29 Dec 2023 - {{hitsCtrl.values.hits}}

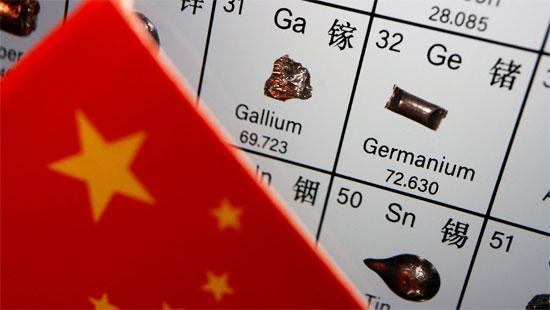

(Forbes) - Closing the gap with China in the production of critical metals is likely to prove harder and take longer than expected if two recent warning shots are a guide.

(Forbes) - Closing the gap with China in the production of critical metals is likely to prove harder and take longer than expected if two recent warning shots are a guide.

A cost blow-out and completion delay at an Australian rare earth project was the first warning.

The second shot was a new trade ban imposed by China on specialized rare earth production equipment, which means rivals will have to develop their own processes for extracting commercial quantities of metals needed in a variety of technologies.

Rare earths have been a Chinese specialty for decades thanks to large deposits of ore and through the application of smart mining and treatment methods which evolved just in time to catch surging demand.

While not household names it would not be possible to run the modern world without neodymium, praseodymium, terbium, or dysprosium, four of the 17 elements that make up the rare earth family.

Permanent magnets used in electrical appliances use rare earths, as do rocket guidance systems.

China’s dominance of the rare earth supply chain has enabled it to dictate prices in a way which has largely thwarted competition, with a handful of exceptions.

Australia’s Lynas Rare Earths survived a Chinese orchestrated price collapse thanks to close Japanese connections, but its chief executive, Amanda Lacaze, remains wary of plans by companies with Chinese connections trying to muscle into the Australian rare earth industry.

U.S. miner Molycorp collapsed during a brutal period of deliberate oversupply, which Lacaze described earlier this month as a marketing plan “to cut the guts out of the price” for a long time.

“We survived because the Japanese government held our hand very tightly during that period and supported us,” she said.

Long-term low interest finance from Japan has seen Lynas emerge as the biggest supplier of rare earths outside China.

The latest attempt by China to thwart rare earth rivals is a ban on the export of technologies it has developed to master the complex treatment of material, which in some cases is radioactive.

The new restrictions, according to the Chinese Ministry of Commerce are designed to “safeguard the country’s economic security and development interests”.

The supply of finished products is not affected, but by limiting access to ore processing, metal refining equipment and know-how will delay the plans of emerging rivals, extending China’s grip on the rare earth business.

Further delays to the entry of rivals also seem likely as developers in other countries hit planning, design, and construction obstacles.

The latest problem for a potential Chinese rival has occurred at the proposed Eneabba rare earth refinery of the Australian mineral sands miner Iluka Resources.

Originally budgeted to cost around $860 million the latest estimate is closer to $1.1 billion with Citi, an investment bank, telling clients last week that the capital cost of the refinery could blow out to $1.25 billion.

“Iluka has also indicated that production from the new refinery will not be until 2026”, Citi said, adding more than 12-months to the original schedule.

Refinery design work is being undertaken by Fluor, a U.S. engineering firm, which is working with Iluka on refinery fundamentals such as cracking, leaching, purification and solvent extraction.

The details of what rare earth processing technologies have just been put on a list of banned exports by the Chinese Government is not known, but it is highly likely that they fall under the umbrella of what Fluor is trying to do at Eneabba.

Demand for rare earths is strong, but so is China’s grip on supply.

27 Dec 2024 4 hours ago

27 Dec 2024 5 hours ago

27 Dec 2024 6 hours ago

27 Dec 2024 6 hours ago

27 Dec 2024 6 hours ago