11 Feb 2019 - {{hitsCtrl.values.hits}}

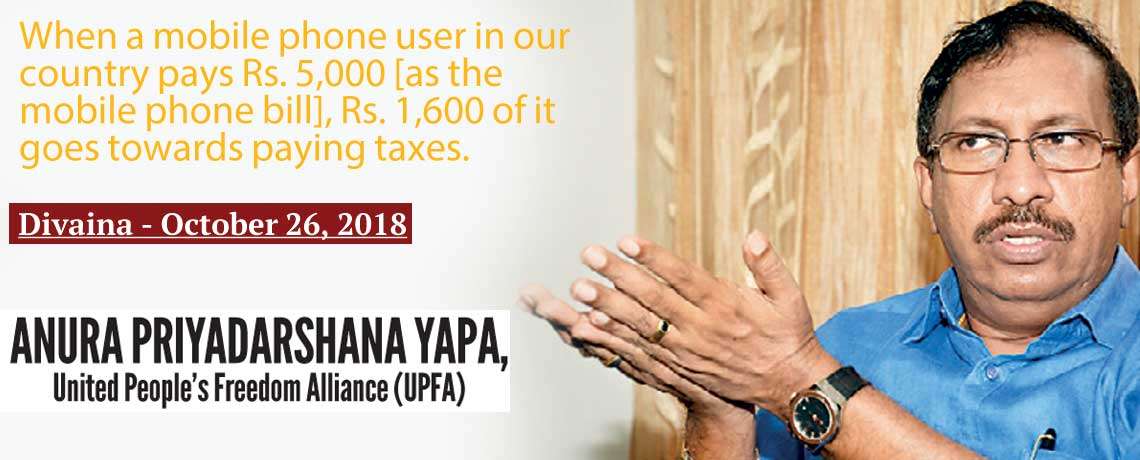

On 26 October 2018, the Divaina reported MP Anura Priyadarshana Yapa making the following claim.When a mobile phone user in our country pays Rs. 5,000 [as the mobile phone bill], Rs. 1,600 of it goes towards paying taxes.

On 26 October 2018, the Divaina reported MP Anura Priyadarshana Yapa making the following claim.When a mobile phone user in our country pays Rs. 5,000 [as the mobile phone bill], Rs. 1,600 of it goes towards paying taxes.

In effect, the MP is claiming that 47.05% of the user’s bill goes towards paying taxes.

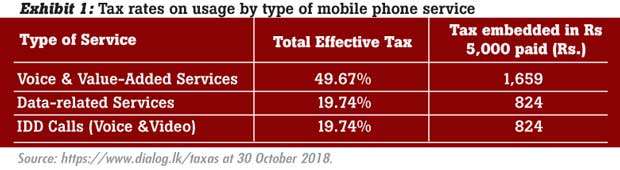

We took tax rates applied on different mobile phone services from the Dialog website. Exhibit 1 shows that the tax rate for Voice and Value-added Services (VVS) was 49.67%. At this tax rate, for every Rs. 5,000 paid as the mobile bill, the tax paid is Rs. 1,659. However, the tax rate for all other services was only 19.74%. This means that for all services except VVS, for every Rs. 5,000 that a user pays as a mobile phone bill, only Rs. 824 goes towards paying taxes – not Rs. 1,600 as the MP claimed.

As the MP’s claimed tax rate is correct only for some mobile phone services, we classified his statement as PARTLY TRUE.

This is an extract from a fact check published on @factchecklka Facebook page on 20 December 2018. Please see www.factcheck.lk for more information.

FactCheck is a platform run by Verité Research.

For comments, suggestions and feedback, please visit www.factcheck.lk.

23 Dec 2024 5 minute ago

23 Dec 2024 39 minute ago

23 Dec 2024 43 minute ago

22 Dec 2024 22 Dec 2024

22 Dec 2024 22 Dec 2024