03 Apr 2023 - {{hitsCtrl.values.hits}}

High-income earning professionals engaged in various occupations were subject to taxes; as were Members of Parliament and Ministers (Picture AFP)

The government has introduced different income brackets under the ‘Pay As You Earn Tax’ (PAYE) system. If you earn between 100,000 to 141,667 rupees per month, you’ll be charged 6% in taxes for what’s earned above Rs 100,000. In the same manner if you earn between 141,667 to 183,333 rupees per month, you’ll be charged 12%. And the tax rate goes up as you earn more - 18% for those earning between 183,333 to 225,000 rupees, 24% for those earning between 225,000 to 226,267 rupees, and 30% for those earning between 226,267 to 308,333 rupees per month; what’s subject to tax in all these categories being the amount earned in excess of the initial bottom figure of each salary scale. If you earn more than 308,000 rupees per month, you’ll be charged 36% in taxes.

6% in taxes for what’s earned above Rs 100,000. In the same manner if you earn between 141,667 to 183,333 rupees per month, you’ll be charged 12%. And the tax rate goes up as you earn more - 18% for those earning between 183,333 to 225,000 rupees, 24% for those earning between 225,000 to 226,267 rupees, and 30% for those earning between 226,267 to 308,333 rupees per month; what’s subject to tax in all these categories being the amount earned in excess of the initial bottom figure of each salary scale. If you earn more than 308,000 rupees per month, you’ll be charged 36% in taxes.

High-income earning professionals engaged in various occupations were subject to taxes; as were Members of Parliament and Ministers who are supposed to be engaging in a honourary service. They serve a term of five years. They are entitled to a pension after their term concludes. An MP, for instance, earns a pension of Rs 18,091 for their five years of service. Ministers and the Leader of the Opposition on the other hand receive a pension worth Rs 21,666 for their service. The speaker’s pension for five years of service is Rs 22,833.50. A Prime Minister completing a full term of five years receives Rs 23,500 as the pension.

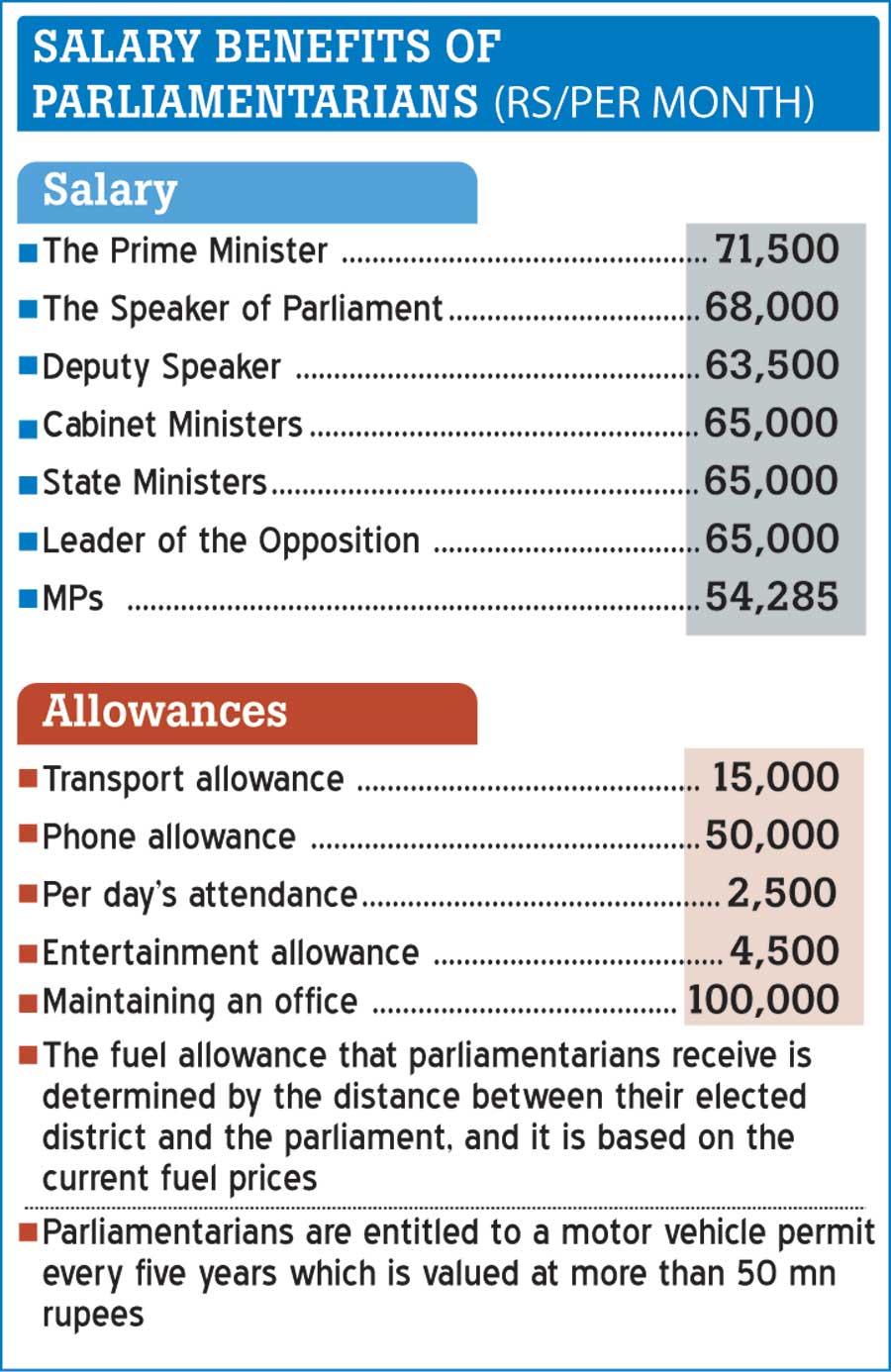

The total salary of a parliamentarian comprises largely of the allowances he or she receives. The Prime Minister earns a basic salary of 71,500 rupees per month. The Speaker of Parliament earns 68,000 rupees, while the Deputy Speaker’s basic salary is 63,500 rupees. Cabinet Ministers and State Ministers earn a basic salary of 65,000 rupees per month, and so does the Leader of the Opposition. As for MPs, their basic salary is 54,285 rupees. They also receive a transport allowance of Rs 15,000, a phone allowance of 50,000 rupees, and 2,500 rupees for everyday they attend Parliament. In addition they receive an entertainment allowance worth 4,500 rupees and 100,000 rupees per month for maintaining an office. The fuel allowance that parliamentarians receive is determined by calculating the distance between their elected district and the parliament, and it is based on the current fuel prices. As a result, their basic salaries vary. The PAYE tax is calculated based on the basic salary of parliamentarians; including these allowances.

The total salary of a parliamentarian comprises largely of the allowances he or she receives. The Prime Minister earns a basic salary of 71,500 rupees per month. The Speaker of Parliament earns 68,000 rupees, while the Deputy Speaker’s basic salary is 63,500 rupees. Cabinet Ministers and State Ministers earn a basic salary of 65,000 rupees per month, and so does the Leader of the Opposition. As for MPs, their basic salary is 54,285 rupees. They also receive a transport allowance of Rs 15,000, a phone allowance of 50,000 rupees, and 2,500 rupees for everyday they attend Parliament. In addition they receive an entertainment allowance worth 4,500 rupees and 100,000 rupees per month for maintaining an office. The fuel allowance that parliamentarians receive is determined by calculating the distance between their elected district and the parliament, and it is based on the current fuel prices. As a result, their basic salaries vary. The PAYE tax is calculated based on the basic salary of parliamentarians; including these allowances.

In addition to the aforementioned allowances, parliamentarians are entitled to a motor vehicle permit every five years, which is valued at more than 50 million rupees. Some ministers even use three or four vehicles in their ministry. They are also allowed to have a support staff of up to 15 people and their coordinating secretary is eligible for 100 hours of overtime pay and fuel allowances based on the current prices, and a person support staff is also appointed, who are often family members of ministers. These staff members also receive official vehicles and phone allowances. MPs are provided with a support staff comprising six people, and MPs in distant provinces are given a house from the Madiwela Housing Complex for a rent of 1000 rupees. Ministers are entitled to official residences during their tenure. Additionally, Members of Parliament receive five million rupees for development activities and an insurance cover running up to two million rupees. If an MP dies as a result of a terrorist attack or accident their family will receive six million rupees. All these privileges are provided to them during their five years of service in the government.

Some ministers even use three or four vehicles in their ministry. They are also allowed to have a support staff of up to 15 people and their coordinating secretary is eligible for 100 hours of overtime pay and fuel allowances based on the current prices, and a person support staff is also appointed, who are often family members of ministers

Member of Parliament Dayasiri Jayasekara recently raised concerns about the impact of income tax on his salary and living. When inquired, he stated that 36 percent of his salary, which amounts to 77,466.72 rupees, was deducted as income tax and with all allowances his total salary exceeded 350,000 rupees. However, another MP representing the Kurunegala district pointed out that the income of MPs varies depending on the allowances received. He said that the allowances of an MP representing Jaffna District and those of an MP representing Kurunegala District are different. He claimed that approximately 83,000 rupees was deducted from his salary as income tax, and his total salary with all allowances was around 300,000 rupees. The basic salary for MPs is 54,285 rupees, and they are also entitled to fuel and office allowances. Only the fuel allowance was increased for MPs in the past, and when the price of fuel increased, the amount of fuel provided was adjusted accordingly, the MP from Kurunegala said. The fuel allowance was increased only for the President and the Prime Minister.

A cabinet minister told us that around 100,000 rupees was deducted from the salary as the income tax. The minister further stated that about 85,000 rupees was deducted from the salary of a state minister. The minister added that they receive Rs. 2,500 per parliamentary session and that there are eight sessions per month. The minister also mentioned that the salary of a minister differs based on various allowances including fuel allowances. It was noted that PAYE tax is deducted from the basic salary plus these allowances.

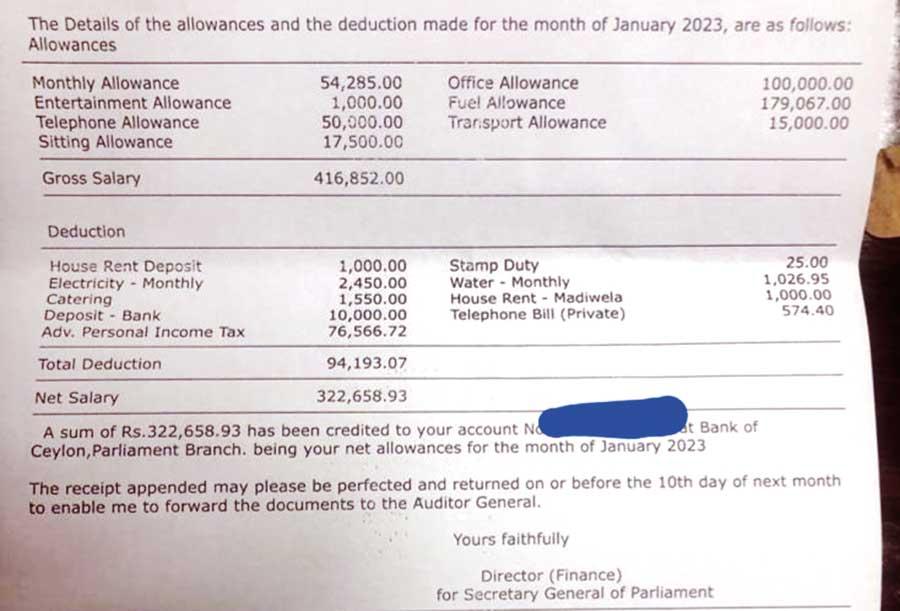

Knowing the approximate amount of tax deducted from a parliamentarian’s salary allows us to estimate their monthly salary. For instance, assume that the tax deducted is around 100,000 rupees per month, then we can add 73,500 rupees (as mentioned in the report on income tax deductions based on salary) to arrive at a total of 173,500 rupees. Dividing this amount by 36 and multiplying by 100 gives us the approximate total salary. However, this amount may vary based on the varying allowances received by each minister. In January 2023, a member of Parliament had to pay a tax of 76,566.72 rupees from his salary. Adding 73,500 rupees as shown to that amount we have 150,066.72 rupees. Dividing this number by 36 and multiplying by 100 gives us the salary of the MP. According to that, the salary of a Member of Parliament in January was 416,852 rupees. 73,500 rupees should be added to find the salary of a minister paying an income tax of 100,000 rupees. Then you get 173,500 rupees. When that number is divided by 36 and multiplied by hundred, you get a salary of 426,388.88 rupees is obtained as the total salary. The salary of a minister who pays 85,000 rupees as income tax can also be calculated using the above method. That is by adding 73,500 rupees to the 85,000 rupees, dividing by 36 and multiplying by hundred. Accordingly, the salary is calculated as 158,500÷36×100 and his salary is 440,277.77 rupees. Government employees or private sector employees do not typically receive these privileges throughout their 60 years of service, while ministers receive them for their five-year term.

The salary slip of a Member of Parliament

28 Jan 2025 6 hours ago

28 Jan 2025 6 hours ago

28 Jan 2025 7 hours ago

28 Jan 2025 7 hours ago

28 Jan 2025 8 hours ago