02 Feb 2017 - {{hitsCtrl.values.hits}}

By hSenid Mobile

Digital services play a vital role in synchronizing digital customer and business process.

Operating in a modern business today, by and large, has become a software affair, with the socially connected mobile consumer segment, and therefore enterprises explore ways to service the customer based on their personal preferences and personas.

Following last week’s discussion on “Synchronizing the Digital Customer and Business”, hSenid Mobile explores further how digital business enables the FinTech industry.

What does the customer want? This is the question that every business executive asks and the savviest executives are asking more frequently than ever before. Technology has placed an unprecedented hype on customer user experience management. More and more, customers expect the levels of expectation set up by technology leaders such as Amazon, Apple, Google, Facebook and Uber —and they expect this from even the dormant corners of markets across all industries.

Digital technologies in many ways have created the opposite impact for consumers and businesses. Consumers have been empowered by the use of smartphones, IoT and social media, via digitalization. Companies, on the other hand, have been urged to adopt digital strategy and has become a core cog in overall business strategy with redefined business operations; more sophisticated omni-channel user experience and increasing points of interaction—in-store, online, social media, and mobile apps.

Key demands

One of the greatest challenges in the banking industry today is to understand the technologies that are reshaping and will continue to reshape the future of banking; and understanding strategic investments.

In today’s context, technology enables businesses to tackle four key customer demands:

1) Value for money through direct to customer

2) Seamless customer experience

3) Quality products and services

4) Understand customer emotions and personas through advance analytics.

Digital disruption in banking is not only limited to bridging the customer and the bank, it has evolved into many banking functions such as, retail and commercial lending, payments, back-office, remittance and consumer banking.

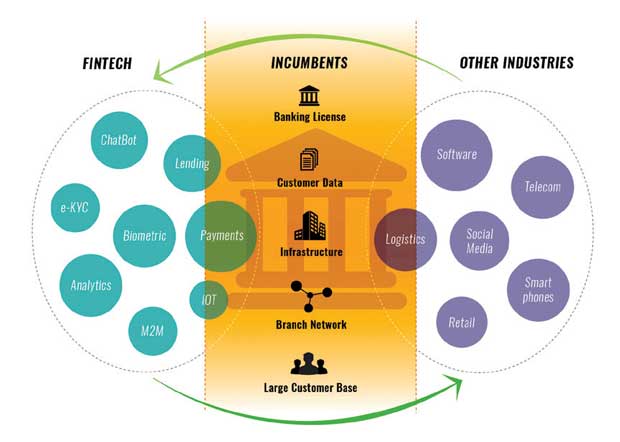

We have seen a trend where financial institutes are converging with other industries and especially technology to innovative and create distinctive products to meet customer expectations. For example, banks and technology companies have converged to provide seamless payment solutions to its customers.

Banks strive to associate with technology companies either through investment, partnership or acquiring technology companies that invest in technologies to compete with future market dynamics. According to CB Insights, approximately a third of financial technology investments were bank-led venture capital investments.

With complex and changing macro environment, banks continuously explore ways of using technology to redefine banking and converge with industry- wide partners. In this context, leading banks have identified an unique space, where they open up Banking as a Service (BaaS) to external service creators to co-create innovative financial services using banking infrastructure and banking assets.

API strategy

In order to successfully integrate with multi dimensional stakeholders, it is vital that banks have an API strategy. Today, APIs have become indispensable and a new dawn for the banking industry is fast approaching, with the advent of the open API economy. Emergence of the open API economy in the banking industry is not simply a short-lived phenomenon.

In today’ context, API strategy is a must and not an option. Banks should strive to create a fully integrated, unique end-to-end journey for their customers and partners.

The technologies being developed that revolve around API’s will have an everlasting impact on the future financial and banking industry, as well as the customer behaviors, thus pushing banks to adopt change or face destruction.

08 Jan 2025 17 minute ago

08 Jan 2025 2 hours ago

08 Jan 2025 3 hours ago

08 Jan 2025 4 hours ago