24 Jul 2023 - {{hitsCtrl.values.hits}}

There is now an elite consensus that the recovery plan is working; but working for whom?

Domestic Debt Optimization (DDO) has been cannibalizing the commentary in recent weeks but I invite the reader to zoom out of this specific aspect of the recovery to focus on the big picture. The current policy trajectory will enable Sri Lanka to post modest GDP growth after the next few years IF EVERYTHING goes to plan, i.e. Sri Lanka meets IMF targets and there is no significant global recession. This article intends to critique the lack of policy focus on Sri Lanka’s main structural economic weakness and to illustrate that political power considerations seem far more urgent to the present regime.

picture. The current policy trajectory will enable Sri Lanka to post modest GDP growth after the next few years IF EVERYTHING goes to plan, i.e. Sri Lanka meets IMF targets and there is no significant global recession. This article intends to critique the lack of policy focus on Sri Lanka’s main structural economic weakness and to illustrate that political power considerations seem far more urgent to the present regime.

- March 2023: The IMF Staff Report for Sri Lanka: “enhance Safety Nets (SSN) to help cushion the poor and vulnerable from the impact of the economic crisis and policy adjustments”

- April 2023: The World Bank Poverty Report: “the negative economic outlook for 2023 and 2024 and adverse effects of revenue-mobilizing reforms could worsen poverty projections… Mitigating these negative effects on the poor and vulnerable will remain critical…”

The government sold the public a plan with targeted cash transfers and social protections; words that were central to the IMF’s own discourse. The World Bank has projected that 7 million Sri Lankans are living in poverty; double the rate from 2019; urban poverty tripled during that same period. Two important dynamics to notice:

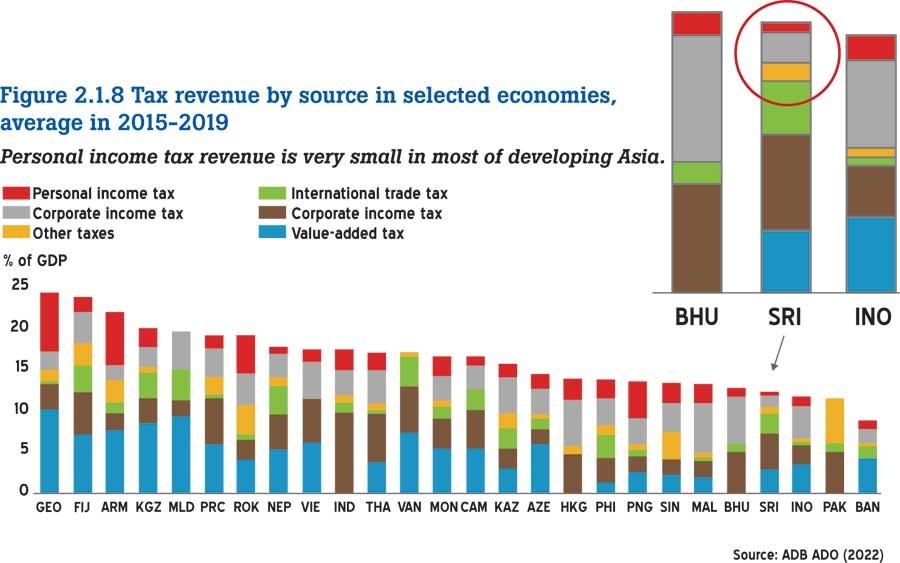

The Internal Revenue Department (IRD) has performed admirably at generating revenue from those already within the tax net but it is unclear whether the GOSL has been successful at widening the net and growing the tax base. I draw your attention to the following chart (1), extracted from a 2022 ADB report. Sri Lanka’s total tax revenue to GDP ratio was below those of peer-group countries. Take a look at the breakdown of tax revenue by source and compare this to other nations on the chart.

Have corporates and conglomerates been bearing the burden of generating additional revenue for the Treasury? Has the Wickremesinghe government sought to aggressively generate higher revenues from entities that benefitted the most from the Gota-era tax cuts?

Instead, here is a brief list of some of the President’s earliest actions, most of which revolve around suppressing dissent. The unnecessarily violent crackdown at GGG The (continued) use of the PTA to remand activists The equally monstrous Anti-Terrorism Act High-Security Zones Act The committee to investigate threats to religious harmony Broadcasting regulatory bill Postponement of local government elections Interference with provincial Governorships.

Policymakers were aware that the lives and livelihoods of Sri Lanka’s poorest segments would be decimated but did not prioritize the social safety net

Bandage for a Bullet Would

Sri Lankan policy is now focused on our primary account surplus, on fiscal consolidation and to be clear, this is a crucial exercise. There must also be a long-term view to cure Sri Lanka’s original economic sin. If we are to be precise, the country’s most significant structural economic weakness is our persistent trade deficit which has led to a multi-decade balance of payments crisis: Sri Lankan exports are mostly low value-added with little technological input Sri Lanka is extremely import dependent and has traditionally imposed excessive trade tariffs and protectionist barriers devoid of a focused strategy. The gap created by spending more foreign currency than we earn has been plugged by loans from countries (bilaterals), institutions and global finance (International Sovereign Bonds - ISBs)

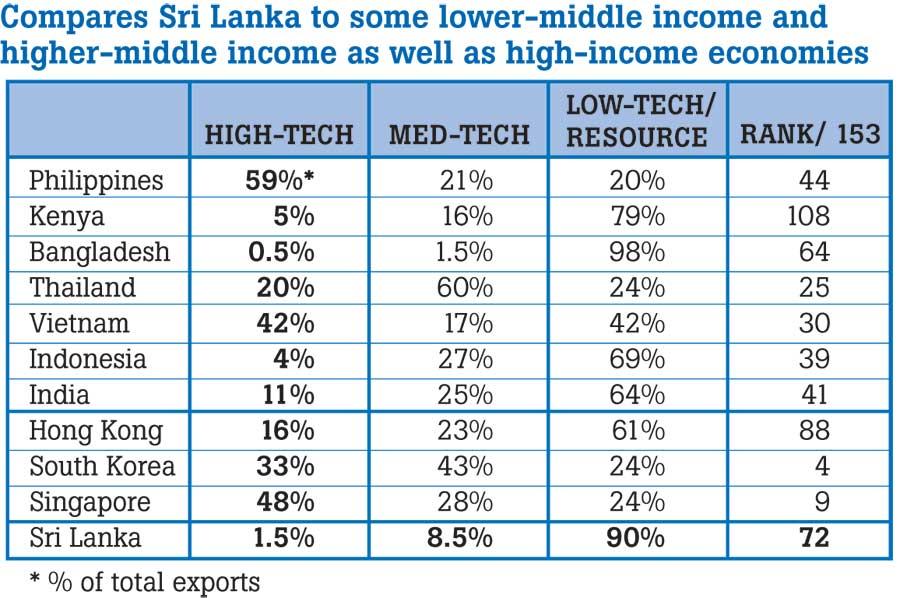

Perhaps policymakers remain unconvinced that Sri Lankan industry has the expertise, capacity and capabilities to expand and diversify our exports; the preference is to instead focus on growth driven by services and tourism. Yet if we compare Sri Lanka’s industrial base to those of peer group nations, you notice glaring deficiencies; Sri Lanka must industrialize if only to create a diversified economy that is more resilient to shocks.

The United Nations Industrial Development Organization (UNIDO) is a specialized agency with a “mandate to promote, dynamize and accelerate industrial development” (unido.org). UNIDO’s research generates an annual ranking of economies based on what is called the Competitive Industrial Performance Index (CIP): it uses data like manufacturing value added per capita (MVA), manufactured exports per capita, industrial intensity and export quality. The measure utilizes a nation’s industrial activity and level of trade liberalization to measure its profile within international trade.

The table below compares Sri Lanka to some lower-middle income and higher-middle income as well as high-income economies.

“High technology” exports are those that have had significant technical or design inputs and value additions. Vietnam is higher than India in the ranking with 42% of its exports categorized as ‘high-technology’ but notice the Philippines with 59% high-tech exports. The top two categories of exports for the Philippines were electronic products including semiconductors, consumer electronics and office equipment; shipped to the USA, China and Singapore etc. Notice the differences between Bangladesh (ranked 64) and Singapore; an economy that is perceived as being service based but is also a major exporter of electrical machinery including transformers and converters, radar apparatus, motors and computers.

Sri Lanka’s export mix is demonstrably weaker than nations whose growth stories we seek to emulate. Vietnam at various points during the past 3 years have had as much as $100 Bn in foreign exchange reserves; can Sri Lanka provide a realistic basis for such a rapid growth of foreign exchange reserves without a robust export oriented industrial strategy?

The United Nations Development Programme (UNDP) report of August 2022 has a similar critique: “… successive governments of independent Sri Lanka largely failed to match welfare orientation with a coherent strategy to find new sources of growth through structural diversification of the economy, refurbishing existing export industries or diversifying into new areas in either agriculture or industry…”

The Curse of Low Expectations

The challenge for every Sri Lankan government has always been to diversify the export base and increase volumes of high-technology exports. In the present era of international trade, this means integrating with global supply chains. The global Free Trade regime is a ‘race to the bottom’, where ‘cost’ is a determining factor. Sri Lanka today has cost-reflective pricing for electricity and fuel which impacts other components of costs, like transport. Sri Lankan labour is also not regionally competitive; so with an underdeveloped export sector and high costs, how does Sri Lanka integrate into global trade flows? Even Sri Lanka’s post-war development story was driven by the construction boom, which shifted focus away from tradable sectors.

The UNDP report reinforced this point: “the complementarity between macroeconomic management and trade liberalization required for maintaining competitiveness of tradable production in the liberalized economy was missing”.

For decades, policymakers utilized protectionism with no coherent strategy to incentivize export oriented industrialization. The current Government has removed tax concessions for exporters, a sector vital to rebalancing Sri Lanka’s trade deficit. This is emblematic of wider policy that is more focused on the deficit and seems disinterested in confronting Sri Lanka’s trade imbalance.

This lack of focus on the export sector from policymakers reveals them to not be fully cognizant of the core challenge for our economy.

Sri Lanka must extract more from the export sector than just the short-term benefits of foreign currency flows. Similar to other East Asian countries such as South Korea, Vietnam and China, the GOSL must utilize official policy and unofficial practice to ensure technology transfers. Such transfers must then be translated into higher-value local industries through whatever is left of Sri Lanka’s entrepreneurial spirit.

The World Bank has projected that 7 million Sri Lankans are living in poverty; double the rate from 2019; urban poverty tripled during that same period

The Vietnamese Experience

Vietnam provides many lessons for Sri Lanka. At a recent multi-party event celebrating ‘Parliamentary Friendship’ between Sri Lanka and Vietnam, Opposition Leader Sajith Premadasa focused specifically on Vietnam’s successful industrialization and called for greater cooperation so that Sri Lanka might learn from this Vietnamese experience. Mr. Premadasa specifically noted the Samsung example; this is encouraging as there is a distinct lack of urgency in incentivizing industrial investment, both local and foreign; the discourse is mired in inflation forecasts, exchange rates, interest rates and tax revenue.

This should be the obvious attraction of the SJB and Mr. Premadasa; a combination of a policy discourse that has focused on export oriented industrialization. The understanding that the GOSL must target incentives toward specific industries based on consultations with the private sector and an analysis of global trade flows. Subsidies and concessions should be limited to industries that have potential in high-value export markets globally.

To complete the Vietnam Story, in 2008, Samsung would explore the option to build a manufacturing plant in Vietnam versus expanding their existing factory in Gumi in South Korea’s North Gyeongsang Province. The mobile phone conglomerate chose Vietnam based on investor friendly policies and accessibility but also due to the talent pool and labour costs. A 2014 article in a South Korean newspaper estimated that the average wage for a worker with a high-school diploma in Vietnam was one-tenth the wage of a similar worker in Korea.

In 2008, the Vietnam Government offered Samsung over 100 hectares of land for free and provided the company with a 4 year tax holiday, exempted certain import tariffs and VAT and subsidized electricity and water. Samsung is reported to have around 30,000 employees in Vietnam.

Today, Vsmart, a brand of Vietnamese smart phones, competes with Samsung and others for market share in the country. The dynamism of the Vietnamese manufacturing sector allowed a pivot to personal electronics just as demand skyrocketed during the pandemic; remember the aforementioned $100 Bn FX reserves. This is one of the major benefits of integrating into global supply chains, it opens up new opportunities and local businesses and entrepreneurs benefit from technology transfers.

The Original Sin

China is perhaps most notorious for what is called ‘Forced Technology Transfer’. As well as using official channels to acquire technological details, in many cases, regulators require foreign firms to release sensitive information to joint venture partners and other market participants, whether it is technical information related to technology, intellectual property such as algorithms and software code, research analyses, structural designs etc.

Even at this stage, instead of policies that incentivize manufacturing and exports, the GOSL is betting on tourism and worker remittances in the short-term. Incentivizing sectors at the expense of industry leads to the LKR being devalued and making industrial exports less competitive in the global market, what is known as ‘Dutch Disease’ in economics.

Previous Wickremesinghe Governments have all had similar failings, an unwillingness to be bold in addressing the trade deficit, utilizing incrementalism on the road to mediocrity. At no time has any Ranil Wickremesinghe-led government taken tangible steps to develop and implement a modern industrial policy; despite Mr. Wickremesinghe himself being a former Minister of Industry (1989-93).

*Email: [email protected]

Twitter: @kusumw

The writer has over a decade of experience in the banking sector after completing a degree in accounting and finance. He has completed a Masters in International Relations from the University of Colombo. He is also a freelance presenter, writer and researcher and hosts an interview show available on Youtube, Instagram and Facebook.

26 Nov 2024 55 minute ago

26 Nov 2024 59 minute ago

26 Nov 2024 1 hours ago

25 Nov 2024 25 Nov 2024

25 Nov 2024 25 Nov 2024