03 Nov 2021 - {{hitsCtrl.values.hits}}

- Approval has also been granted to import 1,341,000 barrels of Octane 92 petrol and 459,000 barrels of Octane 95 petrol

- Crude oil is provided to the corporation by the supplier at the highest price reported ever

- Energy Minister wants 2.5 billion US Dollar loan to be investigated

- So far Sri Lanka’s foreign reserves remain at three billion US Dollars and obtaining 75% of that amount as a loan will create more issues

- State institutes owe the corporation around 150 billion rupees

- The Government has sought loans to import oil and such loans amount to ten fold of the US Dollar reserves the Government possesses as foreign reserves

- The CPC spokesperson said that obtaining loans with interest and giving commissions can only make CPC go bankrupt

Several parties pointed out recently that the country’s crude oil reserves were sufficient only till December and this would lead to a fuel shortage soon. Accordingly the available petrol reserves would suffice until January while the diesel storage would suffice until November. They also said that even though Minister of Energy Udaya Gammanpila sought to purchase oil from the UAE during his visit the Emirates’ authorities turned down his request. In this backdrop the Government of Sri Lanka (GoSL) attempted several strategies to purchase oil and Ceylon Petroleum Corporation sources say that such measures weren’t successful.

would lead to a fuel shortage soon. Accordingly the available petrol reserves would suffice until January while the diesel storage would suffice until November. They also said that even though Minister of Energy Udaya Gammanpila sought to purchase oil from the UAE during his visit the Emirates’ authorities turned down his request. In this backdrop the Government of Sri Lanka (GoSL) attempted several strategies to purchase oil and Ceylon Petroleum Corporation sources say that such measures weren’t successful.

Co-Cabinet Spokesman Minister of Plantation Dr. Ramesh Pathirana said at the cabinet media briefing on October 26 that contracts had been awarded to import diesel and petrol for the first eight months of next year. The Singaporean company Vitol Asia Pvt Ltd has received that long-term contract after the Cabinet approved the proposal made by the Minister Gammanpila to award the contract to the said company; as recommended by the Standing Cabinet Appointed Procurement Committee (SCAPC).

A decision was taken to import 1,137,500 barrels of diesel (maximum Sulfur percentage of 0.05) and 262,500 barrels of diesel (maximum Sulfur percentage of 0.001). Approval has also been granted to import 1,341,000 barrels of Octane 92 petrol and 459,000 barrels of Octane 95 petrol.

"Even though a fuel pricing formula is absent when fuel is issued to the public the calculation of prices of petrol and diesel per litre is done according to a pricing formula. Oil price, any loss and loan interests are calculated according to some formula. The corporation pays a loan interest of one billion rupees monthly - CPC spokesperson”

Even though the GoSL said it was possible to import fuel soon after awarding the tender, a spokesperson of Ceylon Petroleum Corporation (CPC) said that there was an issue regarding importing fuel during the planned period as it takes some time for the shipment to arrive and a loan agreement should be entered into prior to that. CPC Trade unions maintained that it was not possible to import diesel and petrol merely with cabinet approval and a loan agreement should be entered into with the relevant institutes and that takes time. So far the corporation has not entered into any agreement with any institute to obtain loans, they added.

According to the agreement signed in May last year to import petrol, the stocks will last till next January. The GoSL has not renewed that tender to re-import petrol. The CPC spokesperson said that there would be a fuel shortage as a result and Diesel was not imported at the time due to the lack of funds. Minister Gammanpila recently said that diesel stocks in the corporation would last till December. It is uncertain whether he means that the lack of crude oil could be a problem and would lead to a possible crisis. A Nigerian company has received the tender to supply crude oil. Even though the company promised to supply crude oil according to the agreement, from May onwards, the supply had not been continuous, the spokesperson added. “The corporation is now making quick purchases of crude oil. Crude oil is provided to the corporation by the supplier at the highest price reported ever. A barrel costs four dollars. As a result there is a crude oil crisis in the country and the crude oil refining process takes place at a slow capacity. Even if the refining process was to be conducted at maximum capacity there would still be a shortage of crude oil in the country.” he added.

Energy Minister wants loan investigated

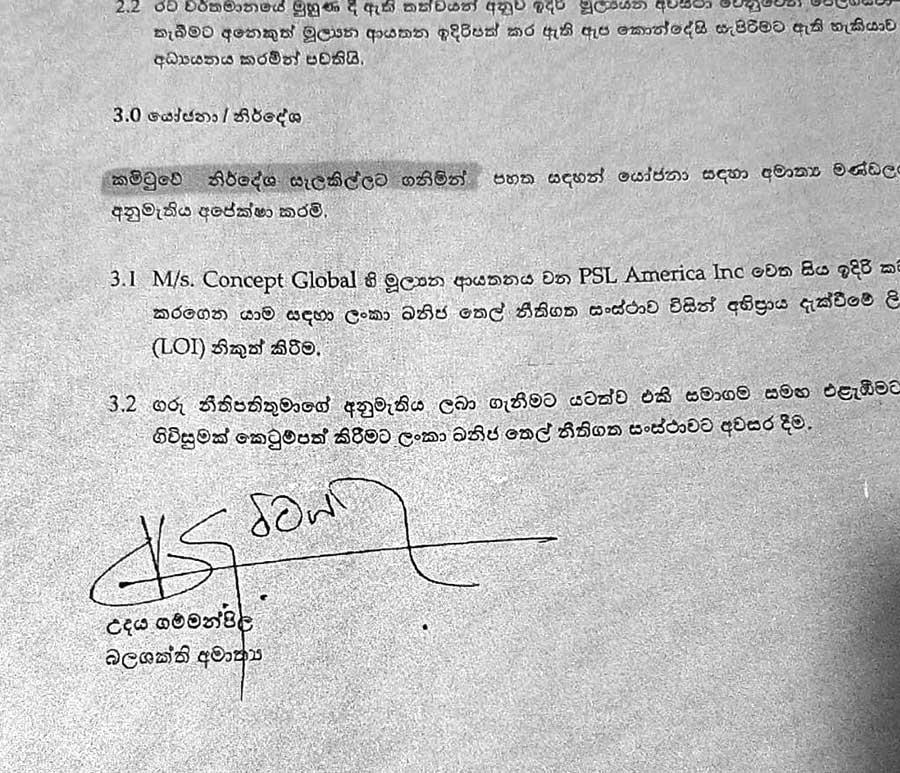

In that context the Cabinet approval has been sought according to a decision taken by the Minister and the board of directors to obtain a loan of 1 billion US Dollars to reimburse loans obtained from state banks. A cabinet paper in this regard has also been prepared. However when the paper was presented for Cabinet approval the loan amount had been increased to 2.5 billion US Dollars. Ceylon Petroleum Corporation’s Jathika Sewaka Sangamaya (JSS)Wing Secretary Ananda Palitha said that he was not aware of how and on whose intentions the loan was increased. The Minister said that the 2.5 billion US Dollar loan should be investigated through a committee named by the Secretary to the Energy Ministry, the Deputy Secretary to the Finance Ministry and the Chairman of the CPC. Even in such a backdrop, there are plans to obtain the concessionary loan with a 3% interest, Ananda Palitha said. “The grace period is 2 years and the repayment period is 12 years. This loan has been sought after agreeing to pay a commission of 7% as the debt raising cost. This procedure is completely illegal. The minister and the board of directors only approved a loan of one billion US Dollars and cabinet papers were prepared for that sum. However the Cabinet has approved 2.5 billion dollars and that is against the monetary policy of obtaining loans,” said Palitha.

"The Treasury will take further measures regarding the loan of 2.5 billion US Dollars. Our officers are assisting that process. The loan process is being attended to. Stocks of petrol and diesel will not end by January or December. The public need not worry - Buddhika Madihahewa - CPC Managing Director”

So far Sri Lanka’s foreign reserves remain at three billion US Dollars and obtaining 75% of that amount as a loan will create more issues. In addition to obtaining more money, disregarding the decision taken by the director board, a commission of 7% is paid to the institutes that issue loans. The commission is 175 million US Dollars and that is 37.8 billion in Sri Lankan rupees,” he added.

The CPC spokesperson said that the corporation owes the two leading state banks more than 3.5 billion rupees and added that GoSL or the corporation would not reimburse those loans. “Even though a fuel pricing formula is absent when fuel is issued to the public the calculation of prices of petrol and diesel per litre is done according to a pricing formula. Oil price, any loss and loan interests are calculated according to some formula. The corporation pays a loan interest of one billion rupees monthly. The public bears all these expenses and not the Government or the corporation,” CPC spokesperson added.

The Government has neither lent oil nor issued oil at a low price to the public. It has to grant more than 500 billion rupees to the CPC as oil subsidies. State institutes owe the corporation around 150 billion rupees. If that money can be retrieved the CPC will not have to obtain loans. Obtaining more and more loans amidst all these losses only impacts people and not the Government.” he affirmed.

"The grace period is 2 years and the repayment period is 12 years. This loan has been sought after agreeing to pay a commission of 7% as the debt raising cost. This procedure is completely illegal. The minister and the board of directors only approved a loan of one billion US Dollars and cabinet papers were prepared for that sum - Ananda Palitha - Ceylon Petroleum Corporation’s Jathika Sewaka Sangamaya (JSS)Wing Secretary”

Loans to import oil

The Government has sought a loan of 3.6 billion dollars from Oman, Ananda Palitha said. “I do not know about its loan interest. The loan has been requested to import oil for a year and the grace period is five years with a repayment period of 10 years. Another loan of 500 million US Dollars has been sought from India to import oil. The Government has sought loans to import oil and such loans amount to ten fold of the US Dollar reserves the Government possesses as foreign reserves.

The public should be informed of the agreements entered into when obtaining a loan with an interest when purchasing oil. The GoSL should disclose whether the countries offering loans want to retain state properties as bonds. According to Palitha no loan requested for has so far received approval. No agreement has been signed yet. But the Cabinet has given approval for a long-term importation of oil from a Singaporean company. Purchasing of oil is not possible as soon as the Cabinet approval is received. The GoSL does not have money to import oil. Loans should be sought with agreements and no such process has taken place yet. That is why the GoSL should explain whether the companies supplying oil have been given properties of the corporation or the state on lease or as bonds,” he said.

In a discussion held with the CPC trade unions Minister Gammanpila indicated that the CPC assets read a negative value. The CPC spokesperson said that obtaining loans with interest and giving commissions can only make CPC go bankrupt. “Even though the Government withdrew from regulating prices of essential items, it continued to impose taxes. If the GoSL acted in the same manner regarding oil the people would have had to bear the burden. In a situation like that the CPC Chairman said that recently the price of one litre of petrol should be subject to a hike of 14 rupees while the price of one litre of diesel should be raised by 16 rupees if the CPC is to avoid making a loss,” the CPC spokesperson said.

When increasing the oil prices on June 11 the Government said that oil prices should be increased to safeguard the two state banks. But according to the COPE reports petrol and diesel were to be issued at a price of 56 rupees a litre throughout 2020. The COPE report reveals that the Government has obtained profits of 40 rupees, by selling one litre of diesel at 104 rupees, and 81 rupees by selling petrol at 137 rupees per litre. The Government announced that even though the world market oil price was reduced the fuel price could not be reduced and that the price of salmon and dhal would be decreased. That did not happen. The Government said that as the two state banks had collapsed and the profit obtained from oil was to be used to reimburse the loans. However that did not happen either. That profit was to be used to establish a fund to stabilize oil prices, but it was all in vain, the spokesman added further. Palitha said that the GoSL had increased oil prices on June 11 by deceiving the people.

Speaking of the claims made by the CPC trade unions on a fuel shortage by December CPC Refinery Manager E.A.S. Edirisinghe said that it is hard to say whether there would be a fuel shortage. “We are trying to manage somehow. We are refining crude oil at a low cost and that will not be a problem. We are attempting other ways to buy oil and are trying to purchase it somehow. Most likely we will receive oil by December. It will not be a problem,” said Edirisinghe.

Speaking on where to raise funds to purchase oil CPC Deputy General Manager (Finance) V. A. Weerasooriya said that there is an officer named Subhashini at the corporation to obtain information and asked us to contact her. When this newspaper contacted Subhashini she said that she could not provide details to the media directly and asked this writer to request for details through the Right to Know Act or to contact the Commercial and Supply Chain for information.

An officer of the Commercial and Supply Chain informed the Daily Mirror to dial 115. The officer responding to our call picked the receiver and hung up even before inquiring who the caller was. Contacting the CPC on 0115455115 proved to be a futile exercise.

CPC Deputy General Manager (Commercial and Supply Chain) M. K. Gurusinghe said that he was not allowed to reveal information to the media and asked the writer to contact the Chairman or the Managing Director.

CPC Managing Director Buddhika Madihahewa said that the corporation was borrowing oil. “The Treasury will take further measures regarding the loan of 2.5 billion US Dollars. Our officers are assisting that process. The loan process is being attended to. Stocks of petrol and diesel will not end by January or December. The public need not worry. The corporation has fuel stocks, hence there wouldn’t be an oil shortage. We sought a loan of 3.6 billion US Dollars from Oman and it is only a proposal. An agreement has not been signed in that regard. The Cabinet approval has been granted and the process is continuing. We requested Cabinet approval to obtain a loan worth one million US Dollars. The Cabinet proposed 2.5 million US Dollars. That process is also continuing. No loan has been finalized. Such processes cannot be completed at once. There are legal concerns that are being handled these days. Fundamental requirements to obtain any of these loans have not been fulfilled. They are being handled and will take time. But the loan of 500 billion US Dollars requested from India is in its final stage. That loan will be granted soon,” said Madihahewa.

"We are trying to manage somehow. We are refining crude oil at a low cost and that will not be a problem. We are attempting other ways to buy oil and are trying to purchase it somehow. Most likely we will receive oil by December, - E.A.S. Edirisinghe - CPC Refinery Manager”

Speaking regarding the stocks of crude oil and petrol and diesel at the corporation Madihahewa said that he could not state the amount at once. “Stocks change according to daily usage. Refining is carried out at a low capacity and the Nigerian company is supplying crude oil keeping with the tender. Oil has been ordered through new tenders. The two state banks have not rejected the letters of credit to import oil and all matters are taken care of. A barrel of crude oil costs more than 95 US Dollars and by December it will exceed 100 US Dollars. Even if some say that a litre of petrol can be issued at 118 rupees, it is not practical according to the current prices. The price of a litre of oil is decided upon by the price of a barrel calculated in US Dollars and divided by litres, shipping fees, insurance fees, transport fees and Government taxes. Crude oil is not purchased instantly and is obtained only by calling for tenders with Cabinet approval based on the approval and recommendations of the Procurement Committee. We cannot obtain oil beyond this process.” he added.

CPC Chairman W. W. D. Sumith Wijesinghe said that Cabinet approval was granted on October 25 to a purchase made under the normal procedure to import petrol and diesel. “Agreements for loans with Cabinet approval are not yet signed and therefor those purchases will delay. We have called for tenders to import oil till January. This approval was granted to purchase oil after January. There will be no fuel shortage.”

Attempts made to contact the Energy Minister Gammanpila were futile. However he informed the media recently that the CPC has fuel stocks to last till January 2022 and therefore people should have no fear.

Cabinet papers presented for the purpose of requesting financial assistance to obtain crude oil

23 Dec 2024 25 minute ago

23 Dec 2024 31 minute ago

23 Dec 2024 39 minute ago

23 Dec 2024 1 hours ago

23 Dec 2024 1 hours ago