12 Apr 2016 - {{hitsCtrl.values.hits}}

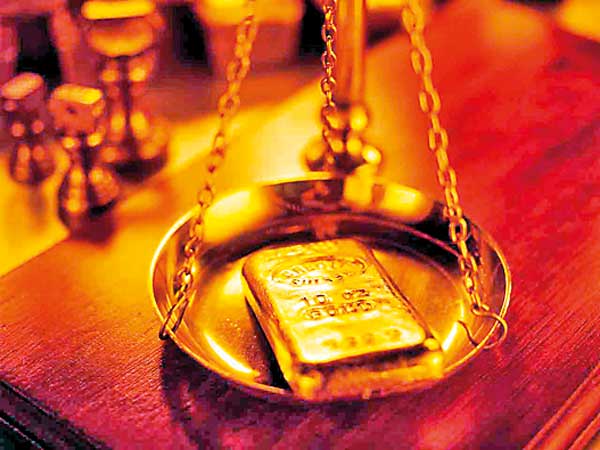

REUTERS: Gold prices shot to their highest in almost three weeks yesterday, setting the market on a steady course toward US $ 1,300 per ounce, drawing confidence from an ultra-low interest rate environment.

REUTERS: Gold prices shot to their highest in almost three weeks yesterday, setting the market on a steady course toward US $ 1,300 per ounce, drawing confidence from an ultra-low interest rate environment.

Weak economic data and uncertainty over U.S. monetary policy has contributed to risk aversion, boosting investor appetite for bullion and other assets perceived as safer stores of value, including the Japanese yen.

Spot gold rose to US $ 1,254.06 an ounce yesterday, its highest since March 22. It last stood at US $ 1,247.20 by 0935 GMT, up 0.6 percent on the day.

“Very loose monetary policy pursued by several central banks should point to even higher gold prices,” Commerzbank analyst Daniel Briesemann said.

“The ECB also increased its bond-buying purchase and has not ruled out further measures - that’s also a positive,” he added.

Briesemann noted gold’s progress in euro terms, approaching the 1,100 euro mark. Strong gains in the precious metal’s value across different currency denominations is an indicator of broad market strength. Scaled-back expectations for further monetary tightening this year helped gold to its best quarter in nearly 30 years in the three months to March.

Fed Chair Janet Yellen said last Thursday that the U.S. economy was on a solid course and still on track to warrant further interest rate hikes.

The U.S. central bank raised rates in December for the first time in nearly a decade.

However, New York Fed President William Dudley on Friday said the central bank must approach further rate hikes cautiously and gradually because of lingering external risks to the U.S. economy, despite some strength at home and welcome hints of inflation.

The dollar was broadly neutral for bullion markets, trading flat against a basket of major currency rivals at 94.241, after slipping 0.2 percent earlier.

Data on Friday showed hedge funds and money managers cut their net long positions in gold futures and options in the week to April 5, but still not far from a two-

month high.

Assets in SPDR Gold Trust, the world’s largest gold-backed exchange-traded fund, fell 0.22 percent to 817.81 tonnes on Friday.

In other precious metals, silver gained around 1 percent to US $ 15.47 per ounce, platinum rose 1.5 percent to US $ 971.99 and palladium was 0.9 percent higher at 541.44 per ounce.

29 Nov 2024 1 hours ago

29 Nov 2024 3 hours ago

29 Nov 2024 4 hours ago

29 Nov 2024 4 hours ago

29 Nov 2024 5 hours ago