22 Aug 2024 - {{hitsCtrl.values.hits}}

Effectiveness of AMCs lies in their unique ability to reduce monetary externalities and costs associated with loan delinquencies

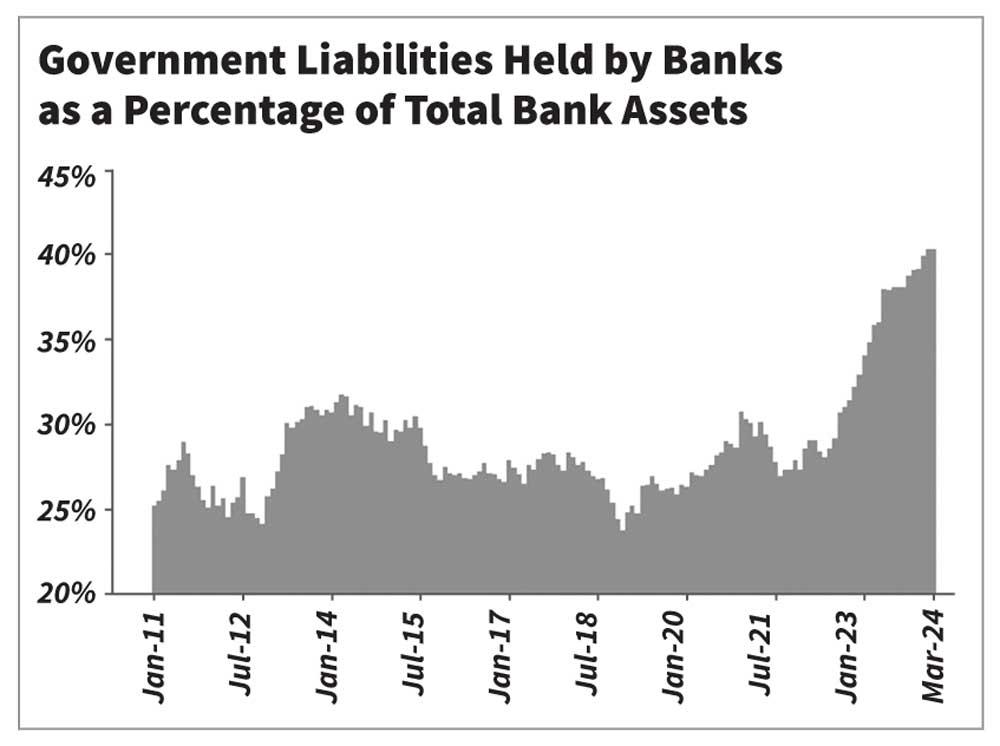

Sri Lanka needs rapid economic growth to overcome the current crisis. At the Public Finance Lounge hosted by Verité Research on July 5, 2024, I highlighted that such growth is difficult to envision given the limited balance sheet capacity in the banking system. There is clear evidence of significant “crowding out” of private loans by government debt. The share of rupee-denominated government debt and other government liabilities has increased from approximately 25% of total banking assets in 2019 to over 40% in 2024. The figure illustrates this challenge.

Sri Lanka needs rapid economic growth to overcome the current crisis. At the Public Finance Lounge hosted by Verité Research on July 5, 2024, I highlighted that such growth is difficult to envision given the limited balance sheet capacity in the banking system. There is clear evidence of significant “crowding out” of private loans by government debt. The share of rupee-denominated government debt and other government liabilities has increased from approximately 25% of total banking assets in 2019 to over 40% in 2024. The figure illustrates this challenge.

There are two key issues at play. First, the restructuring of Rupee debt (‘DDO’) was neither comprehensive nor broad-based, as we argued for in the Verite Research Background Note, “The desirability of domestic debt restructuring,” published in October 2022. By delaying action for a year after our analysis, the government allowed domestic debt to accumulate at interest rates exceeding 25%. It then failed to restructure most of the high-yield bonds issued during that period, rendering the domestic debt restructuring inadequate to address the problem.

Second, loans with an increase in credit risk and non-performing loans (Stage 2 and 3 loans, respectively) are at approximately 25% in 2024 (although there has been a gradual reduction). For context, this figure is below 15% in Europe and the UK and 10% for Thailand and Malaysia. These loans constitute bank capital tied to loans that are either not being repaid or at risk of not being repaid on time (if at all). The first issue requires the newly formed public debt office to reduce the stock of outstanding Rupee debt, particularly the proportion of debt held by the banking system. The second issue requires a mechanism for banks to free up capital from unproductive loans so that they can be utilized in new, productive investment opportunities.

In my articles “Debt restructuring and a path to confidence and hope” (14 January 2022, DailyFT, Sri Lanka) and “Sharing the cost of the crisis: The need to restructure domestic debt together with an ‘Asset Management Company” (19 April 2022, DailyFT, Sri Lanka), I have argued that an Asset Management Company is a necessary institution for Sri Lanka to emerge quickly and resiliently from this crisis.

Asset Management Companies (AMCs) are special purpose vehicles (SPVs), often funded by the government or in collaboration with the private sector, that purchase assets or loans from banks in exchange for cash or other liquid assets such as government bonds. The assets or loans acquired by AMCs are typically difficult to sell to other banks or private sector participants (lack of liquidity in secondary markets) and are often linked to firms in financial difficulties. AMCs free up bank funds, enabling banks to issue new loans to more productive companies.

AMCs have played an important role in stabilizing financial systems worldwide during economic crises by addressing increased delinquencies in banks’ loan portfolios. Although central banks and governments traditionally managed these crises through liquidity support and bank recapitalization, the post Global Financial Crisis era saw AMCs emerge as an alternative approach in countries like Ireland, Spain, and Slovenia. AMCs remove non-performing loans (NPLs) from bank balance sheets, improving banks’ lending capacity. In Europe and Asia, AMCs have been particularly effective in managing corporate loans and debt, purchasing distressed assets at prices reflecting their long-term value to prevent fire sales. Successful examples include Ireland’s National Asset Management Agency (NAMA) and Malaysia’s Danaharta.

Danaharta, Malaysia’s national Asset Management Company, was established during the Asian financial crisis to stabilize the financial system by addressing non-performing loans. Equipped with special legal powers, Danaharta efficiently acquired NPLs at market value using government-guaranteed bonds and implemented a profit-sharing incentive structure to encourage participation from financial institutions. During its operation, Danaharta managed a portfolio totaling RM52.42 billion in NPLs, recovering 58% of their face value. This success was mirrored by similar AMCs across Asia, such as KAMCO in Korea and IBRA in Indonesia, which played crucial roles in developing distressed asset markets and supporting corporate debt restructuring. These AMCs resolved NPLs and strengthened domestic financial markets and legal frameworks, helping to prevent future crises. After completing its mandate, Danaharta’s remaining assets were transferred to Prokhas, a Ministry of Finance subsidiary, for continued management.

In a recent research paper, “Distressed Assets and Fiscal-Monetary Support: Are AMCs a Third Way?”, co-authored with Reiner Martin (National Bank of Slovakia), Edward O’Brien (European Central Bank), and Dimitrios Tsomocos (University of Oxford), we found that the effectiveness of AMCs lies in their unique ability to reduce pecuniary externalities and costs associated with loan delinquencies. AMCs enhance the average returns to bank lending, directly encouraging additional lending (bank lending channel) and strengthening corporate borrowers’ balance sheets (balance sheet channel). A well-designed and well-managed AMC can generate significant welfare gains, regardless of whether they are financed through fiscal or sterilized monetary transfers.

Establishing an AMC in Sri Lanka will provide much-needed balance sheet liquidity and indirect capital support to the banking sector, enabling it to become an engine for the economy’s growth. The capitalization of the AMC from domestic sources and foreign multilaterals would also support the inflow of capital to the private sector. Conversely, allowing stagnant assets to remain on bank balance sheets will create a drag that ultimately limits the country’s growth potential.

Prof M. Udara Peiris is an Associate Professor of Financial Economics at Oberlin College USA, and a Global Academic Fellow of Verité Research; he can be reached at [email protected]

21 Dec 2024 59 minute ago

21 Dec 2024 7 hours ago

21 Dec 2024 8 hours ago

21 Dec 2024 21 Dec 2024

21 Dec 2024 21 Dec 2024