07 Jun 2013 - {{hitsCtrl.values.hits}}

Despite the fact that a growing number of listed companies have been offering debentures as a way to raise capital, the market analysts find that those debentures are hardly seen trading in the secondary market, which is instrumental for the development of a vibrant corporate debt market, Mirror Business learns.

Despite the fact that a growing number of listed companies have been offering debentures as a way to raise capital, the market analysts find that those debentures are hardly seen trading in the secondary market, which is instrumental for the development of a vibrant corporate debt market, Mirror Business learns. It’s relatively harder for the unsophisticated retailer to enter into the debt market compared to the secondary market for equities,” he said.

It’s relatively harder for the unsophisticated retailer to enter into the debt market compared to the secondary market for equities,” he said.Meanwhile the CEO of Capital Alliance Finance PLC, Ajith Fernando expressing similar sentiments said that the Lankan corporate debt market is still in the buying mode and in order to see an active secondary market this demand would have to be saturated.“Sri Lankan corporate debt market was just started. Usually the initial debenture issues carry attractive interest rates and certainly those who invest on those do not want to sell. On the other hand, these are not traders but genuine investors who want to invest for a long period of time,” Fernando noted.

Commenting on the issue, another market analyst requesting anonymity said that majority who had invested in these debentures were banks, insurance & pension funds and unit trusts among other larger companies who want to avoid risking their investments to fluctuations in value by exposing to the market.“So, they opt not to sell because even if they choose to sell 10 percent of the investment, it affects the balance they hold because the total portfolio value will ultimately be determined by the market value,” he said.

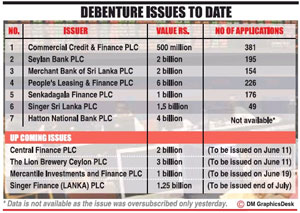

However market liquidity and the market trading cannot take off in isolation and are closely interrelated.“The problem in our corporate debt market now is that there are enough buyers but no sellers. But I am quite certain that the trading will start soon and we are in the right direction,” Fernando confided. Since the exemption of withholding tax on interest income earned from investing in bonds and debentures listed in the Colombo Stock Exchange effective from January 01, 2013 by the budget, seven companies have issued debentures to date raising Rs.17 billion with many in the pipeline.

27 Dec 2024 22 minute ago

27 Dec 2024 37 minute ago

27 Dec 2024 2 hours ago

27 Dec 2024 3 hours ago

27 Dec 2024 3 hours ago