15 Jan 2013 - {{hitsCtrl.values.hits}}

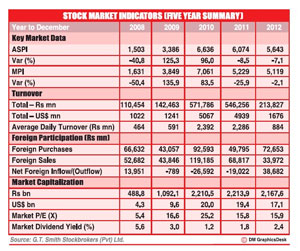

Fresh after witnessing a full year of volatility and challenges in 2012 with the benchmark All Share Index (ASI) closing down 7.1% at 5643, the Colombo Stock Exchange (CSE) is now poised to make a leap, predominantly backed by budgetary proposals and further monetary easing, according to leading stock broking & research firm.

Fresh after witnessing a full year of volatility and challenges in 2012 with the benchmark All Share Index (ASI) closing down 7.1% at 5643, the Colombo Stock Exchange (CSE) is now poised to make a leap, predominantly backed by budgetary proposals and further monetary easing, according to leading stock broking & research firm. As a result and also boosted by strategic market transactions as part of corporate restructurings, C T Smith expects a rise in average daily turnover to be slightly below Rs.2.2 billion, levels seen during post-conflict boom (2009-2010) from the existing level of Rs.884 million.

As a result and also boosted by strategic market transactions as part of corporate restructurings, C T Smith expects a rise in average daily turnover to be slightly below Rs.2.2 billion, levels seen during post-conflict boom (2009-2010) from the existing level of Rs.884 million.

27 Dec 2024 9 hours ago

27 Dec 2024 27 Dec 2024

27 Dec 2024 27 Dec 2024

27 Dec 2024 27 Dec 2024

27 Dec 2024 27 Dec 2024