30 May 2016 - {{hitsCtrl.values.hits}}

Pension funds may be defined as institutional investors, which collect, pool and invest funds contributed by sponsors and beneficiaries to provide for future pension entitlements of beneficiaries (Davis 2000). Therefore, pension funds provide an opportunity for individuals to accumulate savings throughout their working life to finance their consumption needs during retirement.

The financing will be received either in a lump sum or by provision of an annuity. Further, pension funds will provide funds to end users such as corporations, other households or governments for investments or consumption. Therefore, we can assume in a border aspect that pension funds operate as financial intermediaries within capital markets.

Pension funds and capital market

Pension funds operate and are perceived as substitutes and complementary institutions to other financial institutions, specifically to commercial and investment banks. Therefore, as competitors for household savings and corporate financing, pension funds create competition and may aide towards improving the loans and primary securities market (Meng and

Pfau, 2010).

The growth of pension funds will encourage financial innovation, improvements in financial regulations and corporate governance, which will aide in the overall improvement in financial market efficiency and transparency through increased penetration by pension funds. This will widespread the number of interest parties and thereby demanding more information symmetry, stimulating long-term economic growth.

Contribution to economic growth

Capital has the role as the storage device for saving some of the current income for future consumption. The accumulation of these savings represents the wealth of a nation. Therefore, the higher capital productivity could be achieved through investing savings more productively and generating higher capital income.

This is more applicable for a country like Sri Lanka which has relatively low national savings to the gross domestic product (GDP) ratio, compared to the other regional countries such as India, China, Taiwan and Singapore. Therefore, these countries possess relatively high domestic investments than Sri Lanka to fuel the economic growth.

Sri Lanka’s pension funds as a key source of long-term financial savings, play a key role in enhancing the capital productivity by investing in high-yielding instruments, with a calculated risk, enabling to create a new capital base for the reinvestment needs of the country, in order to achieve sustainable economic growth.

Key drivers of capital market

Long-term investors can support sustainable growth and financial stability since the structure of their balance sheets provides the capacity to smooth their resources over the medium and long term. They are not prone to herd mentality and are able to retain assets in their portfolios in times of crisis and in this way play a counter cyclical role. Professionally-managed long-term institutional investors can make an important contribution to growth in various ways, most important by financing long-term projects, such as infrastructure and promoting venture capital, etc. Further, they reduce reliance on the banking system, acting as shock absorbers at times of

financial distress.

Long-term investments can also provide higher returns for long-term savings and thus, alleviating some of the funding gap that is widening due to low interest rates and an increased demographic burden.

The presence of large institutional investors is crucial for the development of the capital market of the country. In many markets, institutional investors such as pension funds, play a critical role in the stock market. Unlike the retail investors, large institutions invest with a long-term focus and are not affected by the short-term price fluctuations.

Since their investment capacity is relatively high, institutional investors can correct the stock market inefficiencies such as speculative actions, thereby stabilizing the market in the long run. In addition, the presence of large local institutional investors in the equity market is critically important to build investor confidence amongst the retail and foreign investors.

Hence, large institutional investors, pension and provident funds by investing in equity create long-term stability and investor confidence in a capital market. It is also imperative that institutional investors such as pension funds are professionally managed and have proper governance.

Alternative investments

Sri Lanka’s pension and provident funds mainly consist of the Employees’ Provident Fund (EPF), Employees’ Trust Fund (ETF), Approved Private Provident Funds and Public Service Provident Fund. The EPF is the largest fund in the country. The EPF, the largest superannuation fund in Sri Lanka, was established under the Employees’ Provident Fund Act No.15 of 1958 to provide retirement benefits for the semi-government and private sector employees. The total value of the fund increased by 12.0 percent to Rs.1,664.9 billion as at end-2015 compared to Rs.1,486.9 billion as at end-2014, both due to the income generated from investments and net contributions (after deducting refunds from contributions) received.

The rapid growth of pension and provident funds will indicate the available investment opportunities need to be expanded to enhance the return to beneficiaries, while managing the associated risk factors of such investments. Hence, pension funds’ investments in the capital market enable their members to indirectly own a stake in some financially stable, fast-growing companies and benefit from the country’s economic development.

Role of EPF in local stock market

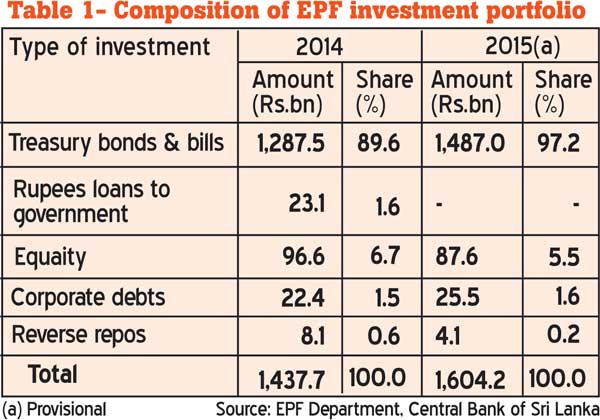

When elaborating on the nexus between capital markets and pension funds it is timely to address the ongoing debate on whether the EPF should invest in the stock market? It is a discussion that is not only fuelled by economic factors but also strengthened by political forces. Historical analysis on the composition of the investment portfolio reveals that greater emphasis is on government securities. In 2015, the investment portfolio consisted of 92.7 percent in government securities, 5.5 percent in equity and 1.6 percent in corporate debentures, commercial papers and trust certificates.

Equity exposure has not gained sufficient momentum throughout the years (refer Chart 1). This observation is rather peculiar amidst promising returns generated in the stock market.

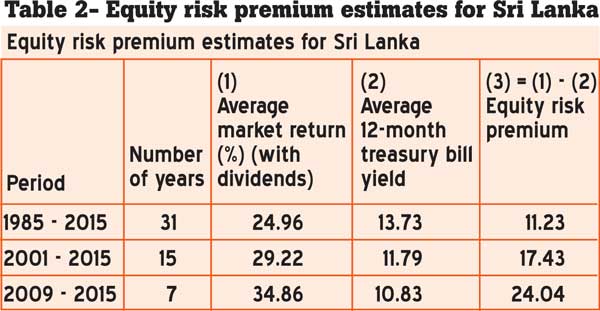

When referring to Table 1 it is evident that the stock market has outperformed government securities (12-month treasury bill yield). The stock market has generated 11.23 percent more than the average 12-month treasury bill yield during the last 31 years (1985-2015). It is important to note that these findings are based on the market index and at times certain fundamentally strong stocks outperformed the index. In such situations the average market return and the equity risk premium would be higher. Even so, the policy decision to limit equity exposure amidst promising market returns is questionable.

One may equate this sluggish trend to the losses incurred in the market. The controversy of the EPF suffering losses subsequent to investing in the local equity market emanates from incorrect decision-making. Some of the investment decisions made in the recent past (especially in 2010-2012) lacked sufficient reasoning. We observed how stocks were purchased at prices much higher than the intrinsic value of stocks. It is an open secret how the EPF bought so called ‘junk’ stocks and some of those companies of which the stocks were bought currently are on the verge of bankruptcy. The negative impact of these decisions did not only hinder investment returns of the fund but also cascaded to the market and hampered investor confidence. What these funds should do is to have a proper plan and invest in fundamentally sound stocks with a long-term view. These pension funds should not engage in day-to-day trading like a typical local investor.

The proposition to increase equity exposure by no means underestimates the risk involvement. Instead it restates the importance of taking calculated risk. Sufficient research should be undertaken prior to selecting stocks. Investments should be in line with the financial goals of the fund. Decision-making should be centralized around a competent panel. Above all, as an instructional investor, the fund should be more accountable and responsible when interacting with the market.

Even though Sri Lanka is sceptical on the subject matter, global stock markets are exploring the opportunity of attracting pension funds in order to revitalize sluggish markets.

A regulation passed in March 2016, resulted in nearly US $ 100 billion of China’s state pension funds investing in equity. China’s pension funds, which account for 90 percent of the country’s social security funds, were only allowed to invest in safer assets like bank deposits and treasuries. The new regulation will also allow investment in bonds, asset-backed securities, index futures, bond futures and the country’s major infrastructure projects. This policy initiative is expected to boost liquidity in the Chinese market.

Rapidly aging population

A main concern for both developed and developing countries is the aging population and the low birth rate due to couples consciously having fewer children or having children late in life. This has led to the insufficient contribution to pension funds through the working population to fund the elderly population. In response, most countries are moving towards private pension schemes (partial or full funded). Therefore, effective management of pension funds, generating healthy yields is a timely requirement due to the expected demographic shift of the population pyramid of the country by 2021. Thus, it is imperative that policymakers reconsider their decision on equity.

26 Nov 2024 51 minute ago

26 Nov 2024 55 minute ago

26 Nov 2024 59 minute ago

25 Nov 2024 25 Nov 2024

25 Nov 2024 25 Nov 2024