no rating will be assigned or maintained.

What is the next step in the rating process?

Once contact has been established between an issuer/obligor and the rating agency, the primary analyst will send the information request to the issuer/obligor. At the start of the rating process, each rated entity or transaction is assigned to a primary analyst, who works with the support of a secondary analyst. For corporate and public finance ratings, the primary analyst is responsible for leading the analysis and formulating a rating recommendation and is typically also responsible for the continuous surveillance of the rating during the life of its publication. The primary and secondary analysts assigned to carry out the analysis have ground presence and have in-depth knowledge of the local background to the industry and economy.

Once contact has been established between an issuer/obligor and the rating agency, the primary analyst will send the information request to the issuer/obligor. At the start of the rating process, each rated entity or transaction is assigned to a primary analyst, who works with the support of a secondary analyst. For corporate and public finance ratings, the primary analyst is responsible for leading the analysis and formulating a rating recommendation and is typically also responsible for the continuous surveillance of the rating during the life of its publication. The primary and secondary analysts assigned to carry out the analysis have ground presence and have in-depth knowledge of the local background to the industry and economy.

What information is used to determine a rating?

The rating agency’s analysis and rating decisions are based on information received from sources known to it and believed by the agency to be relevant to the analysis and rating decision. This includes publicly available information on the issuer, such as company financial and operational statistics, reports filed with the regulatory agencies and industry and economic reports. In addition, the rating process may incorporate data and insight gathered by analysts in the course of their interaction with the other entities across their sector of expertise.

The rating process also may incorporate information provided directly by the rated issuer, arranger, sponsor or other third party. This can include background data, forecasts, risk reports or factual feedback on proposed analytical research and other communications.

What is a management meeting?

Once the analysts have obtained the information and partly completed the assessment of creditworthiness, the primary and secondary analyst would visit the issuer/obligor to engage in a management meeting. The management participates in the ratings process via face-to-face management and treasury meetings, on-site visits or teleconferences and other correspondence. In such instances, the main topics for discussion and key questions are provided in advance of any management meetings and an agenda is established to ensure a productive dialogue. A management meeting is a necessary step in the rating process whether it is for an initial rating or for the annual review of an existing rating.

Additional questions could arise during the course of the rating process and would be addressed by requesting for further information or through follow up meetings. Once all questions and concerns are addressed, the rating would be taken to a committee.

What is a committee process?

Typically, once the analysts have obtained all necessary information and the assessment is completed, the work is taken to a committee who unanimously decide on the final outcome (i.e. the rating to be assigned or affirmed). Ratings are assigned and reviewed using a committee process. Primary analysts incorporate the information from their research into their rating recommendation and supporting committee package while also maintaining a continuous dialogue with the obligor/issuer to resolve any outstanding issues.

Rating committees are required to include analysts from outside the immediate asset class, subsector or geographic area of the entity under review, since peer analysis (on a transaction or entity basis) is a central element of the rating committees’ discussions. The analysts with on ground presence and industry experts form the core rating committee. The rating committee considers the relevant quantitative and qualitative issues, as defined in the rating methodologies, to arrive at the rating that most appropriately reflects both the current situation and prospective performance.

How is the rating communicated to the issuer?

Once a final outcome is unanimously reached by the committee, the rating is communicated to the issuer/obligor. This communication can result in one of two outcomes. The issuer/obligor could accept the rating as given or if there are any differences of opinion they can appeal.

How are differences of opinion handled?

If the issuer/obligor is not satisfied with the rating, they can request for a review provided they have new and/or additional information which could change the final outcome of the rating committee. Such information needs to be provided to the rating agency in a timely manner to ensure the rating is as up-to-date and current as possible. However, it must be noted that the final decision of the rating lies in the hands of the rating committee and the decision cannot be swayed by any individual or issuer. The rating process is an independent and unbiased process and any new information provided will be analysed and taken into consideration if it does have any factual basis of altering the rating. Issuer/obligor has the right to change any factual inaccuracies in the rating report prior to the rating being published.

How are conflicts of interest managed?

To manage any conflicts of interest that may arise, rating agencies generally follow certain procedures and measures such as those detailed in previous articles. One such measure is restricting an analyst from rating an entity that he/she may have any connection to, in order to have an independent rating process and committee.

How is the rating finalized?

Once any factual inaccuracies are corrected and the final outcome is communicated to the obligor/issuer the final rating is released via a press release (if it is a public monitored rating) and a detailed rating report is issued to the obligor/issuer. If the rating is a monitored rating, the process will be continued on an annual basis to review the assigned rating. This could be affirmed, upgraded, downgraded or put on rating watch depending on the situation the issuer/obligor is facing.

Are there any limitations?

Users of ratings should be aware of the general limitations on the nature of the information that rated entities make available. In issuing and maintaining its ratings, the rating agency relies on factual information it receives from issuers and underwriters and from other sources the rating agency believes to be credible. A reasonable investigation is conducted of the factual information relied upon by it in accordance with its rating methodology and reasonable verification of that information is obtained from independent sources. Issuers may choose not to share certain information with external parties, including rating agencies, at any time. While the rating agency expects that each issuer that has agreed to participate in the rating process will supply promptly all information relevant for evaluating both the ratings of the issuer and all relevant securities, the rating agency neither has, nor would it seek, the right to compel the disclosure of information by any issuer or any agents of the issuer.

What is a methodology?

The definition of ‘methodology’ is the systematic, theoretical analysis of the methods applied to a field of study. It comprises the theoretical analysis of the body of methods and principles associated with a branch of knowledge.A rating agency’s analysis is conducted in a manner that is consistent with its established criteria and methodologies. Thus, the analysts responsible for the analytical work, as well as all committee members, are required to give consideration to all relevant factors, including both qualitative and quantitative factors, as defined in established criteria and methodologies.

How are the methodologies developed?

Rating decisions are made in accordance with the criteria applicable to that sector. Each of the analytical groups considers the appropriateness of its criteria and models as individual transactions are rated. As such, criteria and models are reviewed on an ongoing basis.The rating agency reviews whether the analytical group’s criteria and models are still appropriate, given the current macroeconomic and financial market conditions, current investor behaviour, market activity, pricing trends and any other factors deemed relevant.

What is included in the methodology?

As detailed in the previous articles, the methodology consists of the criteria for reviewing an entities key rating drivers, sensitivities, operating environment, company profile, management strategy, risk appetite, financial profile- liquidity and debt structure, support, etc. The methodology for financial institutions (FIs) would also detail the criteria for a stand-alone rating (viability rating) and a support-driven rating, based on stronger of institutional and sovereign support. A viability rating is based on the key rating factors such as operating environment, company profile, management, risk appetite and financial profile. Support rating is based on either the support derived from sovereign with the key rating factors such as sovereign’s ability to support and its propensity to support the banking and FI sector and the propensity to support the particular FI in concern and the support derived from a parent company with the key rating factors being parent’s ability to support and its propensity to support and legal and regulatory obligations/constraints.

(Source: Fitch Ratings)

26 Nov 2024 51 minute ago

26 Nov 2024 55 minute ago

26 Nov 2024 59 minute ago

25 Nov 2024 25 Nov 2024

25 Nov 2024 25 Nov 2024