21 Mar 2016 - {{hitsCtrl.values.hits}}

What is a credit rating?

It is a measure of the ability of an institution to meet its obligation in full in a timely manner. A debt security with a high credit rating is assessed to have a lower likelihood of default than an issuer or debt security with a lower credit rating. Credit ratings are assigned to financial institutions, companies and Governments. The robustness of a rating is measured over economic cycles and business cycles over the years. Accordingly, compliance, managing conflicts of interest and credibility is given importance.

Who provides credit ratings?

Credit ratings are issued by Credit Rating Agencies (CRAs). They fall under the purview (registered) of the Securities and Exchange Commission of Sri Lanka (SEC). Currently, two agencies, Fitch Rating Lanka Ltd and ICRA Lanka Ltd are registered with the SEC. In Sri Lanka, you might come across these agencies engaging in the business of assessing and evaluating the credit-worthiness of any issue of listed securities or securities that are to be listed. They consider the issuers’ ability to perform any obligations imposed on the issue.

Why do investors use credit ratings?

When making investment decisions, credit ratings, any related rating and industry trend reports can be helpful tools, provided you use them appropriately. Credit ratings may offer an alternative point of view to your own financial analysis or that of your financial adviser. Credit ratings may enable you to compare risks among investments in your portfolio.

Considering the credit ratings of multiple credit rating agencies may be useful because they may offer diverse views on the creditworthiness of an investment. In general, if you use credit ratings, they should be a supplement to, and not a replacement for, your own research, analysis, and judgment to determine whether an investment best satisfies your needs. Remember that credit ratings address credit risk only; they do not address other risks such as liquidity risk, interest rate, market risk or prepayment risk. The bottom line is that you should know what you are buying and only invest in what you understand.

Can there be potential conflicts of interest?

Credit ratings agencies are paid by the obligors they rate or by the issuers of the securities they rate, in the same manner auditors being paid by the companies they audit. Thus it could lead to potential conflicts of interest. The credit rating agency may be influenced to determine more favourable (i.e., higher) ratings than warranted in order to retain the clients and to obtain new clients. Nevertheless it is important to state that rating agencies should take adequate steps to mitigate these conflicts of interest such as the following non-exhaustive measures;

Restricting employees and immediate family members from investing in certain industries, issuers and

security types.

Regular checks by compliance officers regarding employees’ and family members’ accounts, securities holdings and securities transactions.

Analytical staff reporting to management if they have a close personal relationship with key management personnel of a rated entity.

Restricting an analyst from rating an entity that he/ she was recently employed by.

Is there a standard rating mechanism?

No. A credit rating is an assessment of the creditworthiness of a debt instrument or obligor, based on a credit rating agency’s analytical models, assumptions, and expectations. There are no standard or agreed-upon methods to measure the accuracy of credit ratings. Thus a credit rating may reflect a credit rating agency’s subjective judgment (based on a scientific methodology) of how an obligor may behave in the future.

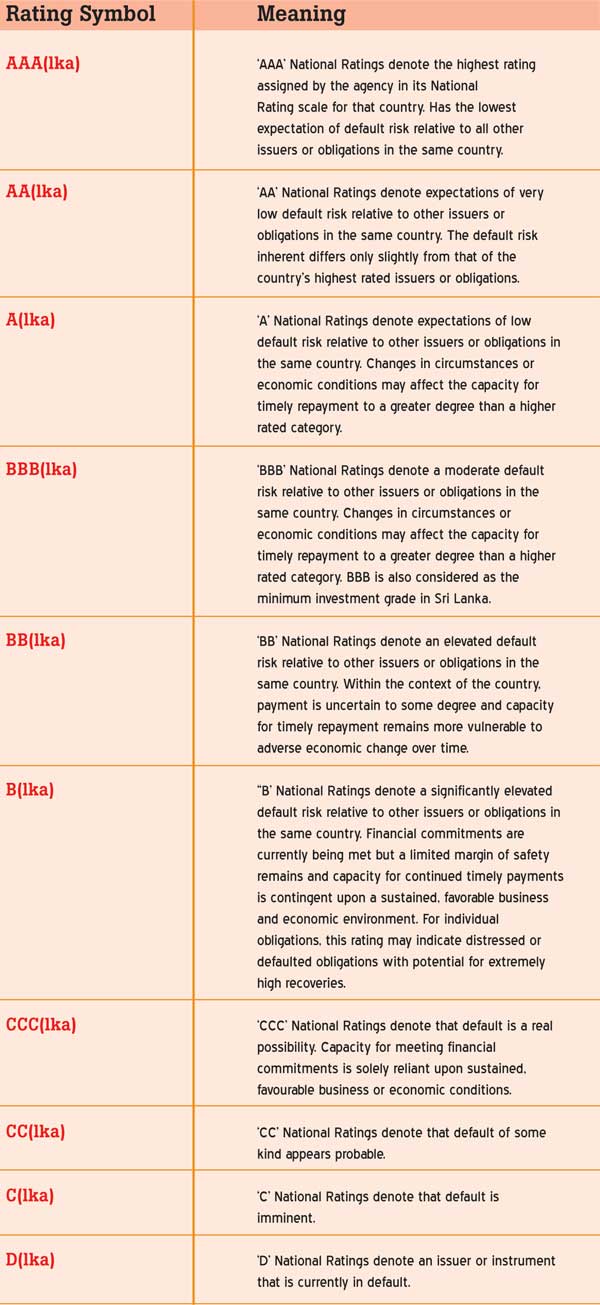

What do credit rating scales signify?

For individuals, the credit rating is conveyed by means of a numerical credit score .Over time, the terms ‘investment grade rating’ and ‘speculative grade rating’ have been established to describe the categories of the rating scale. The rating scale of ‘AAA’ to ‘D’ is categorized as ‘investment grade’ if it is within the ‘AAA’ to ‘BBB’ scale, and ‘speculative grade’ if it is within the ‘BB’ to ‘D’ scale. While all rating agencies do not share a similar rating scale, the most commonly seen rating scale is as follows;

What is a Rating Committee?

It is the Committee that is instrumental in giving ratings. It usually consists of analysts from the home country for knowledge on the local market and analysts from peer countries for knowledge on the international markets.

What is the importance of a Rating Committee?

This Committee ensures that a diverse range of opinions are brought in and a comparative rating is issued. The balance is to ensure there is no bias and Committee decisions should be unanimous.

What is a rating report?

It is a report that will consist of the rating and an outlook. The report will give a rationale for the rating, rating drivers, both upward and downward triggers and any constraining factors for the rating. The rating is also compared with peers both internally & externally.

What is not a credit rating?

A credit rating does not reflect other types of risk, such as market or liquidity risks which may also affect the value of a security. Neither does a credit rating consider the price at which an investor purchased a security or the price at which the security may be sold. You should not interpret a credit rating as investment advice and should not view it as a recommendation to buy, sell or hold securities. It is also important to make note that a credit rating is not a guarantee that a financial obligation will be repaid. For example, a very good credit rating (AAA) on a debt instrument does not mean the investor will always be paid with absolute certainty— there is a probability for instruments rated at this level to default. Credit rating changes can happen at any time, thus investors are expected to be vigilant.

What are the types of ratings given to a Financial Institutions (FI)?

Rating agencies assign a rating to capture the intrinsic creditworthiness of the FI, while also looking into the possibility of the FI receiving external support in case of need. Typically the following categories of rating are given to a FI

Stand Alone Ratings

Support Ratings

Issuer Default Ratings

Issue Ratings

What is Stand-Alone Rating?

Stand-alone ratings are assigned to most commercial banks and bank holding companies. However, these are not assigned to subsidiary banks that do not have a meaningful standalone franchise that could exist without the ownership of the parent, development banks or to other FIs whose operations are largely determined by their policy roles and non-bank FIs, such as securities firms, finance and leasing companies and asset managers.

In assigning this type of rating a distinction is made between “ordinary support”, from which a bank benefits in the usual course of business, and “extraordinary support”, which is provided to a failed bank to restore its viability. Ordinary support includes benefits that accrue to all banks because of their status as banks, including routine access to Central Bank liquidity in line with others in the market. It also includes the benefits a subsidiary bank often derives from its parent, for example in terms of stability and cost of funding, transfer of management expertise and operational systems and assistance with business origination.

What is a Support Rating?

Support Rating reflects the view about the likelihood that the entity will receive extraordinary support in case of need. In assessing either institutional or sovereign support, both the ability and propensity of the potential supporter (FI’s shareholders or the national authorities of the country) to provide assistance are considered.

Support Ratings are assigned to all banks, whether commercial or policy institutions, and are usually assigned to bank holding companies. These ratings

may also be assigned to non-bank FIs, including securities companies, leasing and finance companies and asset-management companies, where those entities’ default risk ratings are support driven, and it is believed the assignment of a support rating would enhance transparency.

What is Issuer Default Ratings (IDRs)?

IDRs, express the opinion on an entity’s relative vulnerability to default on its financial obligations. The default risk addressed by the IDR is generally that of the financial obligations whose non-payment would “best reflect the uncured failure of that entity”.

There are two types of IDRs:

Long-Term IDRs

Short-term IDRs

A FI’s IDRs do not usually reflect default risk on subordinated or “junior” debt or on obligations to entities under common control and government authorities. However, if non-performance on these obligations is viewed as indicative of broader stress that could result in the issuer defaulting on its senior obligations to third-party, private creditors, thus FI’s Long-Term IDR will be downgraded to a very low level.

What is Issue Ratings?

Issue ratings of FIs, reflect the overall level of credit risk attached to specific financial commitments, usually securities. This view incorporates an assessment both of the likelihood of default on the specific obligation, and of potential recoveries for creditors in case of default/non-performance. Short-term FI issue ratings incorporate only an assessment of the default risk on the instrument.

What are the factors considered when rating FIs?

Operating Environment: It takes into account the economic environment (key macro variables that may affect a bank’s fundamental credit strengths etc.), financial market development (structure of the banking system, depth of national capital markets and the development

of infrastructure etc. ) and the

regulatory framework.

Company Profile: It considers franchise,

business model and organisational structure.

Management Assessment: It entails evaluating corporate governance initiatives on both a country specific and issuer specific basis.

Risk Appetite: The agency will apply its own judgment and contrast a bank’s stated risk positioning against its own perception of the degree of risk inherent in a particular business line, product strategy and other material facts will also be considered when giving a rating.

Financial Profile: The starting point is typically audited financial statements, but it will generally also consider unaudited and interim financial statements as well as regulatory reporting such as Basel Pillar 3.

What are the types of ratings given to a Corporate?

Issuer Ratings: An Issuer Default Rating (IDR) is an assessment of an issuer’s relative vulnerability to default on financial obligations, and is intended to be comparable across industry groups and countries. Issuers may often carry both long-term and short-term IDRs.

Instrument Ratings: The ratings of individual debt issues incorporate additional information on priority of payment and likely recovery in the event of default. The rating of an individual debt security can be above, below or equal to the IDR, depending on the security‘s priority among claims, the amount of collateral, and other aspects of the capital structure.

What are the determinants of corporate ratings?

Qualitative and quantitative factors relating to business and financial risks are reflected in corporate ratings. Typically at least 3 years of historic and financial data are used along with the analysts’ forecasts to comparatively analyze with relative players in the same industry or peer groups.

Sovereigns

What are the types of sovereign rating?

The sovereign ratings assigned by rating agencies relate to the likelihood that a sovereign issuer will default on its debt. There are two types of rating:

Issuer Default Ratings: Sovereign Issuer Default Ratings (IDRs) are a forward-looking assessment of a sovereign’s capacity and willingness to honour its existing and future obligations in full and on time. Sovereigns are assigned two IDRs: the Local-Currency IDR reflects the likelihood of default on debt issued (and payable) in the currency of the sovereign, while the Foreign-Currency IDR is an assessment of the credit risk associated with debt issued in foreign currencies.

Debt Issue Ratings: Specific ratings are also assigned to the debt issued by rated sovereigns; the ratings are typically the same as the relevant sovereign IDR.

What are the factors considered in a sovereign rating?

Macroeconomic performance

Structural features of the economy

Public finances

External finances

What is the difference between country risk and sovereign risk?

Country risk and sovereign credit risk are related but distinct concepts. The former refers to the risks associated with doing business in a particular country, while sovereign credit ratings are more narrowly focused on the risk of a sovereign government defaulting on its debt obligations.

(Source: Fitch Ratings)

29 Nov 2024 5 hours ago

29 Nov 2024 6 hours ago

29 Nov 2024 7 hours ago

29 Nov 2024 8 hours ago

29 Nov 2024 8 hours ago