02 Feb 2024 - {{hitsCtrl.values.hits}}

Premier blue chip John Keells Holdings PLC (JKH) reported strong performance for the third quarter of financial year 2024 (3Q24), with all industry groups recording a growth in profits.

Premier blue chip John Keells Holdings PLC (JKH) reported strong performance for the third quarter of financial year 2024 (3Q24), with all industry groups recording a growth in profits.

For the quarter ended 31 December 2023, JKH saw its Group revenue expand by 6 percent to Rs. 72.26 billion from Rs. 68.24 billion recorded in the corresponding period the previous year.

However, for the first nine months of the financial year, Group revenue contracted by 4 percent to Rs. 200.15 billion. This was mainly on account of the significantly higher revenue recorded in the Group’s bunkering business in the previous year due to the steep increase in global oil prices.

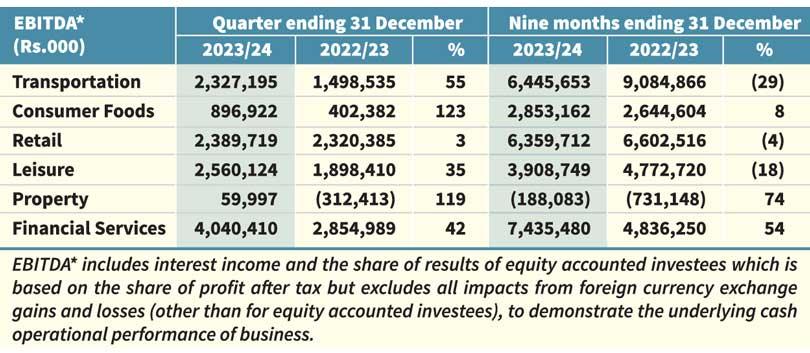

The group earnings before interest expense, tax, depreciation and amortization (EBITDA) in the third quarter expanded by 32 percent to Rs. 13.74 billion due to improved contributions from all businesses, particularly Consumer Foods and Insurance Business.

Cumulative Group EBITDA for the first nine months of the financial year 2023/24 at Rs.31.03 billion is a decrease of 6 percent against the EBITDA of Rs.33.04 billion recorded in the comparative period of the previous financial year.

The Group operating profit grew by 88 percent to Rs. 5.49 billion. In the 3Q23, the operating profit was Rs. 2.91 billion. JKH attributed the growth to the increase in EBITDA together with the gradual easing of interest rates and normalised working capital requirements, particularly in the Consumer Foods and Supermarket businesses.

Cumulative Group operating profit for the first nine months of the financial year 2023/24 declined by 67 percent to Rs. 6.73 billion.

Cumulative Profit Before Tax (PBT) for the year under review includes a net exchange loss of Rs.1.14 billion. This includes the exchange loss on the US$ 225 million term loan facility at Waterfront Properties (Private) Limited on account of the transition of its functional currency from USD to LKR.

Profit attributable to equity holders of the parent grew by 51 percent YoY to Rs.2.99 billion in the quarter under review. On a cumulative basis, the bottom line dipped by a significant 77 percent YoY to Rs.3.88 billion.

The entity said its finance cost in 3Q24 drop by 4 percent to Rs. 5.1 billion, and for the nine months ended 31 December 2023 the finance cost expanded by 39 percent to Rs. 17 23 billion.

Its finance income increased by 16 percent YoY to Rs. 5 billion, and for the first nine months ended 31 December 2023, this decreased by 34 percent to Rs. 23.45 billion.

26 Dec 2024 2 hours ago

26 Dec 2024 3 hours ago

26 Dec 2024 4 hours ago

26 Dec 2024 5 hours ago

26 Dec 2024 6 hours ago