10 Oct 2024 - {{hitsCtrl.values.hits}}

A protest held against the Microfinance and Credit Regulatory Authority Bill earlier this year

Pix by Pradeep Pathirana

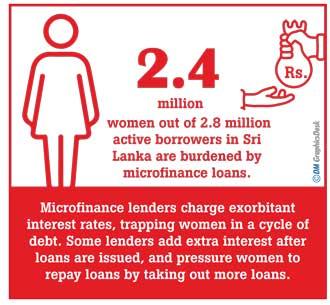

As more women in rural parts of Sri Lanka fall prey to predatory microfinance practices, significant efforts are being taken by civil society groups and independent researchers to ease women off the mounting debt burden. Latest figures indicate that as many as 2.4 million borrowers are women from a total of approximately 2.8 million active borrowers from across the country. Even though microcredit was recognised as a tool to alleviate poverty back in 1990s, today it is a lucrative business that has tightened the noose among rural poor, particularly women.

As more women in rural parts of Sri Lanka fall prey to predatory microfinance practices, significant efforts are being taken by civil society groups and independent researchers to ease women off the mounting debt burden. Latest figures indicate that as many as 2.4 million borrowers are women from a total of approximately 2.8 million active borrowers from across the country. Even though microcredit was recognised as a tool to alleviate poverty back in 1990s, today it is a lucrative business that has tightened the noose among rural poor, particularly women.

Ongoing predation

When this newspaper contacted Bhavana Devi Selvarajah to fix an appointment to meet her in Vavuniya, she was of the impression that another microfinance lender had been trying to contact her. “From which bank are you calling” was her immediate response. It was later on that she realised that we were a media outlet. This is the extent to which women have been pressured by microfinance lenders in rural areas such as Vavuniya. While in Vavuniya, she introduced us to *Chelvi, another woman who was going through emotional distress due to mounting debt burden.

“Once women obtain loans, microfinance lenders add more interests to the interest,” said Selvarajah, a women’s rights activist who has been advocating against fraudulent microfinance practices and defending rights of women in the area. “These lenders brainwash vulnerable women. They would initially lend around Rs. 25,000 and the women would start paying interests. Then the lenders would come and ask them to pay the remaining amount at once. Not knowing the repercussions, women would then obtain loans from another lender, either a microfinance lender or an informal lender to settle the total amount. Thereafter they are given another Rs. 50,000. By this time the interests from the second lender has started accumulating. Apart from giving a loan to one beneficiary, these  companies ask women to gather five more women. So women who have no financial challenges also get involved in this vicious debt cycle. They become each others guarantors. So they spend all the money and by the time they have to repay their interests they are penniless. This sparks many issues in the domestic front,” she explained.

companies ask women to gather five more women. So women who have no financial challenges also get involved in this vicious debt cycle. They become each others guarantors. So they spend all the money and by the time they have to repay their interests they are penniless. This sparks many issues in the domestic front,” she explained.

Mushrooming unregistered MFIs

Chelvi, a mother of three had obtained loans from 13 Microfinance Institutions (MFIs) and had a total of Rs. 26 lakhs as the total payable debt amount. If not for her relatives who came forward to resettle Rs. 23 lakhs of her debt, Chelvi would have been thrown to a dire strait. She works at an Ammachchi outlet from 5.30am to 6.00pm and earns Rs. 1500 daily. She is now trying to repay the rest of her loan amounting to Rs. 300,000 with this job. Her daughter is still unmarried as the social status is a main point of concern in a marriage. They are more interested about the mother’s occupation and dowry than the bride.

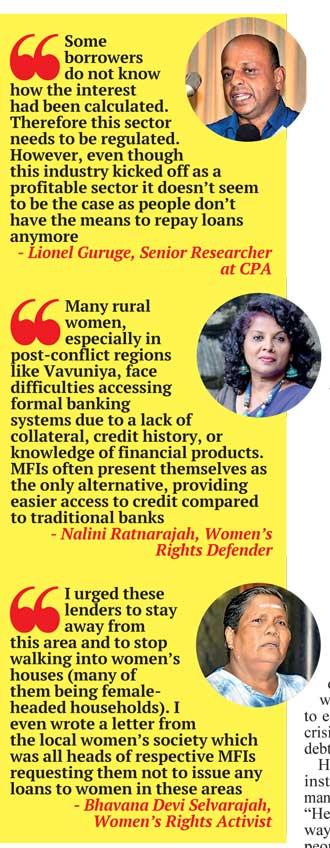

When many women reached out to Selvarajah for help, she immediately acted upon the matter. “I urged these lenders to stay away from this area and to stop walking into women’s houses (many of them being female-headed households). I even wrote a letter from the local women’s society which was all heads of respective MFIs requesting them not to issue any loans to women in these areas. What we found out was that none of these 13 financial institutions have been registered at the Central Bank. The receipts given to women are in Sinhala. The agreements and other documents are either in English or Sinhala. There are some women who can’t even read or write Tamil. So they are being asked to place their fingerprint on these documents. Some women contemplated taking their own life. Lenders also charge documentation fees and other types of fees. If one beneficiary obtained a loan from one bank why are 12 others also lending her loans? How did 13 banks issue loans to someone who is employed in the informal sector,” Selvarajah questioned.

Selvarajah claimed that following the emergence of the microfinance sector, more individuals have started lending loans. “Some women are quite desperate that they would take a loan at whatever the interest rate. For these individuals, it is a profitable business. In fact these women are trapped in a vicious loan cycle. Some women are dependent on these loans. The government should immediately intervene to regulate the microfinance sector,” she said. Selvarajah requested while recalling numerous instances when she had been threatened to stay away from intervening into this matter.

A gamut of pressing issues

Shedding more light on the issue, Nalini Ratnarajah, Women’s rights defender and Executive Director at Women’s Development Innovators said that women in Vavuniya, Sri Lanka, and many other regions are pushed towards obtaining microfinance loans due to a combination of structural, social, and economic reasons. “Many rural women, especially in post-conflict regions like Vavuniya, face difficulties accessing formal banking systems due to a lack of collateral, credit history, or knowledge of financial products. MFIs often present themselves as the only alternative, providing easier access to credit compared to traditional banks,” said Ratnarajah.

She further said that in the Northern District, customary law, specifically Thesavalamai law, plays a significant role in limiting women’s access to formal credit from banks. “Under this law, women are often denied land ownership, which restricts their ability to use property as collateral when applying for loans. Even if a property is in a woman’s name, she is required to obtain written permission from her husband before using it as a source of collateral, further limiting her financial independence,” she added.

Ratnarajah underscored the fact that many women are sole breadwinners or are part of low-income households where the primary source of income may not be enough to meet daily needs. Therefore, microfinance loans are seen as a quick solution to cover immediate needs, fund small businesses, or invest in agriculture or household improvements.

Speaking about post-war economic vulnerability, Ratnarajah further said that the loss of male family members during the conflict has further exacerbated the burden on women, compelling  them to take loans to sustain their families. This is particularly evident in areas such as Vavuniya which has faced long-term socioeconomic challenges due to the civil war.

them to take loans to sustain their families. This is particularly evident in areas such as Vavuniya which has faced long-term socioeconomic challenges due to the civil war.

“In addition, traditional gender roles often place the responsibility of household management and family welfare on women. The expectation to manage these burdens without sufficient resources drives many to microfinance loans as a desperate measure to make ends meet,” she added.

She reiterated how microfinance institutions, particularly in post-war areas like Vavuniya, have been criticized for their predatory lending practices. “Exorbitant interest rates, combined with relentless debt collection tactics, leave many women trapped in a vicious cycle of debt. The pressure from these institutions can be so overwhelming that it leads to extreme outcomes, such as contemplating suicide.”

The lack of social safety nets is another trigger point that pushes women towards obtaining microfinance loans. Ratnarajah further said that the absence of comprehensive government support systems or social safety nets for women, particularly in rural areas, leaves them vulnerable to economic shocks and financial emergencies. “This vulnerability is exacerbated by the pressures of foreign debt and high taxation, which can strain public resources and limit the government’s ability to provide essential services. In such an environment, women often turn to microfinance loans as a coping mechanism, relying on these high-interest loans in the absence of more sustainable and supportive financial alternatives,” she said.

When asked what could be done about microfinance institutions charging exorbitant interest rates, Ratnarajah said that addressing the issue of exorbitant interest rates charged by financial institutions, despite attempts by the Rajapaksa and Ranil governments to reduce them, requires a multifaceted approach. Some of the interventions include strengthening regulatory frameworks, enhance monitoring and oversight, promote financial literacy, encourage responsible lending practices, expand access to formal banking among others.

Call to amend all customary laws

Responding to a query on suggestions to policymakers in resolving the microfinance crisis, Ratnarajah said that her special request to President Anura Kumara Dissanayake is to amend all customary laws to ensure that they are non-discriminatory and promote equal rights for all Sri Lankan women, particularly concerning property rights. “This includes revising existing legal frameworks that restrict women’s ownership and control of property based on gender. Efforts should focus on ensuring that women have the same legal standing as men in matters of land and property ownership, inheritance, and access to financial resources. It is essential to create a legal environment that empowers women to exercise their rights fully, enabling them to independently own and manage property without the need for approval or permission from male family members,” she continued.

She further said that these amendments should be accompanied by awareness campaigns to educate communities about the importance of gender equality in property rights. “This holistic approach will not only enhance women’s economic empowerment but also contribute to broader societal changes that challenge traditional norms and promote equality for all citizens,” she underscored.

CSOs urge govt. to regulate microfinance sector

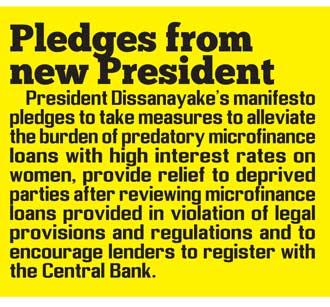

In the wake of mounting concerns regarding unregulated money lending practices, the Credit Regulatory Authority Bill was introduced to ‘establish the microfinance and credit regulatory authority, to regulate money lending and microfinance businesses, to provide protection for the customers of microfinance and money lending businesses and to repeal the Microfinance Act No. 6 of 2016. But experts who have been working at grassroots levels argue that the regulatory-supervisory framework put forth by the previous government doesn’t address the ‘mess’ created by big finance companies. Another criticism is that the Credit Regulatory Authority Bill encourages further commercialization of the microfinance industry. Many other issues pertaining to the Bill had been raised to the authorities by various organizations and independent researchers. But no feasible solutions have been reached to date.

The Centre for Policy Alternatives has been one such organisation that has worked tirelessly to ensure that women who have fallen victim to the microfinance debt crisis are released from the burden. “We have written so many letters to the Central Bank, Finance Ministry, various finance ministers who have served over time and even filed two cases which are pending at the Supreme Court and Appeal Court respectively,” said Lionel Guruge, Senior Researcher at CPA. “Following our interventions the Human Rights Commission of Sri Lanka determined that all documents pertaining to microfinance transactions including receipts should be written in a language that customers understand. The Credit Regulatory Authority Bill has been drafted to safeguard these institutions and if implemented it would worsen the crisis. Therefore we submitted our observations and comments on many vague areas in the Bill,” said Guruge.

One of the progressive steps taken with regards to mitigating the microfinance crisis is the implementation of a set of by-laws in collaboration with several governors from North Central, North Western, Uva, Sabaragamuwa, Southern and Western provinces that would ease the debt burden off the shoulders of rural women. “Once the Provincial Councils Elections take place these laws would come into effect. Some of the conditions urge lenders to refrain from visiting houses of borrowers many of whom are women. Some borrowers do not know how the interest had been calculated. Therefore this sector needs to be regulated. However, even though this industry kicked off as a profitable sector it doesn’t seem to be the case as people don’t have the means to repay loans anymore,” he added.

Another tactic used by microfinance lenders is to file cases against borrowers at District Courts on charges that the latter had breached the lending agreements. “Some women go to the extent of mortgaging their household items to repay loans. The debt burden has transformed into a major social issue with mounting tensions in the domestic front. I remember an instance when a woman was hiding inside a dug well to escape from pressure. The microfinance crisis indebted many people who didn’t have debts under their name,” Guruge further said.

However Guruge opined that certain institutions lend loans in a just and fair manner without adding pressure on borrowers. “Hence there are two sides to this story. In a way, microfinance companies are assisting people by lending money to people at times of need. But the issue lies in the manner in which certain MFIs recover money they have lended. We have observed how these big finance companies have bribed rural mediation boards who in turn add pressure on people to repay their loans at expected deadlines. Certain groups deserve to be released from the debt burden and we believe that the CBSL and Finance Ministry should work hand in hand to provide solutions to this crisis,” he concluded.

Several attempts to contact the Department of Supervision of Non-Bank Financial Institutions at the Central Bank of Sri Lanka to inquire about the implementation of maximum interest rates charged by MFIs following the circular issued in June 2022 remained futile.

After various interventions, the microfinance lenders chasing after Chelvi from Vavuniya, whom we introduced at the beginning of this article have backed off. But in this backdrop, for how long they would stay silent remains a question.

*Name withheld for security reasons

*Translations by T. K Mansoor

*This story was produced with the support of InterNews

25 Dec 2024 9 hours ago

25 Dec 2024 9 hours ago

25 Dec 2024 9 hours ago