07 Jul 2017 - {{hitsCtrl.values.hits}}

The Sri Lankan insurance industry recorded a growth of 16.27 percent in 2016 compared to 2015 in terms of its gross written premium (GWP) across both the long-term and general insurance

business sectors.

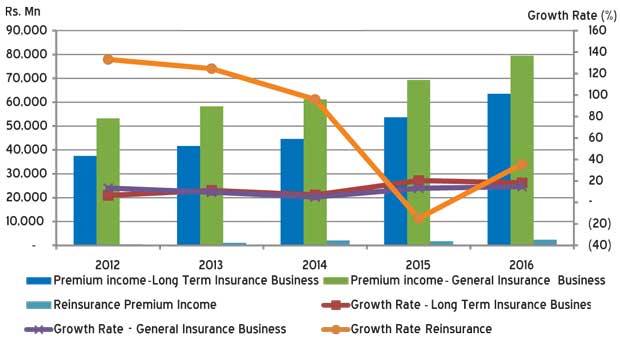

Premium income and growth rate

The long-term insurance sector generated a GWP amounting to Rs.63,495 million in 2016, up by 18.26 percent, against the GWP of Rs.53,691 million generated in 2015. This significant growth was attributable to factors such as increased awareness on life insurance, introduction of new life insurance products to cater dynamic customer requirements such as retirement solutions and investment products, enhanced customer

service, etc.

The general insurance sector recorded a GWP amounting to Rs.79,474 million in 2016, posting a growth of 14.73 percent, compared to Rs.69,271 million recorded in 2015. The general insurers were able to increase their premiums steadily year-on-year (YoY) amid strong competition prevailing in the general insurance market by means such as focus on niche markets, introduction of innovative general insurance products, implementing enterprise risk management strategies, focusing on risk selection and pricing, etc.

The reinsurance premium income generated by the National Insurance Trust Fund (NITF) from the compulsory reinsurance cession of general insurance business amounted to Rs.2,357 million during 2016, recording a significant increase of 35.62 percent against the reinsurance premium of Rs.1,738 million generated in 2015. The NITF’s reinsurance premium has risen substantially in 2016 mainly due to acceptance of reinsurance business from a wider range of different classes of general insurance business.

Insurance penetration and density

The insurance penetration, which reflects the insurance premium as a percentage of gross domestic product (GDP), amounted to 1.21 percent in 2016. Although the insurance penetration had increased in 2016 compared to 2015, which was recorded as 1.12 percent, it is still low compared to most of the other countries in the Asian region.

The penetration of the long-term insurance business in 2016 stood at 0.54 percent (2015: 0.49 percent) and the penetration of the general insurance business was 0.67 percent (2015:0.63 percent), both classes recording slight increases compared to the penetration ratios recorded in 2015.

The insurance density reflects the insurance premium income per person of the population and has increased to Rs.6,743 million in 2016 compared to Rs.5,865 million recorded in 2015, growing by 14.97 percent mainly due to the increased premium income against lower increase in population.

Total assets

The total assets of the insurance industry (after eliminating inter segment transactions), which comprise of the assets belonging to long-term and general insurers and the national reinsurer, the NITF, have amounted to Rs.527,228 million as at December 31, 2016. This was an increase of 12.97 percent compared to the assets amounted to Rs.466,707 million recorded as at December 31, 2015.

Long-term insurers held the majority of total industry assets, which amounted to Rs.345,675 million as at December 31, 2016 (2015: Rs.312,713 million). The assets of long-term insurance business recorded a growth of 10.54 percent in 2016 compared to 2015. The assets of general insurance business amounted to Rs.175,745 million as at December 31, 2016 (2015: Rs.151,177 million) and recorded a growth of 16.25 percent.

The NITF held assets amounting to Rs.5,915 million as at December 31, 2016, belonging to reinsurance business recording a significant growth of 64.12 percent compared to assets recorded as at December 31, 2015, which amounted to Rs.3,604 million. The above-mentioned increases in assets were mainly attributable to the growth in the premium income of long-term and general insurance and reinsurance businesses, which have resulted in the expansion of the asset base of insurers and the NITF.

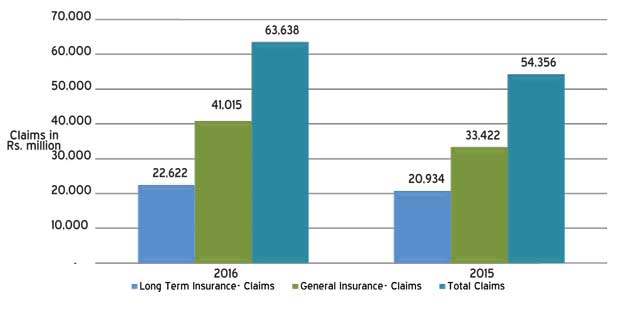

Claims incurred by insurance companies

The claims incurred by the insurance companies in both long-term insurance business and general insurance business was Rs.63,638 million (2015: Rs.54,356 million) showing an increase in total claims amount by 17.08 percent YoY. The long-term insurance claims, including maturity and death benefits, amounted to Rs.22,622 million (2015: Rs.20,934 million). The claims incurred in general insurance business, including motor, fire, marine and other categories, amounted to Rs.41,015 million (2015: Rs.33,422 million). Hence, during 2016, there is an increase in claims incurred by 8.07 percent and 22.72 percent for long-term insurance and general insurance businesses, respectively, when compared to 2015.

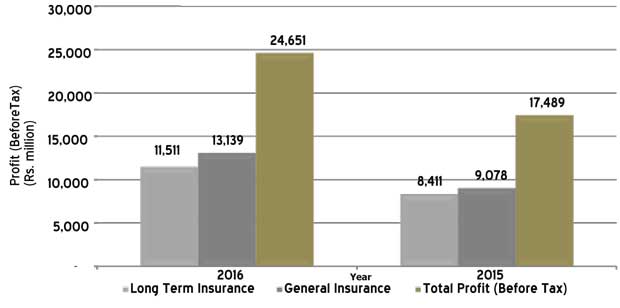

Profit before tax of insurance companies

The profit (before tax) of insurance companies in both long-term insurance business and general insurance business has increased to Rs.24,651 million (2015: Rs.17,489 million) showing a remarkable growth in profits by 40.95 percent. The profit (before tax) of long-term insurance business amounted to Rs.11,511 million (2015: Rs.8,411 million) while the profit (before tax) of general insurance business amounted to Rs.13,139 million (2015: Rs.9,078 million) during the year. Thus, profit (before tax) of long-term insurance business and general insurance business witnessed a growth of 23.72 percent and 44.74 percent, respectively, when compared to 2015.

Dispute resolution and investigations

The Insurance Board of Sri Lanka (IBSL), under its overall objective of safeguarding the interests of policyholders, inquires into policyholders’ grievances in connection with insurance claims pertaining to life and general insurance policies. The IBSL also investigates into any other complaint referred to it against any insurer, broker or agent.

During 2016, 353 new matters were referred to the board. A total of 345 matters were settled/closed during the period. Aggregate value of the claims settled during the period, due to the intervention of the board, is around Rs.21.5 million.

Insurers

Out of the 28 insurance companies (insurers) operating as at December 31, 2016, 12 companies carry on only long-term insurance business, 13 companies carry on general insurance business and three are composite companies (dealing in both general and long-term

insurance businesses).

Insurance brokers

Fifty eight insurance brokering companies, registered with the board as at December 31, 2016, mainly concentrate in general insurance business.

The premium income generated through general insurance business indicates the importance of brokers as an intermediary in the general insurance market. However, insurance brokers’ contribution towards long- term insurance business was insignificant in 2016 as witnessed in previous years. The premium income generated through insurance brokering companies with respect to general insurance business amounted to Rs.17,519 million (2015: Rs.16,124 million) while the premium income generated with respect to long-term insurance business amounted to Rs.263 million (2015: Rs.206 million).

The total premium income from both general insurance business and long-term insurance business amounted to Rs.17,782 million during 2016, compared to Rs.16,330 million during the previous year. Thus, the total premium income generated through insurance brokering business witnessed a growth of 8.89 percent YoY. However, the brokering companies’ contribution as a percentage of the total GWP has dropped to 12.44 percent from 13.28 percent recorded in 2015.

27 Nov 2024 19 minute ago

27 Nov 2024 49 minute ago

27 Nov 2024 1 hours ago

27 Nov 2024 2 hours ago

27 Nov 2024 3 hours ago