A case study of (mis)management of an airline

A lead article on SriLankan Airlines (‘A pawn in the political chess game’ Daily Mirror, November 10, 2016) concluded a year ago that “All governments that have ruled the country so far, should admit that the state-owned enterprises (SOEs) are making and have become an unbearable burden on the country’s economy due to their stupid and rash actions.”

This situation had not changed since. However, the Public Enterprise Development state minister had announced recently that a bailout package had been arranged to the tune of US $ 200 million from Credit Suisse (US $ 150 million long-term and US $ 50 million short-term loan) for SriLankan.

The International Monetary Fund’s (now well-known) stricture on stemming the ‘internal bleeding’ due to the non-restructuring of loss-making SOEs has made the Government of Sri Lanka to make the SriLankan case a ‘litmus’ test for such an enterprise.

The airline itself had run up losses amounting to Rs.108 billion (from the last posting of profits in 2008) and cumulative losses are at a staggering Rs.461 billion (to be taken over by the government and poor taxpayer). One senior cabinet minister even compared the airline’s last year’s record loss of Rs.28 billion to being twice the cost of the compost project, which the government had commissioned in Aruwakkalu, at Rs.15 billion.

The Cabinet-Appointed Committee on Economic Management (CCEM) is headed by Prime Minister Ranil Wickremasinghe, Finance Ministry Advisor Mano Thittawela, now replaced by Finance Ministry Advisor Charitha Ratwatte, Public Enterprise Development Ministry Director Dr. Roshan Perera, along with SriLankan Chairman Ajith Dias and SriLankan CEO Suren Ratwatte. The last two are the ‘lynchpins’ of one of the few serial loss-making national carriers in the world.

The International Monetary Fund’s (now well-known) stricture on stemming the ‘internal bleeding’ due to the non-restructuring of loss-making SOEs has made the Government of Sri Lanka to make the SriLankan case a ‘litmus’ test for such an enterprise

It is interesting for the intelligent reader to recall what the two stewards of the airline had to say in late 2016, nearly a year after the prime minister appointed Dias as Chairman:

We need to cancel the orders for four A350-900s (long-haul aircraft) from Airbus Industrie. The opportunity cost of operating these assets was estimated to be US $ 480 million (loss) each year.

The loss due to the runway revamping (early 2017) would have a further opportunity cost/loss of earnings forgone of US $ 47 million.

The need to wind up Mihin Air and absorb most of their staff by end-October of that year.

Against this scenario the duo envisioned:

The airline to become a regional carrier with flights concentrating on the Maldives/India and Southeast Asia.

Increase the daily frequency to London (Heathrow) by another two per week (making it nine/weekly) in addition to direct flights to Melbourne/Guanzou and Beijing.

Cancelling Paris and Frankfurt sector (running at a loss)

Secure a lease arrangement for six A320 Neo (more suited for short haul) AC to feed the rearranged frequency. The first aircraft was to be delivered by early 2017 (which never happened).

Ground handling function (see my first article entitled ‘The arduous task of turning around the national carrier’ December 2015 on avenues to reduce costs) to be spun off as a going concern/SBU.

Flight Kitchen (Sri Lankan Catering Services) to remain as a separate profitable entity/SBU.

Where does this strategic outlook leave the airline right now? In terms of:

Commercial policy: Restructure the route network and capture the market advantage of both long-haul passengers (with the most margin) often preferring direct flights, as well as the short-haul passenger looking for pricing advantage and convenient connections.

Flight operations: Rationalise the fleet with the above strategy in view. The present fleet of 14 X A330-200s (including six old AC with more than 14 years in service) as against the reduced long-haul flights (Europe/Middle East) and increased frequency of Indian destinations.

Engineering: Rationalise AC servicing to reduce costs. It was documented in my previous article that aircraft utilisation is affected by tarmac delays: example idle planes particularly during C and D checks. AC engineering staff performing low value-adding activities (e.g. retrieving tools), standards while more focussed on FAA/CAA requirements, are totally absent when it comes to using tools; it contributes to lost hours between jobs performed by different AC mechanics.

Ground handling (passenger and cargo): Application of lean management principles to reduce overheads and increase labour productivity with shorter turnaround times in destinations (see ibid Daily Mirror December 10/11, 2015).

Typology of failure

Mc Kinsey (World Wide) had diagnosed two types of airline failures:

1. Those that have fallen behind and are at risk of failure needing to focus on regaining customer trust and loyalty and restructuring route networks, business processes and costs in an ‘improvement and innovation’ reorienting approach.

or

2. They are underperforming airlines, challenged by decline in traditional markets and recognise that opportunities that exist elsewhere; focus on product and service development. Look to possible new/underserved frequencies/routes in a geographical growth, deploying ‘extension and expansion’ reorienting approach.

The history of the airline (as explained in my first article in Daily Mirror in October 2015) was chequered. Political overtones came to displace managerial wisdom as it was the case when the very competent board headed by ex DCA Laxman de Mel and an equally strong CEO (John Fleming ex SAS) were displaced in 1989/90 by Dunstan Jayawardena and a CEO, who found political favour in his appointment. Be as it may, SriLankan falls under the second category, where the misaligned policies aggravated by global competition and escalating operating costs had posed too much of a challenge to the current board.

Decline

A decline in the business of an airline has been defined (Mc Kinsey) as ‘k-type’ or ‘r-type’. The former stems from industry decline, when organisations have exhausted their environmental resources or other organisations have begun competing for limited resources as when there is severe market share erosion or a shrinking market and shrinking financial resources (somewhat typical of the UL case).

The latter (r type) is more internally induced and occurs when a company does not fulfil its potential and becomes uncompetitive due to strategic misalignment with its environment. Most analysts agree that the overwhelming cause of individual airline (or any other business) failures is some type of managerial incompetence.

Strategic misalignment can see a company falling out of sync with its environment, often as a result of top management decisions to undertake ill-advised expansion or their failure to update product lines, overcome functional weaknesses and curtail operating expenses. This can generally be seen as the case with SriLankan.

Fallacy of the hub

It is not difficult to realise that as markets mature, incumbent companies that have developed sophisticated but complex business models face tremendous pressure to find less costly approaches that meet broad customer needs with minimal complexity in products and processes.

In these situations, the firm may know that the cost of complexity is dragging it down but finds changing its business model difficult. No example illustrates this dilemma more vividly than the large US and European hub-and-spoke airlines (Mc Kinsey quarterly September 2017).

Their business model — essentially designed to seamlessly take anyone from anywhere to everywhere, was a great innovation. But this model is no longer competitively sustainable in its current form. Tied to massive physical infrastructure, complex fleets of aircraft, legacy information systems and large labour pools, the major carriers in both regions now face a scathing competition from low-cost carriers (LCC) that dictate prices in large and growing parts of the market. Thus, it is in Asia as seen by many airline failures.

Be as it may, SriLankan falls under the second category, where the misaligned policies aggravated by global competition and escalating operating costs had posed too much of a challenge to the current board

Bankruptcies litter the industry – Sabena, Swissair, United Airlines in the West, Air India (until recently), Garuda and even Malaysian Airways are good examples of carriers approaching near bankruptcy.

How sick is SriLankan?

Strangely SriLankan CEO Captain Suren Ratwatte had announced that SriLankan can be proud of the network expansion into Indian destinations from four to seven – new additions being Hyderabad, Coimbatore and Vishakaptnam. He claims this is the biggest expansion in its network (in the history of UL) besides its non-stop service to Guanzou and Beijing in China. He, in the same breadth, admits however, yields have been poor and costs remain untrimmed (Daily Mirror December 20, 2017).

The recent Mc Kinsey study in contrast announces that the major carriers in the US face a future of red ink, while LCCs such as Southwest Airlines, JetBlue Airways and Ryanair (in the US) and Air Asia (in Southeast Asia) are prospering by exploiting a huge cost-of-operations advantage.

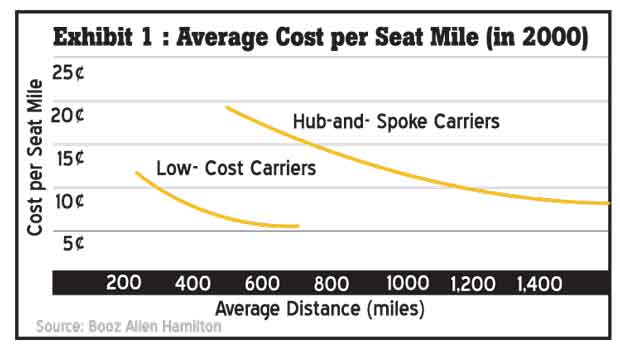

The LCCs spend seven to eight US cents per seat mile to complete a 500- to 600-mile flight, according to our analysis. That’s less than half of what it costs the typical hub-and-spoke carrier to fly a flight of the same duration and distance. (See Exhibit 1)

It is easy to see how costs mount quickly in the hub-and-spoke airlines’ often intricate system of operations.

Their business model is predicated on offering consumers a larger number of destinations, significant flexibility (ranging from last-minute seat reassignments and upgrades to complete itinerary and routing changes) and ‘frills’ (like specialty meals and private lounges).

It is a model burdened by the built-in cost penalties of synchronized hub operations, with long aircraft turnaround times and slack built into schedules to increase connectivity by ensuring there is time for passengers and baggage to make connections.

It’s a fact however that this system of the hub-and-spoke business model relies on highly sophisticated information systems and infrastructure to optimize its complex operations. By contrast, the CLLs have designed a focused, simple, highly productive business model around non-stop air travel to and from medium- to high-density markets at a significantly lower price point.

Cost advantage

The costs, which contribute most in the network airlines (NWAs), are business pace, process complexity, and ticket distribution. In fact, ‘no frills’ and ‘full service’ are misleading labels to describe the distinction between the two types of carriers (NRW vs. LCC). It is the relative simplicity or complexity of their operations that truly distinguishes them.

Most debilitating for NWAs is their inability to overcome their cost burden. As corporate traffic tightening their belts had reduced the frequency of travel, business travellers, who have traditionally accounted for as much as 60 percent of mainline airline revenues, have dropped to below 40 percent.

Therefore, the NWAs will not achieve a competitive cost structure if they do not tackle the fundamental cost penalties associated with their business model. But they must do so without compromising the services, service quality and coverage that distinguish them from their new rivals.

How to get people to cut costs?

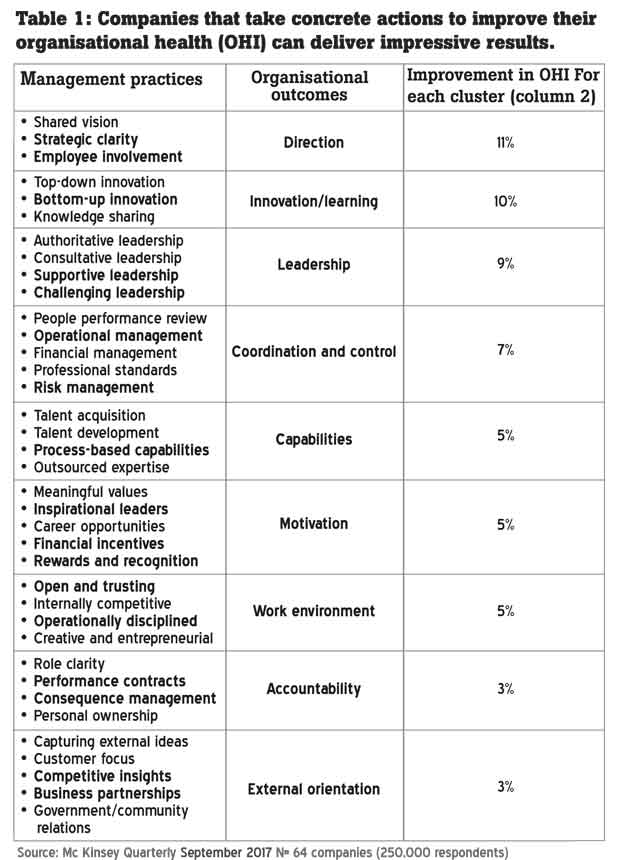

The latest Mc Kinsey research again indicates (Quarterly September 2017) that organisational health (See Table 1 for indicators) determines the improvement in a company’s profits and performance. These indicators are spread over 37 management practices (within nine clusters/outcomes).

In the study of 64 companies with over 250,000 respondents (Mc Kinsey clients) all companies performed better when they improved their health. Around 80 percent of companies that took positive action on health (Organisational Health Index) saw an improvement in their bottom line, with a median six-point increase in their overall health (Exhibit 1).

Strangely SriLankan CEO Captain Suren Ratwatte had announced that SriLankan can be proud of the network expansion into Indian destinations from four to seven – new additions being Hyderabad, Coimbatore and Vishakaptnam

The analysis in Table 1 shows that the indicators, which have the heaviest impact, are those at the top namely direction, leadership adaptation, performance management, risk mitigation, even over clusters such as capability. The bolded practices on the LHS of the given diagram are the author’s estimate of what is not happening at SriLankan (namely 17 of the 37 practices.)

If one chooses to look at only the top three with the most impact, then strategic clarity, employee involvement (with full information sharing and high trust climate) bottom up innovation and supportive leadership are the missing links. This conclusion is validated by the recent protest by the Alliance of Unions of Employees to the media.

Cutting a long story short, SriLankan would not be able to hit all targets but it can certainly implement the four combinations of practices (or ‘recipes’) that, when applied together should drive superior health — and quickly.

These four are the leadership factory (organisations that drive performance by developing and deploying strong leaders at every level, supporting them through coaching, formal training and the right growth opportunities); the continuous improvement engine (organisations that gain their competitive edge by involving all employees in driving performance and innovation, gathering insights and sharing knowledge); talent and knowledge core (organisations that accelerate their performance by attracting and inspiring top talent) and market shaper (organisations that get ahead through innovating at all levels and using their deep understanding of customers and competitors to implement those innovations).

In summary these four practice clusters achieve the following:

Leadership factory: Developing and deploying strong leaders at all levels

Continuous improvement engine: Involving all employees in drive for performance and innovation

Talent and knowledge core: Attracting and inspiring top talent.

Market shaper: Shaping innovation via customer insights and having an external orientation

In a turnaround, mind-sets matter as much as the strategy (see section below on solutions) — the most important of which is how, historically, the organisation had prioritized on-time arrivals and departures and product performance (with unique frills), often at the expense of product cost. In practice, engineers felt it was their job to design/service aircraft, with the cost being an output rather than an input.

To shift this thinking, the leaders need to set out that adding value for customer/passengers, as well as efficient processes, were just as important as on-time schedules and financial performance.

This outlook was sadly missing at SriLankan – especially in engineering, operations and supply-chain management. As would be apparent from the OHI (Mc Kinsey) grid (Table 1) above any organisation needs to be come on top at the first four outcomes to improve the bottom line.

Leaders at helm

Engaging employees at all levels requires strong leadership and role modelling for change to take hold quickly. But change is not a top-down exercise. Health (OHI) improvement happens quickly and sustainably when you drive it top to bottom, bottom to top and side to side. This is best done by engaging a committed set of people (or network of formal and informal influencers.)

In one of the cases in the above study, Mc Kinsey found the client assigned a project manager to coordinate this network of change agents, keeping in touch and checking with them to facilitate knowledge sharing. Thanks to these influencers’ interventions — sharing information with the front line, taking time to talk to customers (quite important to go beyond smile sheets of passenger feedback) and feeding the information back to senior leaders and calling out colleagues who did not adopt the desired attitudes—in such a environment substantial behavioural changes will take hold quickly.

Leaders, as architects of the effort to improve organisational health, can then make changes to ensure that the new mindsets are taking hold. High-performing organisations require leaders who can manage performance and health ambidextrously. Equally important is for leaders to combine internal learnings with external best practices and redefine their interventions to improve the ways in which they rewarded and recognized high-performing teams and individuals.

This is an area where the SriLankan management seems to have definitely failed. Saddled with a legacy performance appraisal system (originally designed by Hay Management Consultants in the 1980s/improved by Emirates in the 1990s), much of the later innovations were overlooked (example variable pay plans or VPP, which is linked to the KPIs) so as to leave the top-performing team members high and dry.

The top leadership were enjoying monthly salaries of over Rs.3.0 million a month and did not lend any credibility to their ‘restructuring cry’ to be heard by the enormous potential talent available within the airline. In fact, the Alliance of Unions had lost all confidence in the top team. Worse, some of the management practices within the top three outcomes (see OHI Table 1) were miserably dismissed and left to their own chagrin.

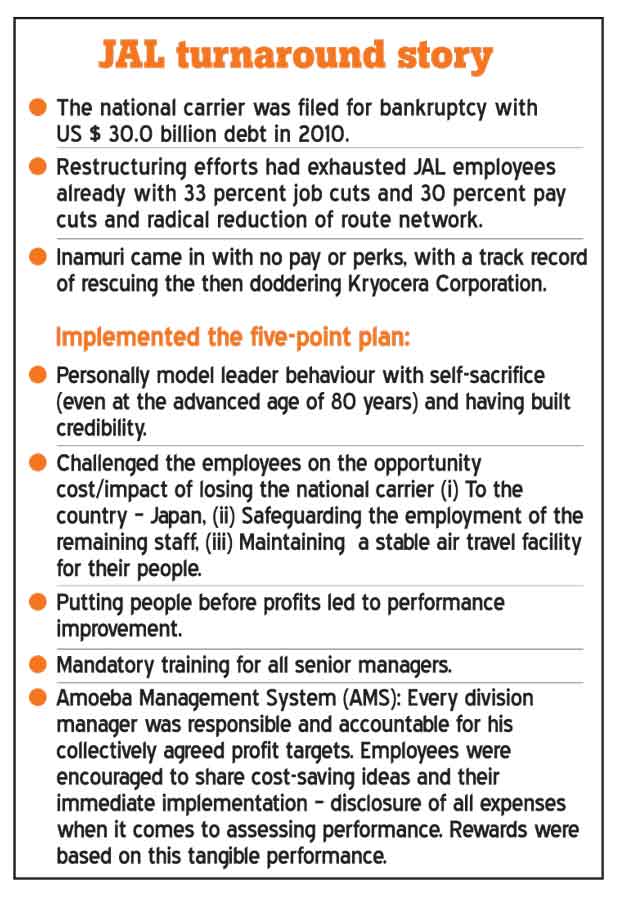

In contrast, JAL chairman/CEO appointed in 2010 led from the front and engaged the talent within, to turn around the airline inside of three years (See Box).

Arrival of the consultant

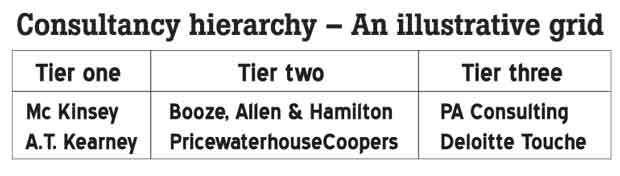

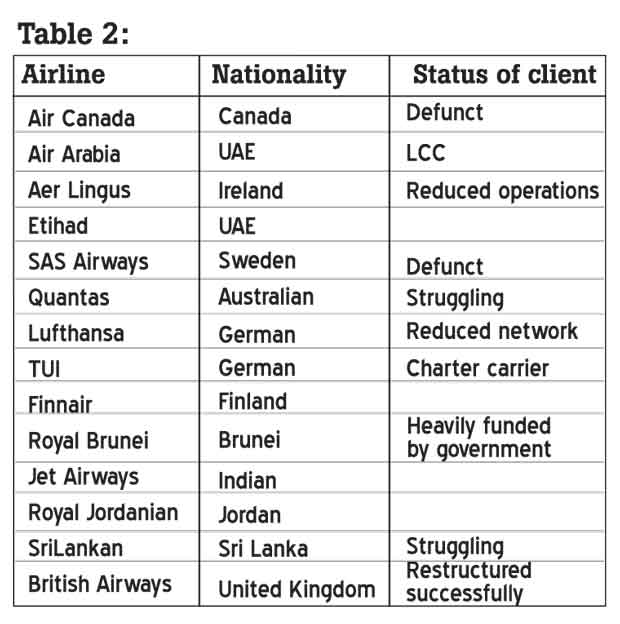

Nyras Aviation Consultants, who were retained by SriLankan, count many airline clients (including many who have disappeared from the radar - see Table 2) and are part of the PA Consulting Group (UK based), which is a third-tier consultancy compared to others, which lead the field of business turnarounds. They claim specialism in advising clients in commercial, technological and strategic reorientation to the global aviation sector.

Led by former Head of Aviation Consultancy of PricewaterhouseCoopers (PwC) Richard Davey and Lain May, Turnaround and End of Lease Lead.

On a cursory inspection one notices that many of their clients (who may have been in trouble) have perished in the ruthless world of NRW vs. LCC battles for airspace subsequently. Table 2 indicates this:

Nyras have been credited with the following restructuring in operations and engineering of two European carriers

(not named):

Ground operations

Aim: To reduce high cost of turnarounds, improve connecting times, implement new work practices and processes and reduce operational head count.

Results: Shorter and more efficient turnaround times, turnaround teams reduced by 30 percent, new ways of working introduced in operations, new value model introduced with head count reduction, automated check in and baggage count, new baggage processes which speed up turnaround times.

Engineering

Aim: Improve productivity, suggest efficiencies to reduce manning levels, cost-effective use of hangar space, provide a gap analysis, documentation design improvements.

Results: Nyras introduced labour efficiency improvements in insourcing and heavy maintenance checks, optimisation of maintenance events performance and reduction of tasks, total profit improvement opportunity of more than 4.2 million euros yearly.

Firstly, given the fact that the consultant necessarily has to look at some of the non-commercial areas to reduce costs, the above are good examples. This fact was very clearly explained in my previous article (published in Daily Mirror in December 2015) namely how to apply lean management principles in ground operations and in engineering checks and maintenance (to reduce turnaround time).

Secondly, it is an inalienable conclusion that head count reduction (not merely to save on the salary bill) to sustain efficiency and productivity of the airline’s operations is a must: SriLankan failed to negotiate a win-win solution with the unions in this critical area.

Solution

It is worthwhile remembering what the former chairman (responsible for the JAL turnaround in 2013) said before we embark on looking at some possible solutions (which SriLankan can implement with the help of its incoming business partner).

Kazuo Inamuri said, “Any company facing tremendous difficulties can not only overcome them but also grow their business significantly as long as all employees are united under their leaders.”

The case history (see Box) illustrates what SriLankan leadership could have learnt from him.

JAL turned around with operating profits of Y 188.0 billion in 2011 (the very first year) and Y 204 billion in 2012. This turnaround was of course assisted by the government takeover of its US $ 4.0 billion debt and tax write offs for nine years. The JAL IPO was oversubscribed in 2016 and jumped from industry basket – case to profit leader. These lessons can help us relook at some focussed solutions to our own national carrier.

In conclusion, a NWA such as SriLankan cannot continue to ignore innovations or operate legacy systems, nor can it separate people management from strategy and its implementation

Some of the ways in which the operational costs associated with flight schedules and connecting passengers for onward destinations can be reduced through are:

Remove scheduling constraints. At present, hub-and-spoke airlines generally schedule flights in a so-called wave system, which means that departures and arrivals are concentrated in peak periods to maximize effective passenger connections. However, the approach causes longer aircraft turnarounds (to allow passengers and baggage to connect to their next flight), traffic congestion and aircraft downtime at the origin cities, resulting in low labour and aircraft utilization.

This system also necessitates more complicated logistics and provides significantly lower yields — up to 45 percent less revenue per mile than for passengers travelling nonstop. Nevertheless, because of the current pricing strategies and fleet structures, the airline has to rely on connecting passengers to fill seats that otherwise would be empty.

By redesigning the airline’s network around the needs of nonstop passengers and making connections a by product of the system, large carriers should be able to cut turnaround times by as much as half, increase aircraft utilization, reduce congestion and significantly improve labour productivity.

A large portion of manpower costs is driven by how long an aircraft is at the gate. Shorter turns would mean that pilots, flight attendants, baggage handlers, maintenance staff and other personnel could be much more productive and still in compliance with safety regulations.

Implement tailored business streams. In other industries, such as manufacturing, complexity reduction has been achieved by applying a tailored business streams approach. The basic principle is to segment operations into distinct business streams: separate processes are created to handle routine and complex activities; capabilities and approaches are tailored to the inherent complexity of the chosen task and based on what customers are willing to pay. That often entails standardizing or ‘industrializing’ the routine and stable processes, while segmenting and isolating the parts of the operation that are more complicated and variable.

By and large, the hub-and-spoke (NWA) airlines have done exactly the opposite. It doesn’t matter whether the passenger is on a simple one-hour flight or is travelling from one continent to another; the schedules are arranged considering the total load factor. This has added unnecessary costs to processes and made them hard to automate and change, requiring massive retraining of personnel, when a process is altered.

If the airline simplifies its core processes, then it can address the basic needs of the majority of customers; they could drastically reduce the number of activities performed at airports. Furthermore, they could automate many more of them, saving huge amounts of time and money. In such a situation, the reservation and passenger-handling process would be designed so that the passengers wouldn’t need last-minute changes or long, multiple interactions with airline staff at the airport. Instead, travellers would be able to get to the gates faster.

Create separate business systems for distinct customer segments. In simplifying its business model, here the airline has to be careful to retain the loyalty of its most profitable and frequent customers by providing more differentiated amenities, lounges and services on the ground and inflight options. This could mean separating both airport and onboard services into two (or more) classes, focused on either leisure or business passengers.

Other industries’ experiences suggest that mingling complex and simple operations, each of which have distinct objectives and missions, often increases costs and lowers service standards. This must be avoided. The goal is to offer a higher service level where it is needed, at a low operating cost. Besides providing more amenities, this approach would help create purer business streams that reflect the distinct needs of different customer segments.

Objective is twofold: Change the business model to serve all customers better by providing a more efficient and less time-consuming experience and provides dedicated services (and flexibility) to the customer segments prepared to pay for them. Just as much the above is a sound strategy, the forgoing reasoning I hope convinces the future partner of SriLankan that the LCC and NWA are two different things. AirAsia may wish to exploit the market situation from Colombo but their services need to be seen as a competitor and not complementary.

Just Do It

The Sunday Times (December 31, 2017) in a new year eve street poll had carried the results that most people (based in Colombo and Galle) do not wish to “Sell SriLankan, which is debt ridden and struggling.”

If that is the direction the government wishes to travel, then it is mandatory in addition to changing its operating model (in keeping with its corporate strategy), the management should be adept at execution. Nike for long carried its tag line (Just Do It), more to emphasise the speed of service and satisfaction to the customer.

Larry Bossidy, one-time CEO of Tech Giant ‘Honeywell’ and Ram Charan (research-based management thinker), famed authors of that book by the same name (Execution: The Discipline of Getting Things Done 2002) say in complementing the above, that “the link between people and operations is crucial”.

In a recent (PwC, February 2017) global survey of strategy (700 business executives) maintains, “Your execution occurs in the thousands of decisions made each day by people at every level of your company.”

Another interesting find was that in their rankings the executives polled only eight of their CEOs were good at strategy creation and at execution. This meant 92 percent of the 700 CEOs were not good at both or either. There was also a correlation between corporate success and effective execution – this was evident in iconic companies (sighted by PwC) such as Haeir, Ikea, Starbucks, Apple and Amazon.

This study prescribes 10 principles to practice and it was thought prudent to identify three among them to be very useful for SriLankan, deriving from the above gap analysis, in accelerating its turnaround.

Clarify everyone’s strategic role

PwC’s client, the General Authority of Civil Aviation (GACA) of Saudi Arabia, decided to improve the way they ran the country’s 25 airports. They started with the hub in Riyadh, one of the largest airports in the country. They had already outsourced much of their activity, redesigning airport practices and enhancing operations. But not much had changed.

Convening the directors and some department leaders, the head of the airport explained that some seemingly minor operational issues — long customs lines, slow boarding processes and inadequate basic amenities — were not mere problems in execution but prevented the country’s goal of becoming a commercial and logistics hub for Africa, Asia and Europe. Individual airport employees, he added, could make a difference.

The head of the airport (airport manager) then conducted in-depth repeat sessions with employees on breaking down silos and improving operations. The people in your day-to-day operations — wherever they are and on whatever level — are continually called upon to make decisions on behalf of the organisation. If they are not motivated to deliver the strategy, the strategy won’t reach the customers.

Financial incentives have only a limited push. They will make that personal commitment only when they understand why their jobs make a difference and why the company’s advancement will help their own advancement. In this case variable pay (VPP) can target KPIs (which are well communicated and has heavy buy in), which help improve time/process or reduce cost.

Align structures to strategy

Set up your organisational structures, including your hierarchical design, decision rights, incentives and metrics, so they reinforce your company’s identity: your value proposition and critical capabilities. If the structures of your company don’t support your strategy, consider removing them or changing them wholesale. Mc Kinsey swears by their rule strategy/structure/systems (always in that order)

Consider, for example, the metrics used to track the results delivered by call centre employees. In many companies, these individuals must follow a script and check off that they’ve said everything on the list — even at the risk of irritating potential customers. Better instead to get employees to fully internalize the company’s strategy and grade them on their prowess at solving customer/passenger problems.

Data analytics is evolving to the point where it can help revitalize metrics and incentives. A spreadsheet is no longer enough to capture and analyse this detailed body of material; you can use large information management systems programmed to deliver carefully crafted performance data. Air India (now turned around) e.g. uses the Horizon (SITA) Passenger Service System (loyalty and revenue integrity suites) to help airline staff to prevent leakage of revenue. No matter how complex the input, the final incentives and metrics need to be simple enough to drive clear, consistent behaviour.

Keep processes simple

Many company leaders wish for more simplicity: just a few products, a clear and simple value chain and not too many projects on the schedule. Unfortunately, it rarely works out that way. In a large airline execution is by nature complex. Capabilities are multifaceted. Different customers want different things. Internal product development design new products or processes without consulting one another. Although you might clean house every so often, incoherence and complexity creep back in, along with the associated costs and bureaucracy through operational silos.

The answer is to constantly seek simplicity but in a selective way. Remember that not all complexity is alike. One advantage of aligning your strategy with your capabilities is that it helps you see your operations more clearly. You can distinguish the complexity that truly adds value (for example, a supply chain tailored to your most important Business Class pax) from the complexity that gets in your way (for example, numerous suppliers when only one or two are needed).

In ‘Fit for Growth: A Guide to Strategic Cost Cutting, Restructuring and Renewal’ (Couto/Caglar and Plansky. 2017), the authors explain effective cost management depends on the ability to ruthlessly cut the investments that don’t drive value. Customer-facing activities can be among the worst offenders. Some customers need more tailored offerings or elaborate processes but many do not. This is typical of most NWA airlines.

For example, Lenovo, a leading computer hardware company with twin headquarters in China and the US, (Lenovo’s ThinkPad computer business was acquired with its purchase of IBM’s personal computer business), has a strategy based on cross-pollination of innovation between two entirely different markets.

The first is ‘relationship’ customers (large enterprises, government agencies and educational institutions), which purchase in large volume, need customized software and are often legacy IBM customers. The second is ‘transactional’ customers (individuals and smaller companies), typically buying one or two computers at a time, all seeking more or less the same few models; these customers, however, are sensitive to cost and good user experience.

Lenovo has a single well-developed hardware and software innovation capability aimed at meeting the needs of both types of customers. But its supply chain capability is bifurcated. The relationship supply chain is complex, designed to provide enterprise customers with greater responsiveness and flexibility. Meanwhile, the company maintains a simpler supply chain with manufacturing sites in low-cost locations for its transactional customers.

The principle ‘keep it simple, sometimes’ is itself more complex than it appears at first glance. It combines three concepts in one: first, be as simple as possible.

Second, let your company’s strategy be your guide in adding the right amount of complexity. Third, build the capabilities needed to effectively manage the complexity inherent in serving your markets and customers.

The Lenovo case illustrates how an airline can innovate to shed unwanted processes (cut costs) and rationalise the service frills and flexibility demanded by the business and premier economy passengers.

Conclusion

In conclusion, a NWA such as SriLankan cannot continue to ignore innovations or operate legacy systems, nor can it separate people management from strategy and

its implementation.

In leading organisations: ‘Ten Timeless Truths’ (Meany and Scott, Mc Kinsey 2017) the authors explain - (1) Talent and teams (2) organisation design and decision-making and finally (3) managing culture and change, are the big three areas to target in any turnaround. JAL’s story and the story of Turkish Airline in recent history are classic examples of this truth.

‘Talent wins games but team work wins championships’ (Basketball legend Michael Jorden)

(Rauff Reffai, Consultant IDA, World Bank Projects, can be reached at

[email protected])

A lead article on SriLankan Airlines (‘A pawn in the political chess game’ Daily Mirror, November 10, 2016) concluded a year ago that “All governments that have ruled the country so far, should admit that the state-owned enterprises (SOEs) are making and have become an unbearable burden on the country’s economy due to their stupid and rash actions.”

A lead article on SriLankan Airlines (‘A pawn in the political chess game’ Daily Mirror, November 10, 2016) concluded a year ago that “All governments that have ruled the country so far, should admit that the state-owned enterprises (SOEs) are making and have become an unbearable burden on the country’s economy due to their stupid and rash actions.”