25 May 2016 - {{hitsCtrl.values.hits}}

With the economy growing at an average of over 7.2 percent since 2009, the island’s real estate sector has enjoyed consistent growth under-pinned by double-digit growth (2013) in the construction sector.

In 2014, the construction sector grew by 20.2 percent as compared with 14.4 percent in 2013. (Source: The Ceylon Chamber of Commerce 2015). . As a result, both the construction sector activity and the safety equipment suppliers in Sri Lanka remain concentrated in Colombo.

Primary concern

Safety is a primary concern in any industrial environment for both employees and a company. There are four types of workplace hazards which may endanger you or a fellow worker. These hazards include: Physical hazards, Chemical hazards, Biological hazards and Ergonomic hazards. Along with proper training, policies and labeling, safety equipment is the best way to avoid workplace injury.

As far as international safety equipment market is concerned According to the UK Market for personal protective equipment 2003- 2012 , the personal protective equipment market consists of head protection, body protection, upper limbs protection and lower limbs protection. We can also note that within each category of protective equipment, there are sub-categories.

By contrast to the UK, in Sri Lanka, there are no records of any industry studies that have been completed. From available sources it can be ascertained that the safety equipment industry in Sri Lanka predominantly supplies the construction sector as opposed to other sectors like hotels, manufacturing, and agriculture and as such, it is the construction sector that appears to be the main source of business for safety equipment suppliers.

Multi-sectoral

Reflecting the construction sector dominated, yet, multi-sectoral nature of the market for safety equipment in Sri Lanka, our primary survey sampling was based on mainly construction, health, hotel and agriculture. To fill the lack of market information available on Local safety equipment industry in Sri Lanka, RIU take the opportunity to conduct a survey on the same.

According to the RIU primary survey on the supply-side of the market, Sri Lanka’s Western Province is home to most of the major suppliers of safety equipment. We can note that 32 of the suppliers are located within the Colombo city limits or in the immediate suburbs of Colombo. A further nine suppliers are located elsewhere in the Western Province and one is located within the Kegalle district in the Sabaragamuwa Province.

According to our research, there is a perception that to find any construction related equipment in Colombo, the buyer simply has to visit Quarry road in Colombo 12 which has the largest concentration of construction material suppliers. As safety equipment is also related to these types of products, we would find that these suppliers do also supply safety equipment. Some of the suppliers that the research team spoke to claimed that the port, which is located in close proximity, also generates much business for them.

Supplier profile

According to the primary research, none of the suppliers are focused only on safety equipment and all suppliers are also involved in supplying hard-ware products.

This phenomenon is also evidenced by the fact that most of the suppliers do not even have a dedicated web-site for their products. In this regard, we can note that the supply side of the safety equipment market in Sri Lanka is not very sophisticated and most suppliers are operating from hardware store outlets in Colombo 12. Some of the larger suppliers have a head office and warehouse facilities.

Demand side of the market

Sample by sector: The research team conducted one-on-one interviews with the top 30

construction companies in Sri Lanka who account for the lion share of spending on safety equipment. A few of the foreign construction companies, including Chinese firms were also interviewed. In order to identify the demands and aspirations of the non-construction sector, a small number of interviews were also conducted with organizations operating in the hotel, health and agriculture sector.

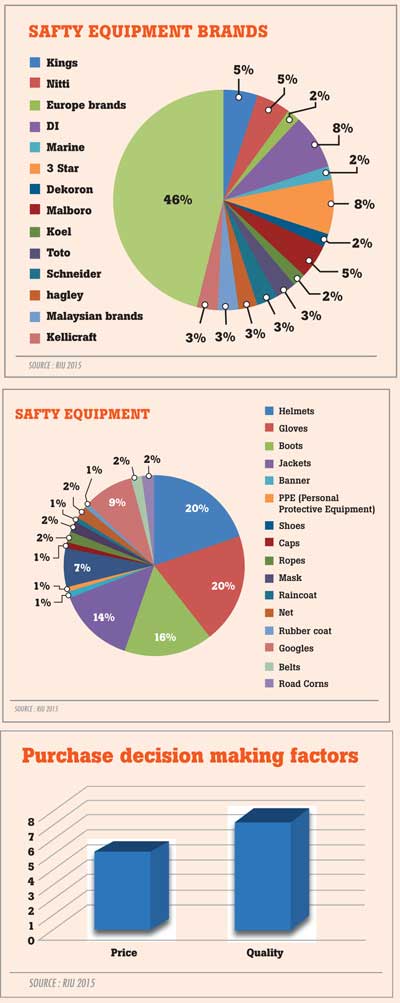

Popular brands: It was found that the companies sourcing safety equipment are less concerned with brand names and more susceptible to seeking the most satisfactory local supplier. Almost all the customers are familiar with whom they purchase their equipment from as opposed to what brand of equipment they purchase and use. Almost half of those interviewed had no knowledge of the brands that they purchased as this decision was in the hands of their supplier.

Price versus quality: According to the data, we can note that the typical spend on safety equipment was between US$50-$100 per employee. Around a third spent up to $50 per employee.

Those interviewed claimed that the quality of safety equipment was important to them and that they did consider quality in the buying decision making process. The buyers claimed that they would try to maximize quality and pay a mid-range price. Low priced products are not popular due to the perception that durability would be compromised at the low end of the market. Most purchasing managers call for several quotations and balance price and quality before they commit to the purchase.

Types of equipment: The most popular products are helmets and gloves followed by boots and jackets. Shoes and goggles for eye protection also account for a significant share of the safety equipment market.

RIU, Real Estate Intelligence Unit, the pioneer in real estate research in Sri Lanka with decades of experience in expertise provides unparalleled market updates, insights and analyses on the real estate market. The Research and Advisory arm of RIU is the knowledge and intelligence behind many of the new and upcoming developments in Sri Lanka.

(Safety equipment industry issues will be discussed in the next issue.)

29 Nov 2024 58 minute ago

29 Nov 2024 1 hours ago

29 Nov 2024 2 hours ago

29 Nov 2024 3 hours ago

29 Nov 2024 5 hours ago