Reply To:

Name - Reply Comment

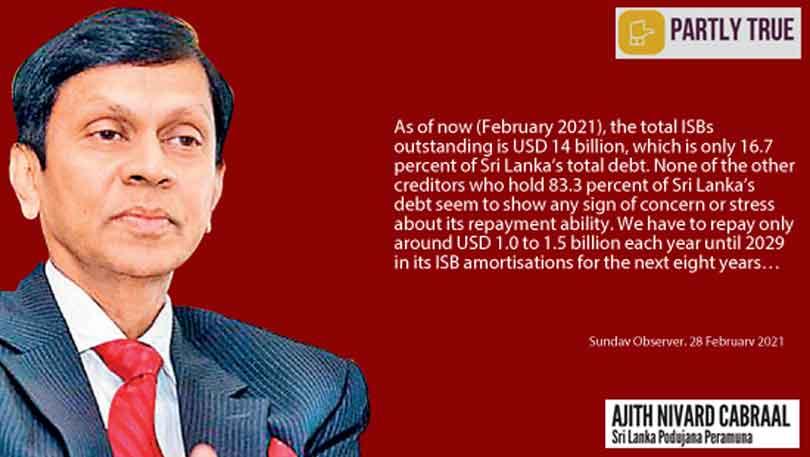

The state minister made two claims:

The state minister made two claims:

Claim 1: Concerns regarding repayment or credit risk can be assessed by the rate of interest demanded by borrowers and willingness to lend. The majority of Sri Lanka’s government non-ISB debt consists of domestic rupee debt (53.5% of total debt). On this, interest rates have declined to very low levels, indicating low concern over credit risk. However, of the remaining non-ISB debt, it is not possible to evaluate the credit risk perception of non-market foreign debt (bilateral and multilateral loans) since new loan interest rates are not always in the public domain (e.g. March 2020 China Development Bank loan). Furthermore, interest rates on Sri Lanka Development Bonds (SLDBs) (comprising 3.3% of total debt) have increased across the board between January 2020 and January 2021.

Claim 2: Sri Lanka does have required annual ISB capital repayments of an average USD 1,405 million each year from 2021 to 2030, which is in the range stated by the state minister. However, he failed to account for the fact that in addition to capital repayments, Sri Lanka must repay interest on ISBs in order to avoid default. As of today, based on the 6.64% weighted average coupon rate (the interest rate paid on a bond) on total ISBs, Sri Lanka will have to pay USD 933 million on average each year in interest costs, in addition to capital repayments.

On his first claim, the state minister was right, in that over half of total debt holders show no sign of stress, though it is not possible to substantiate the claim that no other creditors show signs of stress. On his second claim, he excluded ISB interest payments and thus understated the total liabilities arising due to ISBs that need to be honoured in order to avoid default.

Therefore, we classify the state minister’s claim as Partly True.

*FactCheck’s verdict is based on the most recent information that is publicly accessible. As with every fact check, if new information becomes available, FactCheck will revisit the assessment.