19 Mar 2019 - {{hitsCtrl.values.hits}}

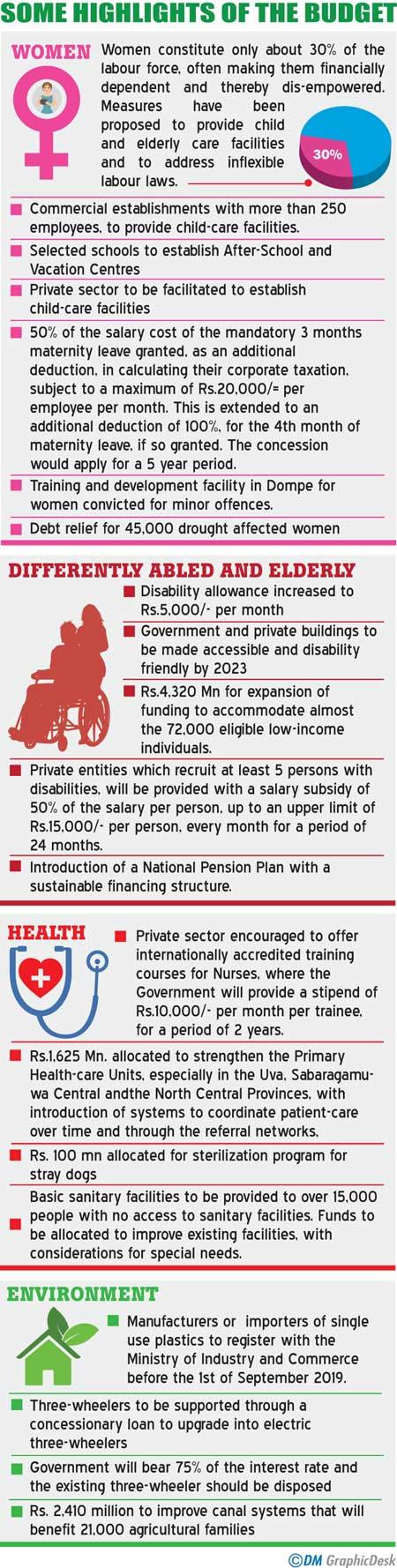

With 119 members voting in favour, the second reading of the Budget for the 2019 fiscal year was approved in parliament last week. Finance Minister Mangala Samaraweera in his Budget speech stressed on the government’s belief in growth led by private enterprise, well illustrated in its pursual of a liberal outward oriented economy. Speculation was rife, prior to its tabling, that the Budget would include populist measures, entailing typical schemes and handouts, with no positive impact on the economy. Analysts however suggested that the government’s plans of effective tax collection, removal of barriers to international and domestic trade and improving market access for exports, will test its capacity of driving private sector driven economic growth.

With 119 members voting in favour, the second reading of the Budget for the 2019 fiscal year was approved in parliament last week. Finance Minister Mangala Samaraweera in his Budget speech stressed on the government’s belief in growth led by private enterprise, well illustrated in its pursual of a liberal outward oriented economy. Speculation was rife, prior to its tabling, that the Budget would include populist measures, entailing typical schemes and handouts, with no positive impact on the economy. Analysts however suggested that the government’s plans of effective tax collection, removal of barriers to international and domestic trade and improving market access for exports, will test its capacity of driving private sector driven economic growth.

While the Budget stayed the course set by Minister Samaraweera’s previous Blue-Green Budget, segments of the public expressed their disappointment in not having witnessed price reductions in essential commodities. The Daily Mirror spoke to several civil society groups in order to discern their views on the 2019 Budget and its implications.

‘Luxury tax will lead to revenue leakages’

‘Luxury tax will lead to revenue leakages’

Vehicle Importers Association of Sri Lanka

Ranjan Pieris, President of the Vehicle Importers Association of Sri Lanka anticipates that sales volumes will decline with the new Budget. “As the production tax on vehicles less than 1000cc has been increased by Rs.175,000 while tax on automobiles with less than 1300cc was increased by Rs.500,000, we anticipate a decrease in sales. There will be an impact on our sales volumes but we cannot comment on this measure introduced through the Budget,” Pieris noted.

“Our concern is the luxury tax, which we believe will lead to revenue leakages. The luxury tax based on the Cost, Insurance and Freight (CIF) value is practically difficult and complicated. We’re in the process of submitting a proposal to rectify this issue. We don’t argue with the ways that the revenue is collected by the government but there has to be a clean way of collecting this tax. Therefore we will request the Ministry of Finance to re-evaluate the collection of this luxury tax,” he said.

‘Budget embeds some positives’

Association of Disaster Risk Management Professionals

President, Association of Disaster Risk Management Professionals, Dr. Buddhi Weerasinghe welcomed certain provisions made through the Budget, especially in terms of climate change threats. “It is only fair to accept that Disaster Risk Management (DRM) cannot ask for its pound of flesh when the government Budget is juggling with the devil and the deep blue sea. However, the Budget embeds some positives apart from the DRM allocation. Sri Lanka records nearly 24.7% malnutrition in the under 5 age group. Almost a quarter of the economically and socially active population by 2050 when predicted climate change will descend in full force. Would it be a population that can cope? Initiatives such as a free glass of milk for primary school children would address malnutrition to some extent. Plans for improving water and sanitation will reduce the potential for post-disaster epidemics especially for the undernourished children,” Dr. Weerasinghe noted.

“Focus on improving the social safety net would provide a buffer for the low income groups and the marginalized whose coping capacities are low in the face of disasters. The promise for infusion of new technology in agriculture and fishery, investments in improved irrigation, declaration of the Exclusive Economic Zone of Sri Lanka as a Marine Conservation Area would contribute to lessen climate change threats on livelihoods and food security,” he said, adding that the successful implementation of these proposals remains to be seen.

‘Government has failed the people’

National Movement for Consumer Rights Protection

Ranjith Withanage of the National Movement for Consumer Rights Protection said that the government has not lived up to its promises. “With the Sinhala and Hindu New Year in view, what we as consumers expected was the Budget to address issues we face in our day to day lives. The cost of fabric, clothing, raw material for household repairs and paint have soared over the past few months, these are usually the most purchased products during the New Year season. No concessions were granted for any of these products,” Withanage highlighted.

“Meanwhile the trishaw prices have gone up and that would only mean that the fares would skyrocket too. The common man’s dream of purchasing a vehicle was only distanced by this move. The cost of a weekend newspaper is now reaching Rs. 100. We have been cut off from the rest of the world because telecommunication prices have soared. The government should have addressed these issues we face at present. Instead, what we were granted was a futuristic and election focused Budget. The people have been deceived once again,” he claimed.

‘Not even superficial relief

for farmers’

All Ceylon Farmers’ Federation

National Organiser of the All Ceylon Farmers’ Federation, Namal Karunaratne was highly critical of the government’s lack of consideration of the needs of the farmers of Sri Lanka, in the 2019 Budget. “The most oppressed segment of society is the farming community. Every manufacturer and producer has the right to determine the price of their products and services in the market, however, farmers are not entitled to this right. Not only have these farmers been suffering due to loans and mortgages, they are also the most vulnerable to suicide. The 2019 Budget has not provided any relief to this important segment of society and we have several criticisms to make about this. Prior to the Budget reading, we have submitted various proposals and had several discussions. No considerations have been made of these suggestions,” Karunaratne charged.

National Organiser of the All Ceylon Farmers’ Federation, Namal Karunaratne was highly critical of the government’s lack of consideration of the needs of the farmers of Sri Lanka, in the 2019 Budget. “The most oppressed segment of society is the farming community. Every manufacturer and producer has the right to determine the price of their products and services in the market, however, farmers are not entitled to this right. Not only have these farmers been suffering due to loans and mortgages, they are also the most vulnerable to suicide. The 2019 Budget has not provided any relief to this important segment of society and we have several criticisms to make about this. Prior to the Budget reading, we have submitted various proposals and had several discussions. No considerations have been made of these suggestions,” Karunaratne charged.

“There is no relief in terms of taxation. From the machinery, to seeds and agro-chemicals required in agriculture, their prices keep soaring. Farmers are being plundered every day. Not even a superficial relief has been provided to these farmers. We staged protests and rallies, demanding for a maximum retail price for rice and we will continue with our engagements over the coming days as well,” he said.

“The President himself admitted that the profit rice mill owners reap is unjust and unfair. Mill owners sometimes get an average profit between Rs. 20 to 25 per kilogram. The government has not even paid farmers for the potatoes, onions and milk it purchased. We cannot expect a government which continues to give false hope, to give relief to our farmers. Yet, we demand that the Ministry of Agriculture intervene and solve the issues of farmers in this country,” he asserted.

‘Workers abandoned’

The Ceylon Mercantile Industrial & General Workers Union (CMU)

The Ceylon Mercantile Industrial & General Workers Union’s General Secretary S.T. Nathan adduced that the 2019 Budget is a popular Budget, tabled in view of the elections. “We proposed the establishment of a National Wage Commission for Private Sector Workers, long before the succession of this government. We have requested an audience with the Minister of Finance, to discuss the establishment of such a commission. These practices exist in countries such as Malaysia and China. However our requests were continuously ignored,”

he charged.

“On one hand we have the plantation workers demanding for a minimum wage. What the government resorted to, was to pay these workers through the funds of the government, instead of compelling employers to pay their workers. These workers don’t work for the government. Why cannot the employers accept responsibility and pay these workers themselves? It is safe to say that the government therefore is looking after the employers and not the workers,” Nathan suggested.

“There has been no increase in wages granted to the private sector. 2.8 million private sector workers in the country amounting to 95% remain unorganised and therefore are powerless without a voice. Trade Unions too have been weakened. This is a regretful situation. The worker has been abandoned. There are hire and fire policies that nobody pays attention to while no EPF and ETF payments have been made to some workers. There is no effective mechanism in place to monitor these practices,” he illustrated.

“We are completely disappointed with the new Budget proposals. Loans will be granted under the new Budget. The country is in massive debt and now people too will be indebted. The government meanwhile will be compelled to increase taxes. It will negatively impact economic stability and growth. In addition the counter terrorism bill, if implemented will suppress the voice of the people. A simple workers’ gathering can be deemed unlawful under this bill. This is really unfortunate and the government will continue to be unpopular among the people as they have been completely ignored and abandoned. Good governance is a good slogan, but in practice with corrupted officials and practicians, we’re not quite sure how viable it is,” he claimed.

‘No positive impact’

Sri Lanka Housewives Association

Deanna Rizvi, President of the Sri Lanka Housewives Association is of the impression that the Budget has not brought relief to the elderly. “We were looking forward to the cost of living being reduced through the new Budget, but as far as I can see, no such relief has been made through these proposals. The majority of our association members are elderly and dependent on our children. However I must note that the pension revisions and ironing out pension anomalies is a great relief and certainly welcomed by pensioners. I cannot comment on whether the Budget has addressed domestic issues and needs, however for us, it has not made any positive impact,”

she commented.

‘Senseless to extend disability infrastructure deadline beyond 2020’

Disability Organisations

Joint Front

Dr. Prasanna Kuruppu, Advisor to the Disability Organisations Joint Front said he was tremendously disappointed with the 2019 Budget, as it had not considered their submissions pertaining to disability related issues in the country. “Prior to the Budget reading, we requested an audience with Minister Mangala Samaraweera. Unfortunately our request wasn’t considered. We had been lobbying since 2017 to make more provisions for the disabled, at least by 2018, but it was all in total vain. The government has a responsibility to society and it cannot be ignored,” he said.

“We have been demanding accessibility for the differently-abled for years and this government has set this goal for 2023, which is senseless. This is a typical political play and we’re not at all happy with the outcome. Politicians are only concerned about the office they hold and we only received an increment of Rs. 2000 from the disability allowance,” he stressed.

Dr. Kuruppu also highlighted the lack of a database, including the number of disabled in the country. “Together our organizations have made proposals to implement such a database to the National Planning Department under the Ministry of Finance. The government is running without any direction and it only infuriates me further that our proposals had not been considered. As MP Sunil Handunnetti elaborated during a recent political debate on TV, Rs. billion 28.885 had been allocated to provide facilities for the disabled. But we cannot see this money being put to effective service for the disabled. Furthermore this amount is separate from the funds allocated through provincial council budgets. We’d like to know, where has the money gone,” he added.

‘Indirect taxes problematic’

National Construction Association of Sri Lanka

Athula Priyantha Galagoda of the National Construction Association of Sri Lanka observed that no special relief measures were introduced for the construction industry. “There are no provisions made under the 2019 Budget that will benefit the construction industry, in my opinion. During meetings held earlier with industry stakeholders and government authorities, there were promises made that our concerns will be addressed, especially our proposal to re-evaluate the Nation Building Tax (NBT). NBT was not applicable to construction contracts until the provisions made under the 2017 Budget. This introduction of NBT on construction contracts has a cascading effect. We are indirectly imposed with other taxes, which eventually amounts to at least 4% of taxation. These issues have not been addressed by the 2019 Budget,’ he said.

30 Nov 2024 51 minute ago

29 Nov 2024 29 Nov 2024

29 Nov 2024 29 Nov 2024

29 Nov 2024 29 Nov 2024

29 Nov 2024 29 Nov 2024