09 Jun 2022 - {{hitsCtrl.values.hits}}

In his statement the MP claims that tax revenue as a percentage of GDP has decreased under every government since 1981.

In his statement the MP claims that tax revenue as a percentage of GDP has decreased under every government since 1981.

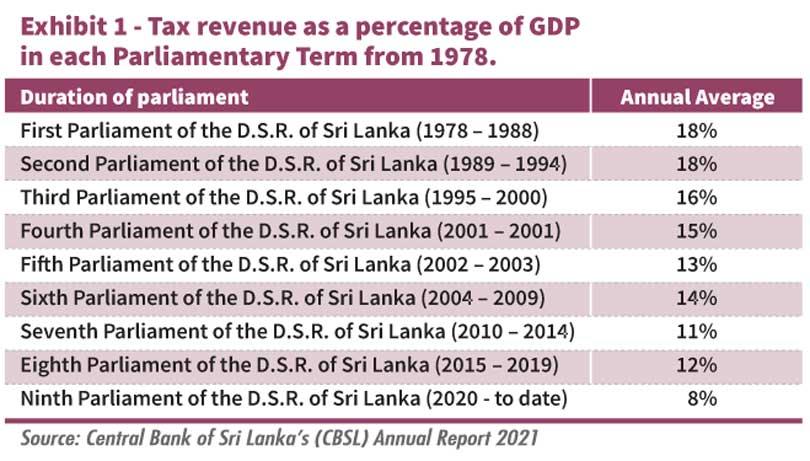

To check this claim, FactCheck.lk consulted the Central Bank of Sri Lanka’s (CBSL) Annual Report 2021 and the parliament website for information on the duration of parliament over the years.

As the tax revenue and the GDP numbers are presented annually, for the calculation of average tax revenue to GDP during a government term (elected parliament), if the term of government has ended during the first six months in the calendar year, the average is calculated for the year end of the previous year. Similarly, if the term of government has ended during the last six months in calendar year, the average is calculated for the end of that year.

Exhibit 1 shows the average tax revenue as a percentage of GDP for all governments voted in since 1978. The calculations show a pattern of decreasing tax revenue as a percentage of the GDP.

However, it also shows that this was not the case under all governments—during governments of the sixth and eighth parliament tax collection increased as a percentage of GDP relative to the previous parliamentary term of government.

The MP is not correct in attributing a decrease in tax collection to all governments. However, because he is correct in identifying a pattern of decrease, which also applied to most parliamentary terms of government we classify the MP’s statement as PARTLY TRUE.

*FactCheck.lk’s verdict is based on the most recent information that is publicly accessible. As with every fact check, if new information becomes available, FactCheck.lk will revisit the assessment.

FactCheck.lk is a platform run by Verité Research.

For more fact checks, visit our website at www.factcheck.lk.

22 Dec 2024 1 hours ago

22 Dec 2024 2 hours ago

22 Dec 2024 4 hours ago

22 Dec 2024 4 hours ago

22 Dec 2024 4 hours ago