18 Feb 2016 - {{hitsCtrl.values.hits}}

With the ongoing drive to modernize the city, price data on land sale registrations and advertised rates reflect several driving factors. Traditionally, a defining characteristic of Central Colombo (01, 02, 03, 04, 05 and 07) is the scarcity of large private land sale registrations. This reflects the widespread level of state presence in this area as well as the high number of illegal dwellings.

Secondly, with the limited number of private property transactions recorded at the Land Registry, the per-perch prices show tremendous variation from as low as Rs.2 million to over Rs.14 million. This is due not only to the socioeconomic factors but also as a consequence of various legal and regulatory issues that impact prices. For example, building permits are only granted to lands of over six perches and as a result, smaller plots are much cheaper.

Perceptions also impact prices. Until recently, lands closer to Galle Road were more expensive than lands closer to the beach due to the perception of higher crime rates along the railway line that runs parallel to the beach. However, with the ongoing initiatives led by the Urban Development Authority (UDA) to clean-up Colombo, these patterns have changed. In the current market, lands offering a sea view can expect a premium.

Apart from making Colombo more attractive, the UDA’s ongoing policy is to give out state-owned lands to investors, both foreign and local, on 66 or 99-year leases, in accordance with the government’s policy, as stipulated in the previous regime.

With the change in political power in 2015, we can now note that there has been progress made on planning and developing beyond Colombo to cover a Western Province ‘Megapolis’ under a dedicated ministry. Therefore, in the long term, land prices in the suburbs and beyond will receive a boost from receiving the benefits of better planning in a similar way to the impact of recent city ‘beautification’ on Central Colombo land prices. However, there will be significant differences between the areas that benefit from new road and rail infrastructure initiatives from those areas that will remain comparatively untouched.

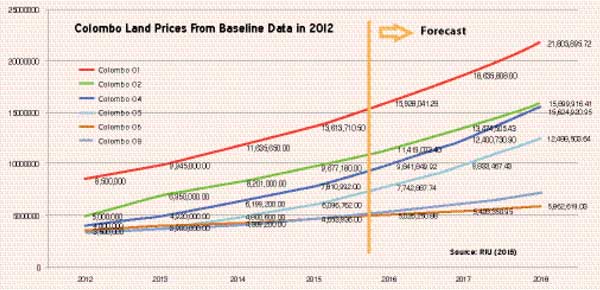

As Research Intelligence Unit (RIU) has been monitoring land prices in Colombo for over a decade, it notes that the land prices in Central Colombo have hiked at extraordinary rates since the end of the war in 2009. This landmark achievement was the most significant factor to impact the property market since RIU started monitoring the market.

Colombo 01: Most expensive

Using RIU’s baseline property prices, it notes that the highest annual land price growth rates were experienced in Colombo 03 and 04, whilst Colombo 01 has remained the most expensive. In RIU’s forecast for the next three years, RIU expects the land prices in Colombo to continue along the same trend in an environment of land scarcity amidst rapid (vertical) development. In the land sales market, there will be no significant difference between the price of lands used for residential and commercial purposes.

Where valuations are concerned, the best authority is to get any property valued through a bank as they set the highest benchmark standards for their valuations. In this regard, a bank valuation would need the full cooperation of the tenant in place. However, valuations can also take place without full access to the property but the banks would not accept these. In the case of state land, the authorized valuer will be the government chief valuer, while in the case of a private land, it will be a licensed valuer.

Presently, Sri Lanka does not have a formal system of registration of certification for real estate brokers and agents. This topic is one that is currently under discussion and debate and we expect some initiatives to be made from within the industry, sometime in the next few years. As a result of the unregulated environment, it is widely recommended that a great deal of care is exercised before a landowner enters into any agreement with an agent or with multiple agents. In the absence of agent certification, the land owner should check the agent’s credentials with the following measures:

RIU’s track record of consulting and advisory in the real estate sector is second to none and covers many highly reputed international clients. RIU is the first research firm to enter the real estate sector in Sri Lanka and continues to conduct specific studies on the Sri Lankan market as well as release weekly, quarterly and annual real estate market reports for developers and investors alike. More recently, RIU also launched a fully-fledged agency arm in order to provide a highly professional service to individual and corporate clients.

(Real Estate Intelligence Unit (RIU), the pioneer in real estate research in Sri Lanka with decades of experience in expertise, provides unparalleled market updates, insights and analyses on the real estate market. The research and advisory arm of RIU is the knowledge and intelligence behind many of the new and upcoming developments in Sri Lanka)

29 Nov 2024 29 Nov 2024

29 Nov 2024 29 Nov 2024

29 Nov 2024 29 Nov 2024

29 Nov 2024 29 Nov 2024

29 Nov 2024 29 Nov 2024