28 Jun 2017 - {{hitsCtrl.values.hits}}

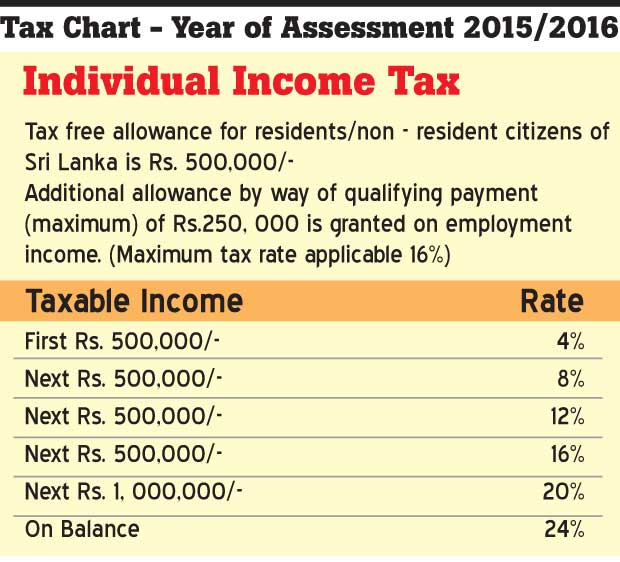

At a time when the country is facing a debt burden, Ministers should play a key role in securing the people’s money. But they seem to care less. While they get to enjoy most perks and benefits, many of them seem to be surviving the tax game as well. The Daily Mirror learns that the statutory allowance for any individual, whether a resident or not is Rs. 500,000. This is a tax-free allowance given to all citizens of Sri Lanka. Therefore in order to charge income tax an individual should have an income amounting more than Rs. 500,000. But when it comes to Ministers this is not the case. While they are being blessed with many perks and benefits, they are also not taxed in most instances. Speaking to the Daily Mirror a few individuals expressed their concerns regarding this matter.

At a time when the country is facing a debt burden, Ministers should play a key role in securing the people’s money. But they seem to care less. While they get to enjoy most perks and benefits, many of them seem to be surviving the tax game as well. The Daily Mirror learns that the statutory allowance for any individual, whether a resident or not is Rs. 500,000. This is a tax-free allowance given to all citizens of Sri Lanka. Therefore in order to charge income tax an individual should have an income amounting more than Rs. 500,000. But when it comes to Ministers this is not the case. While they are being blessed with many perks and benefits, they are also not taxed in most instances. Speaking to the Daily Mirror a few individuals expressed their concerns regarding this matter.

“This is one major problem that this country has,” says Lacille de Silva, former Secretary to the Presidential Commission of Inquiry into Serious Acts of Frauds and Corruption. “Tax officers chase after ordinary people but if we look at these Ministers, they make huge profits. They sell their permits and live lavishly. Some of these Ministers have even failed to show their annual declaration of assets as well. If the tax officers chase after these Ministers they don’t have to burden the public. I think most of these tax officers have gathered money illegally. They don’t seem to be executing the tax law as said. Most of these Ministers don’t pay the tax in the legitimate manner.”

“This is one major problem that this country has,” says Lacille de Silva, former Secretary to the Presidential Commission of Inquiry into Serious Acts of Frauds and Corruption. “Tax officers chase after ordinary people but if we look at these Ministers, they make huge profits. They sell their permits and live lavishly. Some of these Ministers have even failed to show their annual declaration of assets as well. If the tax officers chase after these Ministers they don’t have to burden the public. I think most of these tax officers have gathered money illegally. They don’t seem to be executing the tax law as said. Most of these Ministers don’t pay the tax in the legitimate manner.”

Tax officers chase after ordinary people but if we look at these Ministers, they make huge profits. They sell their permits and live lavishly

Inland Revenue Department Deputy Commissioner General, Ivan Dissanayake said that not all Ministers have been taxed. “Their job is quite different and if we take a Minister in Matara, they will have to go and do most work on the field. Therefore they are not taxed from their salary. Some time back there were discussions to get Ministers to pay income tax according to the formula. In the case of an ordinary person, they are given a limit of Rs. 500,000 and this is common to all. Those who are paid more than Rs. 500,000 will be taxed. There are no separate rates for Ministers and ordinary citizens but it applies to all.”

Those who are paid more than Rs. 500,000 will be taxed. There are no separate rates for Ministers and ordinary citizens but it applies to all

Recently, the government once again sought parliamentary approval for a supplementary estimate to cover Rs. 330 million for the purchase of vehicles for three cabinet ministers, three state ministers, a Provincial Governor and a Secretary to the Prime Minister. Contrary to what has been said or done, the present regime seems to be treating themselves to luxuries.

During the recent floods, another supplementary estimate of Rs. 369 million was proposed to the Parliament, this time to allocate money for vehicles to be given to lawmakers and to renovate their official residences.

Therefore the total amount allocated to buy vehicles mainly for ministers, deputy ministers and senior public officials summed up to Rs. 1,200 million. Yet, fortunately, although the aforementioned amount was then suspended due to the disaster situation, it has already been approved as in most instances.

During the recent floods, another supplementary estimate of Rs. 369 million was proposed to the Parliament for vehicles

In his comments, Attorney-at-law Nagananda Kodituwakku said that these elected representatives have given a pledge to work in accordance with the Constitution. “They have pledged to be faithful to the citizens who came forward to elect them. Everybody from those in the Cabinet to lawyers, judges and other government officials should work according to the Constitution once elected to office. But from what I see, the people in this country have been misled. Vehicles have been given to ministers to perform their duties and work efficiently. But this doesn’t mean that they should be buying and selling permits at their own will. From what I found, although it was said that 45 vehicles were imported on tax-free permits another 46 of them have arrived. So the count goes up to 91. This shows that ministers are given tax-free permits to make money.

In his comments, Attorney-at-law Nagananda Kodituwakku said that these elected representatives have given a pledge to work in accordance with the Constitution. “They have pledged to be faithful to the citizens who came forward to elect them. Everybody from those in the Cabinet to lawyers, judges and other government officials should work according to the Constitution once elected to office. But from what I see, the people in this country have been misled. Vehicles have been given to ministers to perform their duties and work efficiently. But this doesn’t mean that they should be buying and selling permits at their own will. From what I found, although it was said that 45 vehicles were imported on tax-free permits another 46 of them have arrived. So the count goes up to 91. This shows that ministers are given tax-free permits to make money.

45 vehicles were imported on tax-free permits another 46 of them have arrived. So the count goes up to 91. This shows that ministers are given tax-free permits to make money

Prices of essential goods are being increased and people are unable to bear the high cost of living. If someone gets down an ordinary car from India, the tax is Rs. 2 million. In Sri Lanka, the tax on a motor vehicle is 300% more than that in Britain and this keeps increasing every year. So where does the democracy in this country stand? Even those MPs who say that they haven’t used their perks and benefits seem to be doing the opposite. Therefore our officials lack honesty, integrity and loyalty.”

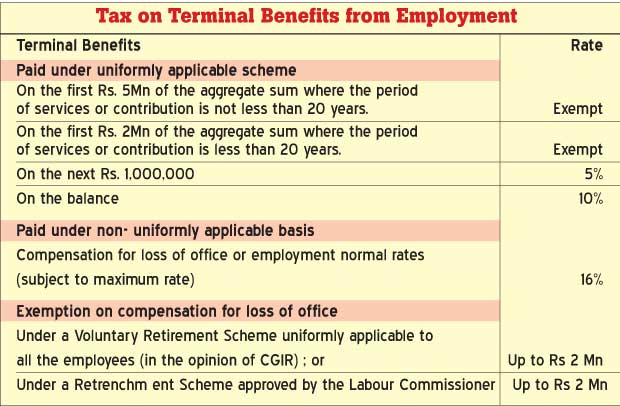

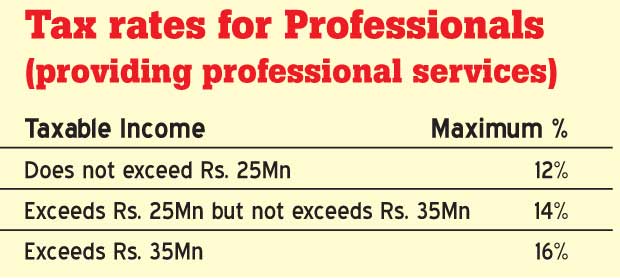

Please refer to the 2015/16 breakdown of tax rates given in graphs:

Speaking to the Daily Mirror, JVP politburo member Wasantha Samarasinghe said that the President and the Prime Minister don’t seem to be ashamed of misusing money in this way. “The people displaced and affected by the Meethotamulla tragedy were given a small compensation and they spent Rs.330 million to bring down vehicles. This is ridiculous. They are misusing people’s money. Many luxury vehicles were brought down during the CHOGM event and nobody knows what happened to those vehicles. It is shameful to see such abuse of power and misuse of people’s money.”

Speaking to the Daily Mirror, JVP politburo member Wasantha Samarasinghe said that the President and the Prime Minister don’t seem to be ashamed of misusing money in this way. “The people displaced and affected by the Meethotamulla tragedy were given a small compensation and they spent Rs.330 million to bring down vehicles. This is ridiculous. They are misusing people’s money. Many luxury vehicles were brought down during the CHOGM event and nobody knows what happened to those vehicles. It is shameful to see such abuse of power and misuse of people’s money.”

30 Oct 2024 14 minute ago

30 Oct 2024 37 minute ago

30 Oct 2024 1 hours ago

30 Oct 2024 5 hours ago

29 Oct 2024 29 Oct 2024