When you purchase a Treasury Bond you are in fact lending money to the Government. Conversely, Section 2 (1) (d) of the Registered Stock and Securities Ordinance No. 7 of 1937 authorises the Government to issue ‘Securities’ in the form of Treasury Bonds, for the purpose of raising Public Debt. T- Bonds are issued on the Primary Market, which is where the Central Bank of Sri Lanka (CBSL) sells the T- Bonds. The issue of Treasury Bonds on the Primary Market was done either at Auctions of Treasury Bonds or by way of the acceptance of Direct Placement. Only Primary Dealers (PDs) and the EPF are permitted to purchase Treasury Bonds at the time they are issued by the CBSL in the Primary Market.

When you purchase a Treasury Bond you are in fact lending money to the Government. Conversely, Section 2 (1) (d) of the Registered Stock and Securities Ordinance No. 7 of 1937 authorises the Government to issue ‘Securities’ in the form of Treasury Bonds, for the purpose of raising Public Debt. T- Bonds are issued on the Primary Market, which is where the Central Bank of Sri Lanka (CBSL) sells the T- Bonds. The issue of Treasury Bonds on the Primary Market was done either at Auctions of Treasury Bonds or by way of the acceptance of Direct Placement. Only Primary Dealers (PDs) and the EPF are permitted to purchase Treasury Bonds at the time they are issued by the CBSL in the Primary Market.

Thus, the only Participants in the Primary Market are the CBSL, Primary Dealers and the EPF. In the year 2015, there were 16 licensed Primary Dealers. At present, there are 15 Primary Dealers. Corporate institutions and individuals who wish to purchase Treasury Bonds, can do so in the Secondary Market through Accounts they maintain with Primary Dealers.

Importantly, Section 106 (1) of Chapter VI of the Monetary Law Act sets out the role of the CBSL as the Fiscal Agent of the Government, while Section 112 states that, the CBSL shall act as the Agent of the Government and for the account of the Government, when issuing such Government Securities. Section 113 also stipulates that the CBSL shall, as the Agent of the Government, be responsible for the management of the Public Debt. All these functions are carried out by the Public Debt Department (PDD) in the CBSL.

In 2015, there was huge public concern over the process of this issuance of T-Bonds following alleged irregularities that transpired between CBSL high officials and Primary Dealers.

After almost a year of scrutiny, the Presidential Commission of Inquiry into the Issuance of T-Bonds recommended the CBSL in its report that, it is appropriate to conduct a ‘forensic audit’ ascertaining significant irregularities and closely examine the procedures followed in the PDD and decision- making process applied for raising public debt.

However, in the meantime, based on the Bond Commission report, former Governor, Arjuna Mahendran and his son-in-law Arjun Aloysius and his company, PTL had been indicted in High Court with other suspects under the Public Property Act and Registered Stock and Securities Ordinance for a loss of 688 million incurred due to the February 27, 2015 T-Bond auction. Court orders issued have frozen several accounts of PTL including more than Rs. 10 billion belonging to it.

This article is based on three final forensic audit reports, prepared by BDO India LLP for The Monetary Board of Central Bank of Sri Lanka.

The final Report of the Forensic Audit on issuance of T-Bonds during the period 1 January 2002 to 28 February 2015 by the public debt department

Irregularities under Direct Placement

Deviations from the laws, policies and guidelines

The Forensic reports says that the Monetary Board hasn’t specifically approved issuance of T-Bonds through Direct Placements to Primary Dealers (PDs) other than the EPF and ‘Other Captive Sources’. However, from February 2008 on wards, the Public Debt Department (PDD) was issuing Government securities through Direct Placements to Primary Dealers (other than EPF and ‘other Captive Sources’).

This practice of PDD accepting Direct Placements from non-captive PDs was never questioned by the Monetary Board. However, it appears that the issuance was in the knowledge of the Monetary Board and the practice of accepting the Direct Placements from other than “captive sources” was continued by the PDD from 2008 on wards. (2.1.3. A, B)

Deviation from the approved yield rates – ‘loss 889 mn’

Forensic Report explains that for the period October 2012 – February 2015, yield rate structures were prepared and approved by the Deputy Governor overseeing PDD. During this period, it was noted that 142 placements amounting to Rs. 337.30 Billion were made above the proposed yield rates including the volume-based inducements. In summary, in 42 Direct Placements, a loss of Rs. 889.81 Million was caused to the Government of Sri Lanka due to the deviations in the issue rates over and above the prevailing secondary market yield rates of similar maturities. (2.1.4. A, B, F)

Settlement of direct placements made beyond five days from transaction date

It was further analysed that out of the 145 placements, 141 placements amounted to Rs. 198.72 Billion; the difference between the transaction date and the settlement date was ranging between 6-9 days. In four placements aggregating to Rs. 4.43 Billion, the difference between the transaction date and the settlement date was more than 10 days. The four placements wherein the difference between is identified as more than 10 days. (6.1.10)

ISINs (International Securities Identification Number) offered in direct placements without conducting auctions – ‘loss 800 mn’

It was further identified in the Report that out of 431 issuances of Treasury Bonds through Direct Placements during this review period, 94 placements amounting to Rs. 55.15 Billion were made over and above the prevailing Secondary Market yield rates of similar maturities resulting to the loss of Rs. 0.81 Billion to the Government. (6.2.9)

Same ISIN offered to same PD at different prices on the same transaction date and same settlement date – ‘loss 53 mn’

The Forensic report also noticed that in 54 instances the Direct Placements accepted from same PDs on same transaction date having same settlement date and same ISIN were made at different prices (6.3.1). Out of the above 54 issuances, 16 placements amounting to Rs. 8.47 Billion were made over and above the prevailing Secondary Market yield rates of similar maturities resulting to a loss of Rs. 53.37 Million to the Government. (6.3.6)

Same ISIN offered to different PD at different prices on same date – ‘loss 835 mn’

It was also noticed in the report that in 207 instances the Direct Placements accepted from different PDs on same transaction date having same settlement date and same ISIN, but were made at different prices. (6.4.1). Out of the above 207 issues, 80 placements amounting to Rs. 63.49 Billion were made over and above the prevailing Secondary Market yield rates of similar maturities resulting to loss of Rs. 835.49 Million to the Government. (6.4.5)

Lack of formal announcements for direct placements

The report says that, unlike the formal announcements made to issue Treasury Bonds under the Auctions, there were no announcements made regarding the issue of Treasury Bonds through Direct Placements during this period.

‘It can be concluded that a definite system for inviting bids from PDs for Direct Placements was not available in the PDD Operations Manual of PDD and all PDs were not given equal opportunity to participate in the Direct Placement’. (9.1.2. B)

It was also stated that there was no definite system for identification and selection of the PDs for issue of T- Bonds through Direct Placements. The PDD Operational Manual states that “Front Office communicates with relevant institutions to make arrangements for placements”. (9.1.2. A)

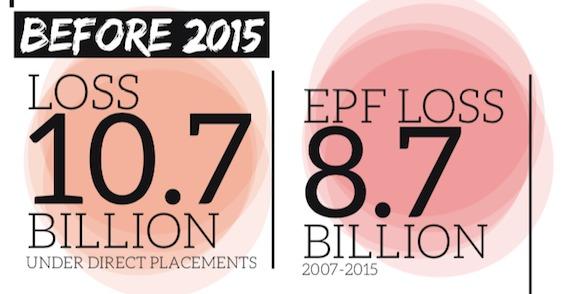

Total Loss through Direct Placements to the Government during 2005-2015

During the review period, 4,670 Direct Placements transactions were made by PDD pertaining to the Period 1 January 2005 to 28 February 2015. (2.3.5). ‘Based on comparison of the issue rates of Direct Placements and Base rates on transaction dates, the after-tax issue price was lower than the Base Price calculated in 1,105 Direct Placement transactions and the same has resulted in loss of Rs. 10.47 Billion to the Government of Sri Lanka (GoSL) during the period 1 January 2005 to 28 February 2015. (8.2.8)

Ajith Nivard Cabraal (Former Governor, 2006-2015)

Ajith Nivard Cabraal was the former Governor of the CBSL and Chairman of the Monetary Board from July 2006 till January 2015. “It was mentioned in PCOI report and as noted during the public domain searches that the relatives of Mr. Ajith Nivard Cabraal held influential positions in PDs and/ or related company of PDs, during his tenure as a Governor of the CBSL.” (11.1.4)

No voice recording system in PDD

The Report says that, the facilities for recording of calls or the call logs were not installed in respective offices and dealing rooms of the PDD to authenticate the negotiations between the officials. Also, the facilities for keeping a video record of the activities performed by the various divisional officials of the PDD were not available during the Review Period. (9.1.2.D)

Digital forensic reveals deletion of files

The Forensic Report also says that in the case of Dr. M Z M Aazim (Assistant Governor), the confidential list of devices to be procured for digital imaging was originally sent on 18 June 2019 and subsequently, the “.ost file” was found to be deleted from his device.

“It raises a concern if there was any potential leak of confidential communication between BDO India and the CBSL. Further, Dr. M Z M Aazim received a Memo on 21 June 2019 from the Governor of the CBSL mentioning that the electronic device issued to him would be obtained by the Forensic Auditors for a digital image. However, the procurement of his device was delayed and procured on 25 June 2019 due to his official commitments.” (10.3.1. G)

Report says that “It cannot also be construed that the deletion activity was performed by officials other than those, who these devices were assigned-to. Despite the active denial / rejection by the selected officials, of having performed the deletion activity, the possibility of deletion of the data files by the users themselves cannot be ruled-out.” (10.3.1. G)

Final Report of Forensic Audit on primary and secondary market transactions of EPF during the period from 1 January 2002 to 28 February 2015

- During 2007-2015, it was noted that the PDD offered lower yield rate to the EPF

- Several messages between Mr. Arjun Aloysius and employees of PTL were noted

THE EPF LOSS under direct placements during 2007-2015 was 8.7 BILLION

Lower yield rate offered by the PDD to the EPF in direct placements

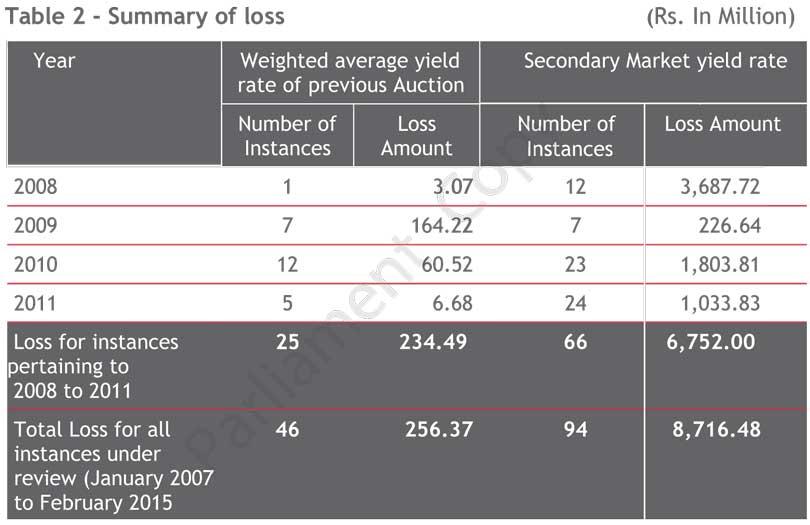

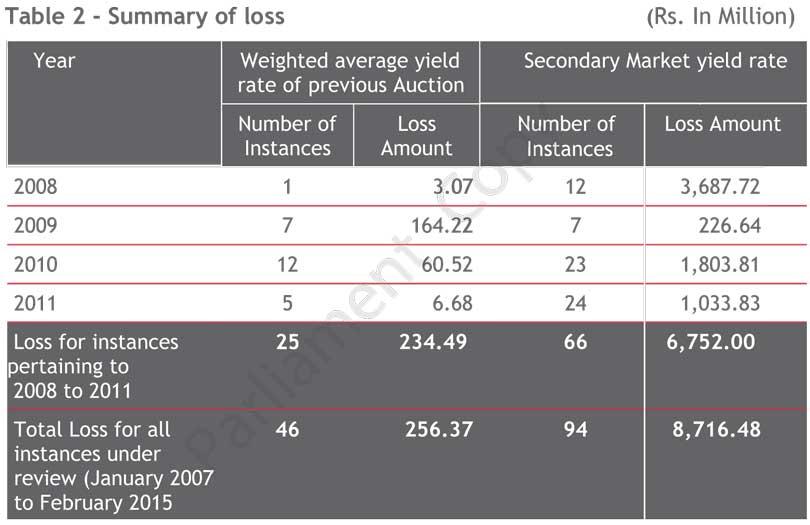

During the review, it was noted that the PDD offered lower yield rate to the EPF (2.15). In 46 out of 203 instances the PDD offered yield rate was lower than the previous ‘Auction Weighted Average Yield Rate’. Due to lower yield rate, the EPF had incurred loss of Rs. 256.37 Million. (2.16)

In 94 out of 346 instances, the PDD offered yield rate was lower than the Secondary Market yield rate. Hence, due to lower yield rate, the EPF had incurred loss of Rs. 8,716.48 Million. (2.17)

Minutes of the Monetary Board meeting of 7 October 2008 stated that “...Issuing Treasury Bonds to EPF and other captive sources at an interest rate 5 basis points above the Secondary Market rates through private placements.”. (2.19). However, during the period 2008 to 2011, the EPF yield rate was significantly lower in comparison to the Secondary Market yield rate even though the Monetary Board has approved the issue of Treasury Bonds to the EPF and other captive sources at an interest rate of five basis point above prevailing the Secondary Market yield rate. “It is evident that the PDD has not offered the prevailing market rate to the EPF”. (2.20)

EPF Loss in Secondary Market was 620 million

In 177 out of 651 purchase transactions, the purchase price of the EPF was higher than the Secondary Market price resulting in loss of Rs. 620.81 Million. (2.38). Investments made during 2014 contributed 91.03% of the total loss incurred by the EPF amounting to Rs. 565.15 Million. The difference between the purchase yield rate and prevailing Market yield rate was ranging between 1 to 80 basis points. (2.39). It was noted that the loss from transaction with PTL, PABC and WTL in 2014 amounts to approximately Rs. 321 Million (52% on the overall loss for the period) with the variance in the yield rate ranging from 4 to 80 basis points. (2.40)

Final Report of Forensic Audit on issuance of T-Bonds during 1 February 2015 to 31 March 2016:

Deviations from laws, regulations and guidelines

‘The Direct Placements were suspended by Mr. Arjuna Mahendran from February 27, 2015 without prior approval of the Monetary Board. And the powers of Monetary Board cannot be delegated to the Governor, to exercise in his individual capacity’. Also, this decision can be treated as unapproved decision as the Monetary Board did not ratify subsequently. (2.1.1. B). Report also states that, it was an inappropriate action by the PDD by relying on verbal instruction of the Governor instead of the written approval from the Monetary Board for discontinuing Direct Placements as method of raising public debt by the PDD. (2.1.1. C)

n Irregularities in conduct of auctions

During 2015-2016, 127 offers of Treasury Bonds were made through Auctions. Of these 127 offers, 30 offers were cancelled, and 97 offers were accepted by the PDD. 12 offers of Treasury Bonds were made through Direct Placements. (2.3.1)

“It was noted that in 10 offers out of 97 accepted offers, Perpetual Treasuries Ltd (PTL) in consort with Pan Asia and DFCC had entered transactions into the Secondary Market wherein high volume of identified securities were obtained at low prices in Primary Market by taking advantage of insider information. These securities were sold to the EPF at substantial higher prices as compared to the daily and weekly average trading prices prevailing in the Secondary Market. It was also noted that the EPF either did not participate or place bids in less volume or at higher yield rates in Primary Market and at the settlement date, the EPF bought securities at higher prices in Secondary Market. “(2.2.1)

In 2015, there was huge public concern over the process of this issuance of T-Bonds

No direct evidence?

However, the documentary and digital evidences reviewed and limited number of voice recordings of dealer rooms of PDs did not suggest these anomalies are directly or indirectly linked to any potential nexus between the employees of the PDD and the beneficiary PDs. “It is pertinent to note that the CBSL did not install voice record system at the PDD and significant limitations existed on the availability of ESI in terms of email files and email deletions. (2.3)

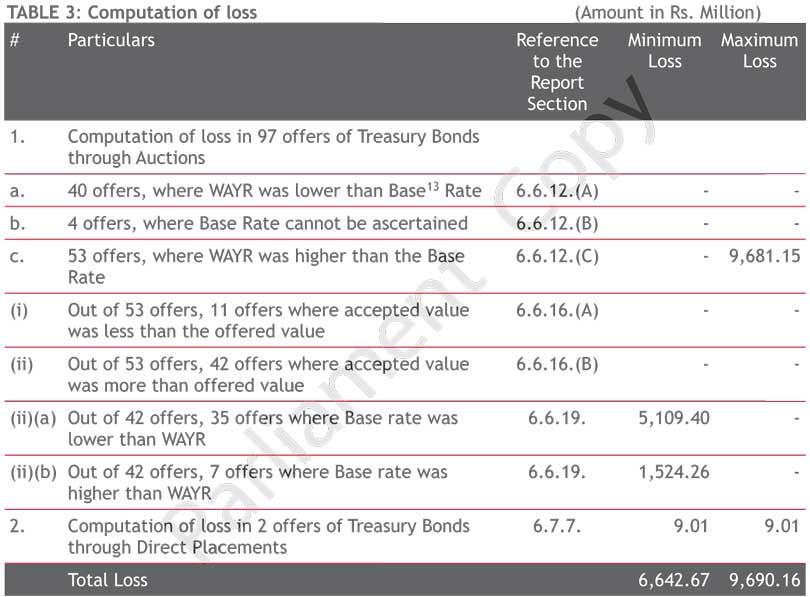

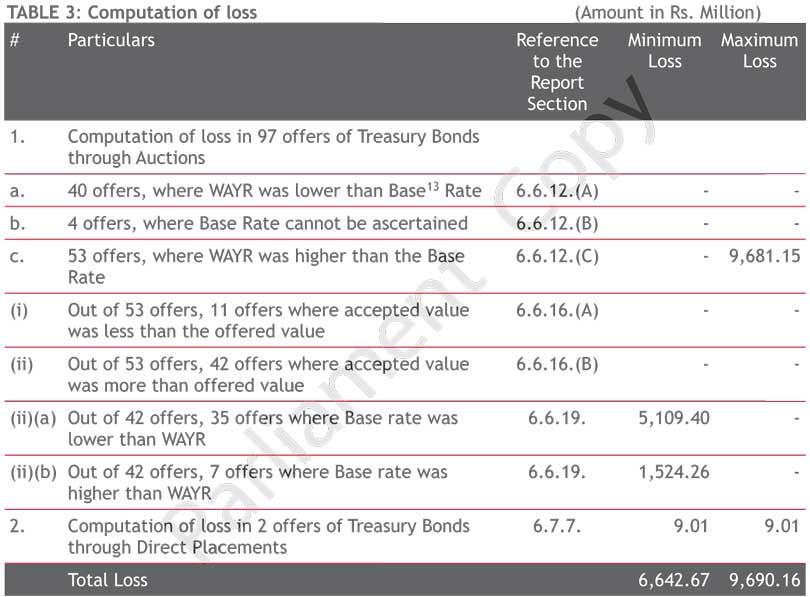

Minimum loss 6.6 billion -Maximum loss 9.6 billion during 2015 Feb- 2016 Mar.

The computation of loss on issuance of Treasury Bonds through Auctions and Direct Placements

Based on the above table, the loss caused to the Government of Sri Lanka from the issuance of Treasury Bonds at WAYR higher than the prevailing Secondary Market yield rates was ranging from Rs. 6.64 Billion to Rs.9.69 Billion. (2.3.5)

Conflict of interest exists but no direct evidence?

While identifying any potential connection between the identified employees of the CBSL and PDs, a conflict of interest relationship was identified between Mr. Arjuna Mahendran and Mr. Arjun Aloysius. The same was corroborated by the statement made by Mr. Arjuna Mahendran before Commission of Inquiry that his son-in-law had a beneficial interest in PTL and continued to be a Director and Shareholder of the Holding Company of PTL while he was the Governor of CBSL. (2.4.1.A)

Even though, it can be concluded that Mr. Arjun Aloysius continued to be involved in the operations of PTL, throughout the period when Mr. Arjuna Mahendran was the Governor of the CBSL and the conflict of interest was not resolved, (2.4.1. D) however, the report says that the documentary and digital evidences reviewed and limited number of voice recordings of dealer rooms of PDs did not suggest that Mr. Arjuna Mahendran was directly involved in sharing insider information with Mr. Arjun Aloysius or PTL. (2.4.1.E)

Potential nexus between employees of the CBSL, PDs, market participants

Relationship between Mr. Arjuna Mahendran, Mr. Arjun Aloysius and Mr. Dimantha Seneviratne

It was noted that Mr. Dimantha Seneviratne was found to be associated with Pan Asia as its CEO and was associated with HSBC as a Chief Risk Officer from February 2000 till February 2014. And Mr. Arjuna Mahendran was also associated with HSBC as its Managing Director covering whole of Asia from May 2008 till June 2013. (2.4.2. A). Therefore, it can be inferred that the geographical areas where Mr. Dimantha Seneviratne was employed, falls under the purview of Mr. Arjuna Mahendran and indicates a possible association between Mr. Mahendran and Mr. Dimantha Seneviratne.

During the review of contents of Mr. Arjun Aloysius’s mobile phone, it was noted that Mr. Arjun Aloysius had interacted several times with Mr. Dimantha Seneviratne in the latter part of 2016.

However, the forensic report says that the documentary and digital evidences did not suggest that the relationships and / or associations identified above have led the collusive behaviour between Pan Asia and PTL. (2.4.2. A)

The report states that during the review of Market Manipulation Report and media articles, it was noted that PTL was involved in transactions in the Secondary Market in collusion with DFCC. “It was observed that Mr. Kasun Palisena and Mr. Nuwan Salgado had contacts in DFCC which could have resulted in market manipulation of by PTL via its contacts.” (2.4.2. C)

However, the forensic report says that the documentary and digital evidences did not suggest that the relationships and / or associations identified above have led to have led the collusive behaviour between PTL and DFCC. (2.4.2. C)

the documentary and digital evidences reviewed did not suggest these anomalies are directly or indirectly linked to any potential nexus between the employees of the PDD and the beneficiary PDs

Digital forensic reveals

- The email communications between Mr. Kasun Palisena and Mr. Arjuna Mahendran, indicate that Mr. Arjuna Mahendran was in regular touch with the KMP of PTL for business matters not related to the CBSL. (8.2.3.C.1.C). Based on the data made available for review, it appears that the association between the two continued after Mr. Arjuna Mahendran’s release from the position of Governor of the CBSL (2.5.4. B.2)

- Several messages between Mr. Arjun Aloysius and employees of PTL were noted after Mr. Arjuna Mahendran’s completion of term as a Governor of the CBSL on 30 June 2016, which confirmed Mr. Arjun Aloysius’ involvement in the business operations of PTL. (2.5.4. A.1)

- Over 700 Viber calls were undertaken between Mr. Arjun Aloysius and Mr. S Pathumanapan (Employee of CBSL) during the period October 2016 – January 2017. (2.5.4. A.2). However, the documentary and digital evidences did not suggest that the relationships and / or associations identified above have led to any sharing of insider information by Mr. Pathumanapan to PTL.

- On review of Forensic Report on Communication Analysis provided by the CID, conversations between Ms. Thakshila Kumari, Mr. Badugoda Hewa Amal Fernando, relatives of Mr. Indika Saman Kumara(Dealer of EPF during 2015-2016) and Kasun Palisena of PTL were noted. However, the documentary and digital evidences did not suggest that the relationships and / or associations identified above have led to any sharing of insider information by Mr. Saman Kumara to PTL. (2.5.4. A.3)

When you purchase a Treasury Bond you are in fact lending money to the Government. Conversely, Section 2 (1) (d) of the Registered Stock and Securities Ordinance No. 7 of 1937 authorises the Government to issue ‘Securities’ in the form of Treasury Bonds, for the purpose of raising Public Debt. T- Bonds are issued on the Primary Market, which is where the Central Bank of Sri Lanka (CBSL) sells the T- Bonds. The issue of Treasury Bonds on the Primary Market was done either at Auctions of Treasury Bonds or by way of the acceptance of Direct Placement. Only Primary Dealers (PDs) and the EPF are permitted to purchase Treasury Bonds at the time they are issued by the CBSL in the Primary Market.

When you purchase a Treasury Bond you are in fact lending money to the Government. Conversely, Section 2 (1) (d) of the Registered Stock and Securities Ordinance No. 7 of 1937 authorises the Government to issue ‘Securities’ in the form of Treasury Bonds, for the purpose of raising Public Debt. T- Bonds are issued on the Primary Market, which is where the Central Bank of Sri Lanka (CBSL) sells the T- Bonds. The issue of Treasury Bonds on the Primary Market was done either at Auctions of Treasury Bonds or by way of the acceptance of Direct Placement. Only Primary Dealers (PDs) and the EPF are permitted to purchase Treasury Bonds at the time they are issued by the CBSL in the Primary Market.