23 Apr 2020 - {{hitsCtrl.values.hits}}

“Countries like Singapore (and many others) have built large storage capacity and oil trading hubs over the years; using both domestic and foreign investments. Sri Lanka on the other hand, has an 800-acre enviable oil tank farm that we inherited from the British, but is now almost a forest. Why? Because every time the government attempted to develop the facility, the opposition brought the country to a grinding halt.

The war cry was ‘selling the family silver’; in fact that was never the plan. Such is power of cheap politics that has continued to hold our nation back,” he said.

He said , “In 2003, the then Ranil Wickremesinghe Government signed a 35-year lease agreement with India to refurbish the World War II-period oil tank farm in Trincomalee; an awesome asset going a waste. LIOC immediately started refurbishing the lower tank farm of 15 units with the upper tank farm of 74 to be done subsequently. The project stalled after UNP lost in 2004 with threats by the new Rajapaksa government to ‘nationalize’ (can’t, as it was never sold) the leased oil tanks. None of that happened and LIOC went ahead investing tens of millions of dollars to bring the infrastructure to good condition and also to build two new units. Then again in 2016-2018 the Sirisena-Wickremesinghe government resumed the project and agreed to create a joint venture between CPC and LIOC to develop the upper tank farm. But, the Joint Opposition protested, crippled the progress and stopped the negotiations with Delhi. By then Japan had also expressed interest and was considering investment. Once again the threat was to ‘nationalize’ the leased tank farm and to develop the facility via the CPC; an SOE that makes annual losses in the dozens of billions of rupees with nothing available for such investments; in this case expected to be some US$300 million.

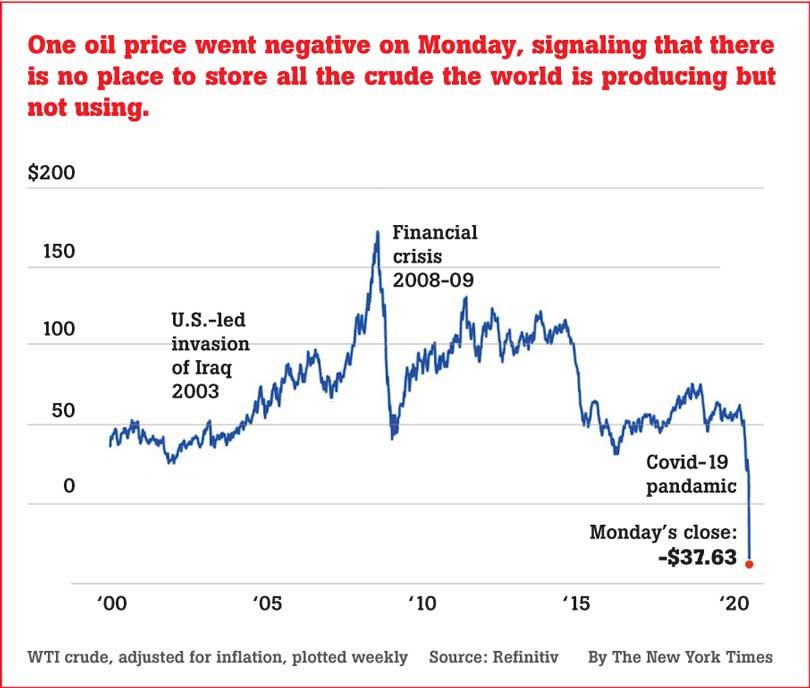

So, in the end, we have 99 oil tanks that can hold close to 1.2 MT of oil or some 7.5m bbl (Singapore’s Oil-tanking company terminal capacity is 8.2m bbl) at a time oil companies are paying buyers to take oil off their hands (May delivery WTI contracts at US$ minus 37/bbl) or at historic lows (Brent at US$15-20/bbl) but, our inability as a nation to understand trade and markets and appreciate simple economic logic has kept us watching others rake in profits, while we suffer making losses,”.

28 Nov 2024 41 minute ago

28 Nov 2024 44 minute ago

28 Nov 2024 59 minute ago

28 Nov 2024 2 hours ago

28 Nov 2024 2 hours ago