Reply To:

Name - Reply Comment

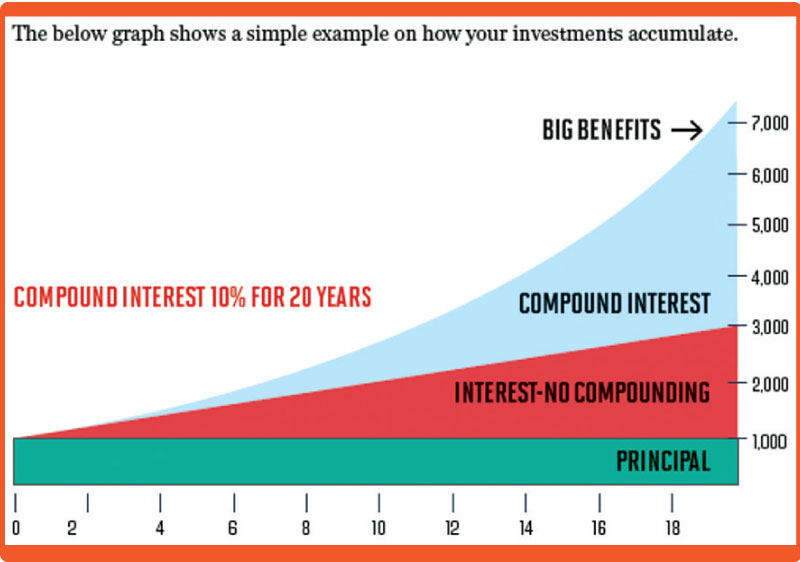

Financial planning is not something that is limited to high net worth individuals or corporates; it is something we all must practice from an early age to build financial discipline and to manage one’s income vs expenditure in order to have enough savings and investments for future consumption. First Capital AGM – Asset Management Kavin Karunamoorthy reveals points to consider both for those already in the know and those hoping to cautiously test the investment waters.

When embarking on your investment journey, it is important to understand the different asset classes available to you. Fixed income instruments such as treasury bills and bonds, bank deposits, unit trusts and listed corporate debt are mid-low risk instruments suited for a risk-averse investor, while an investor with a higher risk tolerance could look at instruments such as the stock market, property and real estate, unlisted corporate debt, or derivatives.

However, as the age old saying goes ‘don’t put all your eggs in one basket’. An investment bank or a professional wealth manger can help you manage and diversify your investments, while lowering risk and maximising returns. Hence, it is important to seek out information from the correct sources.

Time and Goal setting

Investors should consider four main points:

What the experts bring to the table

Investment banks and professional wealth managers can provide investment strategies across all asset classes for individuals and corporates, while keeping track of market opportunities, recognising trends, and matching them to your interest, with a focus on performance, liquidity, risk management and other relevant factors.

The First Capital approach

We understand that not everyone’s requirements are the same; that is why our vision is to disrupt and revolutionise the financial services industry with a range of alternative financial products and services for corporate and retail customers alike, which will give better yields and redirect financial resources to the most needed in the economy.

With over 35 years’ of delivering ‘Performance First’, having insights into investment trends and markets access, First Capital is on a unique footing with a 360-degree view of the financial market. Backed by the strength of the Janashakthi Group, our team comprises of experts from the banking and finance industry, capital markets, insurance, and the real estate industry, enabling us to service clients’ needs.

As attractive as a fixed deposit with the flexibility of a savings account!

First Capital offers a range of short-term to long-term fixed income and equity Unit Trust Funds, which provide newer investors with a cost-efficient and a practical way to start investing in several types of assets under professional guidance.

For example, our flagship First Capital Money Market Fund enables an individual without a large base of savings to invest in a diversified portfolio of over Rs. 20 billion, managed by a professional wealth manager. Currently, the fund yields 7.22% p.a.

The fund accumulates funds from both individuals and corporates and channel them to different investments in corporate debt and government securities which mature within one year, while striking a balance between the risk and return.

Customers can open an account via our digital account opening facility and self-register on our online customer portal for flexibility, convenience, and peace of mind.

The Bank of Ceylon, is appointed as trustee and maintains custody of the Fund’s assets, representing the interest of the investors and monitors transactions carried out by the Fund. The Securities and Exchange Commission of Sri Lanka licenses and regulates unit trust funds, conducts periodic on-site audits, and rigorously examines the qualifications of fund managers.